What is "Single-Entry" Accounting?

Single-Entry Accounting is simpler and easier to use than the alternative double-entry approach. However, single-entry systems alone cannot meet accounting needs of most businesses.

Governments and regulatory agencies everywhere require businesses to keep accurate records of financial transactions. Businesses report these records periodically to tax authorities and, in the case of public companies, report also to shareholder owners. To meet these requirements, every business, large or small, public or private, establishes its own accounting system.

At start up, each new business chooses one or the other of the two standard approaches to accounting: Single-entry accounting, or double-entry accounting.

Define Single-Entry Accounting

Single-Entry Accounting is a form of accounting in which each financial transaction results in a single entry in a journal or transaction log. As a result, the accounting system is called a single-entry system. The approach is also known as single-entry bookkeeping.

Sections below explain why the vast majority of businesses, large and small, public and private, find the single-entry approach inadequate for meeting their accounting needs. Most choose instead the double-entry approach. However, under certain conditions, some small businesses can operate successfully with single-entry systems.

Single-Entry vs. Double-Entry Accounting

The single-entry approach contrasts with the alternative, double-entry accounting, in which every financial event brings at least two equal and offsetting entries: One is a debit (DR) and the other a credit (CR). As a result:

- Firms using the double-entry approach report financial results with an accrual reporting system.

- Firms using single-entry approach are effectively limited to reporting on a cash basis.

The Single-Entry Approach is Simpler Than Double-Entry

On the positive side, single-entry accounting is simple and more straightforward to use than the double-entry approach. Most people can readily understand and use single-entry methods without special training or background in accounting or finance. Nevertheless, the overwhelming majority of firms, worldwide, use double-entry not single-entry accounting.

Explaining Single-Entry Accounting in Context

Sections below further explain single-entry accounting and bookkeeping, focusing on four themes:

- Example transactions illustrating the nature of single-entry accounting.

- Advantages and disadvantages of both single-entry and double-entry systems.

- Reasons that most firms choose double-entry accounting

- Business settings where single-entry accounting is sufficient

Contents

- What is "Single-Entry" Accounting?

- The nature of single-entry systems: Single-entry system examples.

- When and where are single-entry bookkeeping and accounting sufficient? Can public companies use single-entry systems?

- What are single-entry system advantages and disadvantages? How do they compare to double-entry systems?

Related Topics

- Double-entry accounting explained with examples. See Double-Entry System.

- Cash accounting with a single-entry system. See Cash Basis Accounting.

The Nature of Single-Entry Systems

Single-Entry System Examples

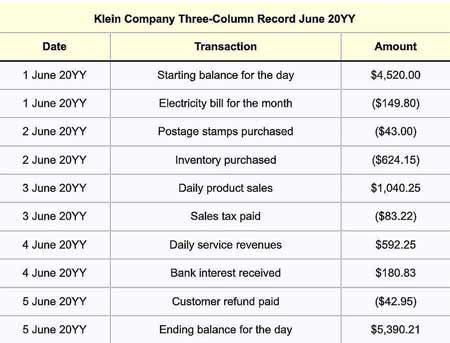

The single-entry approach is very similar to the check register that individuals use to keep track of checks, deposits, and balances for a personal checking account. In both cases, users merely record the date, amount, and name of each transaction. Exhibits 1 and 2, below, show how the single-entry record might look for a few days transactions for a small business.

Three Column Single-Entry Record for a Small Business

small business. Incoming funds are positive numbers, and outgoing funds are negative numbers (in parentheses). This simple record shows transactions for five days.

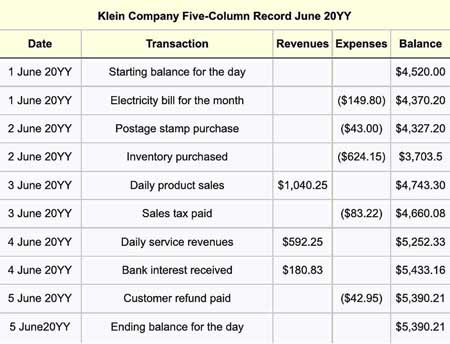

Five Column Single-Entry Record for a Small Business

The user can, of course, add more columns to show different categories of revenues or expenses. The only requirement is that the record must have enough revenue and expense categories to meet tax reporting needs.

When is Single-Entry Accounting Sufficient?

Can Public Companies Use Single-Entry Accounting?

Single-entry bookkeeping and accounting can be adequate for a small business practicing cash basis accounting. Small firms may, in fact, prefer single-entry accounting over a double-entry system when all or most of these conditions apply:

- The Company uses cash basis accounting, not accrual accounting.

- The firm has few financial transactions per day.

- The company does not sell on credit. Customers must pay at the time of the sale either in cash or, by bank transfer, 3rd-party debit card, 3rd-party credit card, or by writing a check. The firm does not deliver goods or services and then invoice customers for payment later.

- The firm has very few employees.

- The company owns few valuable business-supporting physical assets. For example, it may hold product inventory, office supplies, and cash in a bank account. But it does not own buildings, substantial office furniture, large computer systems, production machinery, or vehicles.

- The company is privately held or operates as a sole proprietorship or partnership. As a result, the firm need not publish an Income statement, Balance sheet, or other financial statements that are mandatory for public companies.

Firms That May Use Single-Entry Accounting

Under such conditions, a single-entry system may meet the firm's planning and reporting needs. As a result, the single-entry system may be adequate for:

- Supporting income tax reporting for the company

The primary data for this includes outgoing expenses and incoming revenues. - Proving that the company collects and pays government sales taxes for goods or services sales

- Showing that the company pays its income taxes

- Forecasting future budgetary needs and sales revenues

- Proving that the company complies with minimum wage and employee tax withholding requirements

- Providing real-time visibility and control of incoming and outgoing funds. The firm must be able to avoid overspending budgets or overdrawing bank accounts

Advantages and Disadvantages

Single-Entry Compared With Double-Entry Systems?

The positive and negative aspects of single-entry accounting are readily apparent in comparison with the alternative approach, double-entry accounting.

Single-Entry System Advantages

Single-entry accounting has the significant advantage of simplicity over double-entry accounting.

- People with little or no background in finance or accounting readily understand single-entry records and reports.

- Small companies can use single-entry systems without hiring a professional accountant or bookkeeper.

- The single-entry approach does not require complicated accounting software. The examples above show, for instance, that firms can create and maintain a single-entry system easily in a written notebook or simple spreadsheet.

Single-Entry System Disadvantages

Single-entry accounting provides insufficient records and insufficient control for public companies and other organizations that must publish audited financial statements. Nor can it—by itself—give owners and managers crucial information for evaluating the company's financial position.

Some of the important differences between the two approaches illustrate the disadvantages of the single-entry approach:

Double-Entry System: Built-in Error Checking

A double-entry system provides several forms of error checking that are absent in a single-entry system. In the double-entry system, every financial transaction results in both a debit(DR) in one account and an equal, offsetting credit (CR) in another account. For each reporting period, total debits must equal total credits. That is:

Total DR = Total CR

Moreover, a single-entry system works so that the Balance sheet equation always holds:

Assets = Liabilities + Equities

These equations together are known as the accounting equation. Any departure from these principles in a double-entry system is a signal that account histories include an error.

Single-Entry System: Error Checking Is Not Built In

This kind of error checking is missing from the single-entry system.

If the single-entry bookkeeper mistakenly enters, say, a revenue inflow as $10,000 when the correct value is $1,000, the error may go unnoticed until the firm receives a bank statement with an unexpected low account balance.

In a double-entry system, however, the $1,000 cash deposit entry (a debit to an asset account, cash on hand) will be accompanied by another entry recognizing the source, for example, a credit to a liability account (e.g., bank loan) or a credit to another asset account (accounts receivable). And, if the firm omits the second entry, the sums of credits and debits in the system would differ, immediately revealing the error.

Double-Entry System: Focus on Revenues, Expenses, Assets, Liabilities, and Equities.

A double-entry system keeps the firm's entire "Chart of accounts" in view. This chart for a double-entry system has, in fact, five kinds of accounts in two categories:

- Firstly, Income statement accounts: (1) Revenue accounts, and (2) expense accounts.

- Secondly, Balance sheet accounts: (3) Asset accounts, (4) Liability accounts, and (5) Equity accounts.

All transactions in a double-entry system result in entries in at least two different accounts. When the company receives cash through a bank loan, the double-entry system records:

- Firstly, a debit (DR) for an asset account, e.g., Cash on hand. For an asset account, a DR is an increase.

- Secondly, a credit (CR) to a liability account, e.g., bank loans. A CR to a liability account increases its balance.

Single-Entry System: Focus on Revenues and Expenses Only

A single-entry system tracks Revenues and Expenses but does not monitor Assets, Liabilities, or Owners Equities.

With a single-entry system, however, the company may receive cash from a bank loan and record that as incoming cash. In this case, however, there is no easy way to register the corresponding increase in liability (bank loan debt).

Singly-Entry Systems Do Not Support Accrual Accounting

Single-entry systems, moreover, work hand-in-glove with cash basis accounting, where firms record inflows and outflows only when cash, in fact, flows. Also, single-entry systems cannot easily support the alternative, accrual accounting. When the delivery of goods and services and customer payments come at different times, for instance, accrual accounting provides mechanisms for implementing the matching concept. Consequently, the firm recognizes revenues and the expenses that brought them in the same accounting period.

If the vendor delivery and the customer payment fall in different time periods, however, the single-entry system has no way of matching the two events. The single-entry system, therefore, can present a misleading picture of earnings for either period.

In Conclusion: Single-Entry Accounting is Inadequate For Public Companies

These difficulties make it extremely difficult—if not impossible—to build a single-entry system that conforms to GAAP requirements in most countries (Generally accepted accounting principles). This lack may not concern sole proprietorships, partnerships, or small privately-held corporations. For such firms, the accounting system must support only the tax and employment reporting requirements.

It is nearly impossible to build a single-entry system, however, that by itself supports the reporting needs of public corporations (companies that sell shares of stock to the public). A single-entry system, in fact, is inadequate, for any firm that must report statements of income, financial position (Balance sheet), retained earnings, or cash flow ("Changes in financial position").