What Are Profitability Metrics?

Achieving Profitability is every firm's reason for being . Profitability metrics measure progress towards that objective.

Profitability metrics address questions about a company's financial performance and financial position such as these:

- Is the company profitable?

- Does it make good use of assets, equities, and debt?

- Is it producing value for shareholders?

- Will the company survive and grow?

Business textbooks typically describe the highest level objective for profit-making companies as "Increasing owner value." Firms pursue this objective by earning profits. After a successful period, they can use earnings to increase owner value in two ways:

- Firstly, by paying dividends directly to shareholders.

- Secondly, by adding the remaining profits to an equity item on the Balance sheet, Retained earnings.

In this sense, earning profits is a company's reason for being, and profitability metrics measure the firm's ability to reach its highest objectives. Industry analysts give priority to the current Operating margin, for instance, when comparing a firm to other companies, industry standards, or the firm's performance in previous periods.

Profitability Metrics in Two Families

- Firstly, three essential profitability metrics are margins. Each margin refers to earnings (profits) as a percentage of sales revenues.

- Secondly, another four profitability metrics are also investment metrics. Each essentially compares the company's investments in assets and equities with its earnings from these investments.

Explaining Profitability Metrics in Context

Sections below define and illustrate seven favorite profitability metrics. Each appears in context with related measures and the business questions the metric addresses. Example calculations use figures from the sample Income statement, Balance sheet, and Statement of Retained Earnings also included below. Profitability metricsappearing below include the following:

Profitability Margins

- Gross Profit / Gross margin

- Operating Profit / Operating margin

- "Net Profit on Sales" / Profit margin

Profitability Investment Metrics

- Return on total assets

- ROCE Return on capital employed

- Return on equity ROE

- Earnings per share EPS

Contents

- What are profitability metrics?

- Profitability metrics are financial statement metrics (business ratios).

- What is the difference between profitability and profits?

- Seven frequently used profitability metrics (business ratios that measure profitability)

- Income statement example provides input data for profitability metrics

- Balance sheet example includes input data for profitability metrics with an investment viewpoint.

- Retained earnings statement example provides input data for the EPS profitability metric.

Related Topics

- Selective "Earnings before" metrics: See Earnings before interest and taxes.

- Profitability in the Annual report and financial reporting: See the article Annual report.

- An overview of cash flow and financial statement metrics: See Financial Metrics.

Profitability Metrics Are Financial Statement Metrics

Profitability Metrics are Also Named Business Ratios

Profitability metrics make up one metrics family, belonging to the larger group of financial metrics families known as financial statement metrics. Note, by the way, that some analysts refer to financial statement metrics as business ratios."

Common usage notwithstanding, not all of the mainstream financial statement metrics are ratios. The profitability metric Net profit, for example, is a difference, not a "ratio," and the same is true of the liquidity metric, "Working Capital." However, each of the profit margins and investment metrics below is genuinely a ratio, built from financial statement figures.

Financial statement metrics use data from company statements to assess a firm's financial performance for a given period or its financial position at one point in time. Input data for these metrics come primarily from the four accounting statements in Exhibit 1:

What Purpose do Financial Statement Metrics Serve? Who Uses Them?

The primary interested parties and users of financial statement metrics include:

- Boards of directors and shareholder owners

These parties use profitability metrics for evaluating management performance. - Investors

Profitability metrics are of keen interest to those considering buying or selling stock or bonds in a company. - Company officers and high-level managers

These parties turn to profitability metrics to identify company strengths, weaknesses, and targets for business objectives.

What are financial statement metrics families? What questions does each family address?

Mainstream financial statement metrics belong to six families. "Metrics" in each family attempt to address a specific kind of business question about the firm.

- Profitability metrics (the subject of this article).

Profitability metrics ask:

Is the firm profitable?

Does the firm earn acceptable margins?

Is the firm earning good returns from its assets? - Activity and efficiency metrics.

Activity metrics ask:

Is the firm using resources efficiently? - Liquidity metrics.

Liquidity metrics ask:

Can the firm meet near-term financial obligations? - Leverage metrics.

Leverage metrics ask:

How do creditors and owners share business risks and rewards? - Valuation metrics.

Valuation metrics ask:

What are the firm's prospects for future earnings? - Growth metrics.

Growth metricsask:

Are revenues, profits, and market share growing at acceptable rates?

Sections below define, explain, and calculate profitability metrics. Links above for other metrics families lead to similar coverage on separate pages for activity, liquidity, leverage, valuation, and growth metrics.

Input data for calculating Profitability metrics below are from the Income Statement, Balance Sheet, and Statement of Retained Earnings examples below.

Profits vs. Profitability

What's the Difference?

There is a difference between a company's profits and its profitability.

Profits

Profits are actual monetary value the firm earns in the period. This value appears in currency units.

"For the year 20XX, Grande Corporation earned Net profits (Net income) of $2,612,000."

This item is the Income statement bottom line: Net sales revenues less all expenses.

Profitability

Profitability refers to the company's ability to earn, measured as a ratio of profits divided by Net sales revenues.

"For the year 20XX, Grande Corporation reports a Profit margin of 6.4%."

This margin is the ratio of $2,612,000 profits divided by $32, 983, 000 Net sales revenue.

Note that the Income statement measures profits, while profitability metrics, of course, measure profitability.

At the end of each period, analysts consider both kinds of measures when judging a firm's earnings performance. They pay attention to both because a firm can earn profits, for instance, but still be relatively unprofitable compared to other companies in the same industry. And, the company can be relatively "unprofitable" compared to other potential uses of the company's assets.

Owners and potential investors have a keen interest in profitability metrics because they measure a company's ability to earn. Because the company must make profits in to survive and grow, company directors, managers, employees, and competitors also have a high interest in company profits and profitability.

Seven Profitability Metrics

Business Ratios Measure Profitability

Those inside the company with access to the firm's accounts could, in principle, calculate new profitability metrics daily, as balances in various accounts change. Outsiders, of course, must wait for the firm's published statements after each reporting period.

At that time, analysts will compare the firm's profitability metrics with industry "best in class" figures, and with the firm's competitors. They will consider not only the current measures but also period-to-period trends in these metrics.

Which Metrics Define Profits and Margins?

This article defines and explains three frequently used profit metrics and their associated profitability margins: (1) Gross profit, (2) Operating Profit, and (3) Net Profit.

Three Income statement profits

At the first mention of "earnings," or "income," many people think of several "profits":

- Firstly of "bottom line" Net income (Net profit on sales) as the measure of a company's financial performance for the period. Also, however, the Income statement contains other "profits" as well:

- Secondly, the difference between Net sales revenues and Cost of goods sold is the firm's Gross profit.

- Thirdly, profit from operations (that is, before taxes and before gains and losses from financial and extraordinary items) is the firm's Operating profit.

Three Income Statement Margins

All three profit lines from the Income statement (Gross profit, Operating profit, and Net profit) can also appear as a percentage of Net sales revenues, that is, as margins. Gross margin, for instance, is Gross profit divided by Net sales revenues (see Exhibit 2, below).

Note that margin percentages usually refer to net sales figures. However, when the Income statement does not distinguish between Net sales and Gross sales, the analyst must base margin percentages directly on "Revenues" as the Income statement shows them.

Margins are important performance indicators because they are central to the company's business model. Margins in the business model, that is, show exactly where the company expects to earn and the expected profitability. As a result, Income statement margins show how well the company is meeting its business plan objectives.

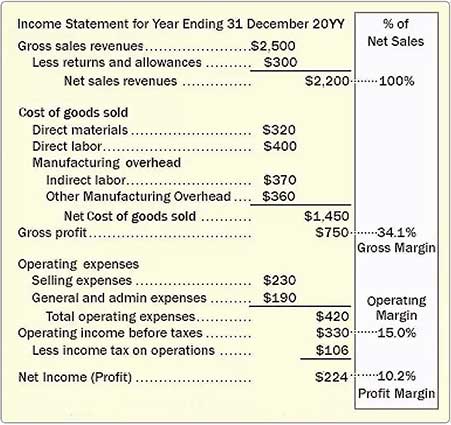

The Income Statement in Exhibit 2 and the table in Exhibit 3, below, show the relationships between a firm's three profits and its three margins.

Profitability Metric 1

Gross Profit / Gross Margin

Gross profit is an accounting term for Net sales revenues minus the costs of producing the goods and services sold. These costs have different names, depending on the nature of the firm's business:

- In firms that manufacture products, the name is Cost of goods sold (COGS).

- For companies that sell services, the name is Cost of services.

- Where firms sell both products and services, the name can be Cost of sales.

The firm's Gross margin is a ratio made of Gross profits divided by Net sales revenues. The result appears as a percentage. Gross margin, therefore, is thus the profit margin before subtracting most indirect and general costs of doing business. Gross profit and Gross margin, in other words, show the firm's earning ability before factoring in overhead expenses.

Calculating Gross Profit and Gross Margin

Gross profit and Gross margin examples use data from the example Income statement in Exhibit 3 below.

Net sales revenues: $32,983,000

Cost of goods sold: $22,043,000

Gross profit

= Net sales revenues – Cost of goods sold

= $32,983,000 – $22,043,000

= $10,940,000

Gross Margin

= Gross profit / Net sales revenues

= $10,940,000 / $32,983,000

= 33.2%

Using Gross Profits and Gross Margins

A firm can report a healthy Gross profit and Gross margin, and at the same time report poor Operating profits. In that case, the company is producing and selling products efficiently, but it is not operating efficiently in other areas. Inefficiencies might lie, for instance, in general administration, infrastructure support, or research and development. In other words, the company is incurring unacceptable overhead expenses.

A Gross margin using Income statement figures is the company's Gross margin for the period, of course. However, the firm also needs to know actual Gross margins for individual product lines and different products and services. Note that Gross margins by specific products can show, for instance, that some sell at a loss, while others are quite profitable.

Calculating individual product Gross profits and margins typically requires information beyond the firm's public financial statements. For these, the analyst needs access to particular product revenues and product COGS.

Profitability Metric 2

Operating Profit / Operating Margin

Operating profit appears on the Income statement after adding revenues and subtracting expenses for the company's core operating business. However, the Income statement calculates operating profit before factoring in other revenues and expenses. As a result, Operating income does not reflect financial income, financial-related charges, extraordinary items, or taxes (except for companies in financial services, where financial income and expenses docontribute to Operating profit).

The Operating margin is a ratio made of Operating profits divided by Net sales revenues. The result usually appears as a percentage. Operating margin, therefore, is the profit margin after subtracting most indirect and general costs from the firm's regular line of business.

Calculating Operating Profit and Operating Margin

Operating profit and Operating margin examples use data from the example Income statement in Exhibit 3 below.

From the example Income statement.

Net sales revenues: $32,983,000

Cost of goods sold: $22,043,000

All other operating expenses: $7,810,000

Operating profit

= Net sales revenues – Cost of goods sold – Operating expenses

= $32,983,000 – $22,043,000 – $7,810,000

= $3,130,000

Operating Margin

= Operating profit / Net sales revenues

= $3,130,000 / $32,983,000

= 9.5%

Using Operating Profit and Operating Margin

Operating profit and Operating margin, therefore, show company earnings (before taxes) from its normal operating business. For this reason, analysts often look first to Operating profit and margin instead of bottom line Net profit to address questions about the firm's core business: For example;

- Is the company reaching its objectives for earnings growth?

- Is the firm's reaching its objectives for earnings growth?

- How do company margins compare to competitors?

Operating Profit and Operating Margin as Selective Income Metrics

Operating profit and margin, in fact, also belong to another family of metrics that address questions about the firm's core business performance. These metrics are selective earnings metrics. "Selective" here means they derive from a just a few selected items on the Income statement, but not all revenues and expenses. Another common earnings metric in this family is EBIT (Earnings before interest and taxes).

Analysts and investors sometimes focus on Operating margin and other selective metrics instead of the bottom line Net profit margin. They do this when revenues and expenses outside the core business impact bottom line Profits enough to misrepresent core business performance. For more on EBIT and other selective earnings metrics and their use, see Earnings Before Interest and Taxes.

Using Bottom Line Net Profit and Net Profit Margin

Moving beyond the focus on core business performance, however, analysts will also compare a company's Operating profit margin with its bottom line Net profit margin. This comparison is especially informative after a period when the company has significant gains or losses from its financial investments or "extraordinary" items.

A company that must reduce employee headcount substantially, for instance, typically incurs large extraordinary expenses for the action. These cover severance packages, outplacement costs, and other costs that go with laying off employees. The large extraordinary expenses impact bottom line Profit margin, but they do not affect Operating profit margin. It is, of course, possible to have a positive Operating profit, while "bottom line" Net profit is negative. In such cases, the message to investors can be this:

Yes, the company shows a net loss for the period, but that was the result of one-time extraordinary items. Note especially that Operating profits for the core business remain strong. The firm's prospects for continued growth are therefore excellent."

Profitability Metric 3

Net Profit on Sales / Net Profit

Net profit (or Net profit on sales) is the company's reported income after taxes, after operating revenues and expenses, after extraordinary items, and after financial income and expenses. And, the firm's Profit margin is Net profit as a percentage of Net sales revenues.

Net profit can increase owner value of the company in two ways.

- Firstly, adding to retained earnings. Income transferred to Retained Earnings is an Equity item on the Balance sheet.

- Secondly, going to shareholders as dividends.

The Board of directors always decides the distribution of net profits between dividends and retained earnings.

Calculating Net profit on Sales / Profit Margin

The Net profit and Profit margin examples use data from the example Income statement in Exhibit 3 below.

Net sales revenues: $32,983,000

Net expenses:

Cost of goods sold: $22,043,000

Operating expenses: $7,810,000

Financial expense net : $393,000

Net taxes: $958,000

Other net gains:

Grain from extraordinary item: $347,000 gain

Net profit

= Net sales revenues – Total expenses + Total other gains

= $32,983,000 – $31,204,000 + $347,000

= $2,126,000

Profit margin

= Net profit / Net sales revenues

= $2,126,000 / $32,983,000

= 6.4%

Metrics That Compare Returns to Costs

Profitability Metrics With an Investment View

The remaining four profitability metrics take an "investment view." These metrics, that is, compare owner investment costs directly with owner investment returns.

Note that the four investment metrics presented here (ROA, ROCE, ROE, and EPS) all incorporate an earnings figure in the numerator of a ratio. The earnings figures, of course, represent earnings for a specific time span, usually the most recent reporting period.

As a result, the metrics measure the company's earning efficiency for the reporting period.

Profitability Metric 4

Return on Total Assets ROA

The Return on total assets, or more simply, Return on assets (ROA) metric is also called "Return on Investment," or ROI for the company.

This ROA or ROI should not be confused with the cash flow metric return on investment, or simple ROI, which compares investment costs to investment returns for a single action or investment.

Calculating Return on Total Assets

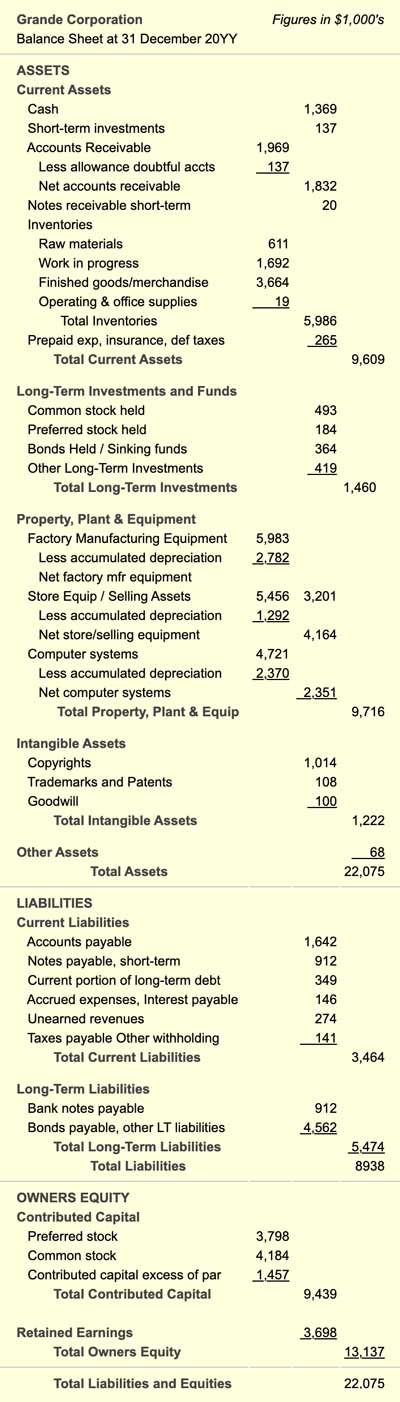

Return on Assets ROA examples use data from the Income statement in Exhibit 3 and the example Balance sheet in Exhibit 4, below.

From a given Income statement and Balance sheet, Return on total assets derives in either of two ways with the same result.

ROA Method 1

The first ROA method derives Return on total assets from Income statement Net profit and Balance sheet Total assets.

From the sample financial statements below:

Net profit on sales: $2,126,000

Total assets: $22,075,000

Return on total assets

= Net profit on sales / Total assets

= $2,126,000 / $22,075,000

= 9.6%

ROA Method 2

With the second Method, ROA calculates by multiplying the Profit margin on sales (profitability metric 3, above) by Total asset turnover (illustrated in this encyclopedia as an activity and efficiency metric).

This method for deriving ROA, incidentally, is the final output of the DuPont System of analysis—which also names the ROA metric as "Return on Investment" for the company.

From the sample Income statement and Balance sheet below:

Net sales revenues = $32,983,000

Net profit = $2,126,000

Total assets = $22,075,000

Profit margin

= Net profit / Net sales revenues

= $2,126,000 / $32,983,000

= 6.4%

Total asset turnover

= Net sales revenues / Total assets

= $32,983,000 / $22,075,000

= 1.49 total asset turns / year

Return on total assets

= (Profit Margin on sales) x (total asset turnover)

= 6.4% x 1.49

= 9.6%

Using Return on Total Assets Figures

Return on assets is, therefore, a measure of "what the company earns" relative to "what it has to work with."

Generally, analysts prefer higher ROA results to lower ROA results. Not surprisingly, however, companies in asset-intensive industries (e.g., transportation, construction, or heavy manufacturing) tend to have low ROA figures, whereas companies in sectors that do not require an extensive asset base (possibly financial services or consulting) usually have much higher ROA figures.

A calculated ROA refers of course to the specific reporting period for its input data. To evaluate ROA figures, analysts and investors assessing compare the company's ROA to standard ROA levels for the particular industry. And, they will also pay attention to year-to-year changes in a company's ROA.

Profitability Metric 5

Return on Capital Employed ROCE

Analysts also view the four "investment" metrics in this section as measures of efficiency, the ability of a company to earn from its resources. Note especially that ROA above asks what the company makes using its asset base, while ROCE and ROE (this section and the next) ask what the company earns for owners from the Equity base.

The first profitability metric referring to the firm's Equity base is also known as an efficiency metric, "Return on Capital Employed ROCE." This metric asks explicitly what the company makes from capital employed. As the example below shows, capital employed involves the equity base, but it is not synonymous with the equity base.

Calculating Return on Capital Employed

For calculating ROCE, the "Return" component is usually one of the "selective measures of income," that is, "Earnings before interest and taxes EBIT" (mentioned above under Operating profit). In practice, analysts compute EBIT from Income statement line items by starting with Net Income and adding back interest expense and tax expense.

Note the following figures from the Exhibit 3 Income statement below:

Net income (profit): $2,126,000

Interest expense paid: $511,000

Income tax on operations: $958,000

Tax on extraordinary gain: $118,000

"Adding back" interest and taxes to "Net income" produces the company's EBIT:

The "Return" component of ROCE = EBIT

= Net Income + interest expense paid

+ Income tax on operations paid+ Tax on extraordinary gain paid

= $2,126,000 + $511,000 + 958,000 + $118,000

= $3,713,000

The "Capital Employed" component of ROCE is commonly defined in several different ways, but usually it is calculated from Balance sheet figures for Total assets and Current liabilities. From the Exhibit 3 Balance sheet below, the following figures will contribute to Capital Employed:

Total assets: $22,075,000

Current liabilities:$3,464,000

From these figures, Capital employed results as:

Capital employed = Total Assets + Total Net Revenues – Current Liabilities

= $22,983,000 – $3,464,000

= $19,519,000

Return on Capital Employed ROCE is then the ratio of EBIT to Capital employed;

ROCE = EBIT / (Capital employed)

= $3,713,000 / $19,519,000

= 19.02%

Using ROCE Figures

Note that the EBIT figure for ROCE represents earnings performance for a reporting period usually the most recent year. However, the Capital employed input figures (Total assets and Current liabilities) are from the Balance sheet, a "snapshot" of the company's financial position at the end of the reporting period.

Since these latter figures can fluctuate during the period, some analysts maintain that a more realistic measure of earnings efficiency from capital results when using the period's average asset base, and average current liabilities figures instead of the end-of-period data.

When they use averages instead of end-of-period figures, some people still call the resulting metric ROCE. Others, however, call it Return on average capital employed (ROACE).

ROCE Rule of Thumb

ROCE should, in any case, be higher than the company's cost of capital—otherwise, the company seems to be losing money. Beyond this, ROCE figures for a given company are most useful for when comparing the company's current ROCE to ROCE figures from earlier periods.

As a result, analysts will look for year-to-year trends in a company's ROCE, as indicators that the company either is or is not improving its ability to earn efficiently from "capital."

Profitability Metric 6

Return on Equity ROE

Besides the ROCE metric above, another measure makes a more straightforward and more direct comparison of company "returns" to the Equity base: Return on equity (ROE).

Some analysts consider Return on equity (ROE) the most important of the profitability metrics because it compares the company's returns (Net profit) directly to the value of the company's equities—what the company owns outright. Others, however, reserve the "most important" distinction for the Earnings per share (EPS) metric in the next section.

Reflecting other commonly used names for "shareholder equity," the ROE metric also has the names Return on owners investmentand Return on net worth.

Calculating Return on Equity ROE

Analysts use two different approaches to computing ROE. Note that the two methods lead to different numerical results.

- Firstly, some analysts and investors prefer to calculate ROE using total equities from the Balance sheet and Net profit from the Income statement. This approach is illustrated below as Simple ROE.

- Secondly, others prefer to remove the contribution of preferred share dividends and preferred share equities from the calculation. They do so because owners of "preferred" shares have precedence over owners of "common" shares in two circumstances:

- Firstly in the payment of dividends.

- Secondly in payouts in the event of liquidation.

From the sample Income statement, Balance sheet, and statement of retained earnings below:

Net profit on sales: $2,126,000

Total stockholders equities: $13,137,000

Common stock equities:

= Total Stockholders equities – preferred share contributed capital:

= $13,137,000 – $3,798,000

= $9,339

Preferred share dividends: $33,000

(Simple) Return on equity (ROE)

= Net profit / Total stockholders equities

= $2,126,000 / $13,137,000

= 16.2%

Return on Common Equity

= (Net profit − Preferred dividends) / Common stockholders equities

= ($2,126,000 – $33,000) / $9,339

= 22.4%

Using Return on Equity Figures

Simple ROE and Return on common equity show directly how the company's earnings compare to the owners' investment (shareholders investment). By contrast, ROA (previous section) shows how earnings compare to the total owner investments plus any asset investments made with borrowed funds.

Because earnings (profits) come from both owner investments (equities) and assets funded by lenders (liabilities), the ROE metric is sensitive to leverage effects. ROA, on the other hand, is not susceptible to leverage because ROA refers to the total asset figure. As a result, ROA pays no attention to the source of funds for assets.

Example Income Statement

Input Data Source for Profitability Metrics

The example Income statement in Exhibit 4 below provides data for profitability metrics.

Example Balance Sheet

Input Data Source for Profitability Metrics

Profitability metrics with an "investment view" use data from the Income statement in Exhibit 4 above, the example Balance sheet in Exhibit 5, below, and the Statement of Retained Earnings in Exhibit 6, below.

Example Statement of Retained Earnings

Input Data Source for Profitability Metrics

This example Statement of retained earnings in Exhibit 6 provides data for the profitability metric Earnings per Share (EPS).