What is Amortization?

The term Amortization is best known in reference to paying off bank loans. To amortize a loan is to pay off a loan.

Amortization has at least two meanings in business, both of which refer to making regular payments over time.

Define Amortization

Amortization refers to a stream of payments that accomplish either of the following:

- Reduce the book value of intangible assets.

- Pay off loans or other debt.

Death to the Loan!

The English word amortization has etymological roots in Middle English, Old French, and Latin words for "kill" or "death" (mortem is Latin for death). It is appropriate to say that amortization "kills off" the loan or the asset value.

Explaining Amortization in Context

This article further defines and illustrates amortization and related terms as they appear in financial accounting and business generally. Terms such as the following have to do especially with the value of assets:

Contents

- What is amortization? Two different meanings in business.

- How does amortization reduce book value of intangible assets?

- Amortization to pay off loans or retire other debt.

Related Topics

- For coverage of the similar accounting practice, depreciation, see the article Depreciation Expense.

- For more on the nature of expenses of various kinds, see Expense.

Amortizing Intangible Assets

Amortization sometimes means the accounting procedure that gradually reduces the book value (carrying value) of an intangible asset, over time, in the same way that depreciation expense lowers the book value of tangible assets. Asset amortization—like depreciation—is a noncash expense that reduces income statement net income, thereby creating tax savings for owners.

What Are the Major Intangible Asset Categories?

Accounting practice recognizes intangible assets as physical assets, with an expected useful life of a year or more. General names for different kinds of intangible assets include Goodwill and Intellectual Property. More specific names for asset classes include Brand Name, Artistic Assets, Franchise Holdings, Customer Relationships, a Customer Lists, Use of Patent Rights, or the company's Proprietary Technology.

Intangible assets, moreover, are either indefinite or definite:

- For Indefinite intangible assets, owners expect to own them as long as the company is in business. For indefinite intangibles, there is no "end of life" in view. Generally, owners cannot amortize intangible assets, although regulators encourage accountants to re-evaluate the asset's indefinite nature from time to time.

- For definite intangible assets, however, owners expect to hold them for a limited time, or else they have a service life or economic life with a definite end in view. Definite intangible assets are eligible for amortization.

Assigning Value to Intangible Assets

The value of intangible assets in private industry can be large and real (see the article Branding and Brand Value, for instance). The company's accountants face a challenge, however, when trying to set the initial book value and amortizable life of intangible assets.

The US Financial Accounting Standards Board (FASB) and similar authorities in other countries provide detailed and specific guidance in this regard (e.g., FASB 141), which may refer to factors such as the cost history of purchased intangibles, forecast impact on income, or the likely cost of creating another intangible asset of equal value today. Ultimately, however, these value judgments inevitably include a subjective component.

Amortizing Intangible Assets in Accounting

Amortization of definite intangible assets in this sense almost always uses the straight-line method. For a definite asset with a 10-year life, for instance, the amortization expense each year would be one-tenth of its initial amortizable value. The timing and rates of amortization expense charges constitute the amortization schedule (similar to a book-value depreciation schedule for tangible assets).

Amortization expenses from the amortization schedule appear on the firm's financial statements:

- Amortization appears on the Income Statement as an expense, like depreciation expense, usually under Operating Expenses, or "Selling, General and Administrative Expenses.

- Amortization appears on the Balance sheet, accumulating from year to year to reduce asset book value, just as accumulating depreciation reduces the book value of tangible assets.

- Amortization is a noncash expense but it nevertheless impacts the Statement of changes in financial position

SCFP (Cash Flow Statement).

Under SCFP "Sources of Cash-Operating Activities," owners add back (subtract) noncash expenses including amortization and depreciation, so that the remaining total for Operating Activities represents only real cash inflow.

For tangible assets, the total book value subject to depreciation is usually the cost of record less residual value. Definite intangible assets, however, are usually have no residual value, and so amortizable value for them is normally the full book value. When firms purchase certain definite intangibles for use over a limited time (e.g., usage of patent rights), the useful life is the amortization life. For other definite intangibles, however, amortization life may be the asset's service life or economic life.

Amortization as Debt Retirement

The term amortization is familiar as a term for paying off debt with regular payments, as in "amortizing" a mortgage, or "loan amortization." Note that "pay off" is a verb for the act of reducing an outstanding debt to 0, while "payoff" is a noun naming the result of the act.

The primary tool that borrowers use for managing payments throughout loan life is an amortization scheduleHe—a table listing payment dates, payment amounts, and the impact of each payment on outstanding debt.

The Nature of Amortization

Amortization payments for retiring debt have two characteristics:

- Payments are regular.

Borrowers pay at regular intervals, and all payments are the same (except sometimes for the final payment, which may differ from the other payments, to make the payment series cover exactly what is due for interest and principal).

- Each payment interest due and a portion of outstanding principle due. After paying for interest due on the outstanding balance since the previous payment, what remains retires a component of the outstanding balance.

How Do Lenders Calculate Amortization Payments?

Lenders set up a up the loan contract and amortization schedule by calculating the periodic payment amount that will pay off a loan with several specific characteristics. They can calculate payment amounts only after setting values for these items: following: principal (amount to borrow), loan life, payment frequency, and interest rate per period. Standard symbols for bringing these values into the payment calculation formula are as follows:

P = principal, the amount borrowed.

n = the number of periods = the total number

of periodic payments to be made. This is

(loan life in years) * (periods per year).

i = interest rate per period. This is the

(annual interest rate) / (periods per year).

For instance, an individual might approach the bank asking for a 5-year $25,000 loan to purchase an automobile, when the annual interest rate for borrowing is 6.0%. If the loan is to be set up with monthly payments, P, i, and n are as follows:

P = $25,000

i = 0.5% per period = (6.0%) / (12).

n = 60 = (5 Yrs) * (12 pds per yr)

By convention, the symbol A stands for the monthly payment amount. The letter A is appropriate because the payment stream is—to the lender—an annuity. Using the symbols above, the formula for payment amount A is easy to implement by hand calculator:

A = (P * i ) / (1 - ( 1+ i )n

Alternatively, the borrower wishing to find A from P, i, and n, can find an abundance of free "Loan Calculators" or "Amortization calculators" on the internet.

Find Payment Amounts by Spreadsheet

For the individual wishing to try out many different possible data sets, however, or to produce a loan payoff table (such as the example in the next section), it may be preferable to implement the formula in a spreadsheet of your own. When implementing this formula in an MS Excel spreadsheet, for example, it is helpful to set up first a small table in the spreadsheet, putting the values for i, P, and n in the Value column:

Then, assign names to the right-column value cells, using labels such as those in the center column (Value Cell Name). Then the Payment formula for A, above, can be written in Excel, as:

= ( Principal * Interest) / (1 - ( 1 + Interest )^Number)

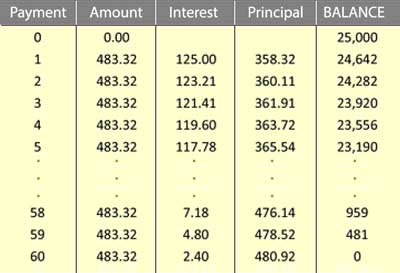

Using the given example values, the monthly payment A is $483.32.

Loan payoff tables Summarize Amortization

During the life of a loan, borrowers may understand the amortization impact of each payment from a loan payoff table (loan amortization table), such as Exhibit 1.

The payoff table shows the progress amortization after each periodic payment. The table shows

- How much of each payment pays for the period's interest.

- How much of each payment pays for reducing the balance due on the principal.

- The remaining principal balance due after each periodic payment.

Such a table is of high interest to borrowers who may wish to pay off the loan completely at some point before the final period.