What are Payables? Accounts Payable?

Does the firm manage its short term debts effectively? Financial metrics such as Accounts Payable Turnover provide an answer.

Every business that practices accrual accounting operates continuously as both a debtor and a creditor at the same time. The constant interplay between credit and debt is a normal and useful reality in business everywhere. The only exceptions are a few very small businesses that buy, sell, and pay entirely with cash.

- Receivable is a general term for money that others owe the firm—usually customers or borrowers. Receivables appear as Assets on the balance sheet.

- Payables is a general term for monies the firm owes others—to sellers and lenders, of course, but also to the firm's own employees.

This article explains and illustrates the payables role in financial accounting. For more on receivables, see Account Receivable.

Define Payable, Accounts Payable

The term Payable refers simply to a debt that a firm owes to a particular creditor. A payable exists when two conditions apply:

- First, the firm legally owes a specific amount.

- Second,, the creditor believes and expects they will receive payment.

Accounts Payable is an accounting system liabilities account holding all of the firm's payables.

Buyer's Payable is Seller's Receivable

Consider a buyer who makes a purchase and takes delivery of the goods, but does not pay the seller immediately. The seller is, therefore, selling "on credit." As a result, buyer and seller now have a creditor-debtor relationship. That relationship lasts until the buyer pays.

The buyer's accounting system records the short-term debt as an account payable by crediting a liabilities account, Accounts Payable. The same debt enters the seller's system as an Account Receivable.

The unpaid purchase price remains an account payable for the buyer for the life of the debt. When the buyer pays, the accounts payable balance decreases by the same amount and the debtor-creditor relationship ends.

Explaining Account Payable in Context

Sections below further define, describe and illustrate Account Payable in context with similar terms and concepts, focusing on four themes:

- Explaining Payables, Receivables, and Account Payable concepts in accrual accounting.

- Example transactions showing how to record Payables and Receivables as journal entries.

- Financial Metrics that reflect the firm's Payables performance efficiency, including Account Payable Turnover and Days Payable Outstanding.

- How double-entry transactions for payables ensure that the Balance Sheet Always balances.

Contents

- What is an "Account Payable?"

- What are payables and receivables?

- What is the meaning of "Accounts Payable?"

- How does buying create an account payable? Example journal entries.

- Which financial metrics involve Accounts Payable?

- What is the role of Accounts Payable in the company's financial structure?

- Where do accounts payable appear on the Balance sheet?

- Where do input data for Accounts Payable metrics appear on the Income statement?

Related Topics

- For more on the concepts Accounts Receivable and Receivables, see the article Accounts Receivable.

- See Accrual Accounting for an overview of the role of accrual concepts in business commerce from the perspective of both the buyer and seller.

- The article double-entry System explains the role of Debit and Credit transactions in keeping track of accrued items, and for keeping the balance sheet in balance

What Are Payables and Receivables?

Under accrual accounting, firms track some of their debts under the name payables. Accounts payable is an example. Monies that others owe the firm appear as receivables, such as Accounts receivable. Note that both receivables and payables are legally binding obligations, shdfd one party owes another.

Accounts Payable is typically not the totality of the firm's short-term debt. Short-term debt appears in other accounts with a name including payable, such as:

- Employee wages payable

- Short-term notes payable

- Loan interest payable

- Taxes payable

- Long-term debt portion payable this period

What is the Meaning of Accounts Payable?

Accounts Payable is an accounting system account holding the sum of all current account payable items. Bookkeepers and accountants credit and debit "Accounts payable" as the firm incurs and pays off debts for buying goods and services. As a result, the current balance of this account is the sum of payables the firm currently owes to sellers.

In the accounting system, the firm's debts appear in two major categories:

- Firstly, Accounts Payable is a Current Liabilities account.The term "current" means these debts are due in the near term (within a year or less).

- Secondly, the other significant "Liabilities" account class, of course, is "Long-Term Liabilities." These debts are not due for total pay off in the next year.

Accounts Payable is Possible Only Under Accrual Accounting

The Accounts payable concept only applies where firms practice accrual accounting with a double-entry accounting system. The alternative to accrual accounting is cash basis accounting, which recognizes only two kinds of transactions: cash inflows and cash outflows.

Companies using cash-basis accounting can, of course, incur debts and bills they must pay in the short-term. And, they may even refer informally to these debts as "Accounts payable." Nevertheless, under cash-basis accounting, such obligations exist are outside the accounting system until the debtor pays with cash.

By contrast, when the buyer's firm uses accrual accounting, the buyer creates an account payable when purchasing goods or services on credit. Starting when the sale closes, the time when the sale closes, seller and buyer have a creditor-debtor relationship. That relationship lasts until two events occur:

- Firstly, purchase delivery to the buyer.

- Secondly, buyer payment to the seller.

The following sections show how both parties record and track debt transactions during the life of the debt.

Account Payable Journal Entries

Consider a purchase by a retail merchant, Woofer Pet Supplies. On 2 September, Woofer purchases pet food merchandise inventory from its supplier, Ajax Wholesale Feed Company. Ajax charges Woofer $1,180 for the order. Woofer does not pay Ajax immediately, however. Consequently, Ajax gives Woofer an invoice marked "Payable" for that amount.

Woofer's bookkeeper or accountant, therefore, makes two journal entries for the purchase:

- Woofer creates a new account payable and adds (credits) its value to Accounts Payable. Note that Accounts Payable is a liabilities account, and therefore its balance increases with a credit transaction.

- The second mandatory entry in a double-entry system is a simultaneous debit to the asset account, Merchandise Inventory. Asset account balances increase with a debit transaction.

Exhibit 1 below shows how these transactions appear in the buyer's journal.

| Woofer Pet Supplies Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 2-Sep-20YY 2-Sep-20YY |

103 Merchandise Inventory 200 Accounts payable |

$1,180 | $1,180 |

Exhibit 1. The buyer purchases merchandise inventory on credit, which requires two journal entries. Firstly, the buyer debits (increases) Merchandise Inventory, a Current assets account. Secondly, the buyer credits (increases) a Current liabilities account, Accounts payable.

At the same time, in the seller's back office, Ajax keeps track of the creditor-debtor relationship with two journal entries:

- Ajax applies a $1,180 debit (increase) to one of its asset accounts, Accounts Receivable.

- Ajax simultaneously applies a $1,180 credit (increase) to its own Sales Revenue account.

The debt is now "on the books" in both companies.

How Does Buying Create an Accounts

Example Journal Entries

Three days later, on 5 September, Woofer uses a bank debit card to pay Ajax the full $1,180 due. As a result, Woofer's accountant makes two journal entries simultaneously:

- The buyer (Woofer) decreases (debits) the Accounts payable balance.

- The buyer decreases (credits) the balance in its own Current Assets account, Cash.

Exhibit 2 below shows how these transactions appear in the buyer's journal.

| Woofer Pet Supplies Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 5-Sep-20YY 5-Sep-20YY |

200 Accounts payable 150 Cash |

$1,180 | $1,180 |

Exhibit 2. The buyer pays cash to cover the debt to the seller with two transactions. Firstly, the buyer debits (decreases) accounts payable, because the buyer has now cleared the debt, and secondly, the buyer credits (decreases cash) for the amount of the payment.

Notice that both companies treat the bank card payment as a cash transaction.

On the seller's side, Ajax accountants increase (debit) their Current asset account, Cash, and decrease (credit) another of their asset accounts, Accounts Receivable. Note that the seller claims "Sales Revenues" immediately at the time of the sale. Not until the buyer pays, however, does the seller's new asset value flow from the seller's Accounts Receivable into a cash account.

The Buyer's Viewpoint

On the buyer's side, Woofer accountants now post these transactions to the general ledger. The ledger has a "T-account" format, showing the transaction history of each account.

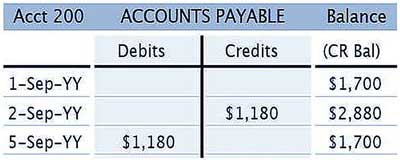

A small part of Woofer's Accounts Payable ledger presence might look like the T account in Exhibit 3:

Which Metrics Measure Accounts Payable Efficiency?

Accounts Payable Turnover and Days Payable Outstanding

Analysts use the company Accounts payable balance to address questions like these:

Is the company…

- Maintaining sufficient liquidity to support operations and meet short-term spending needs?

- Managing its Accounts Payable liabilities efficiently?

- Accounts payable status benefiting or harming financial performance and financial position?

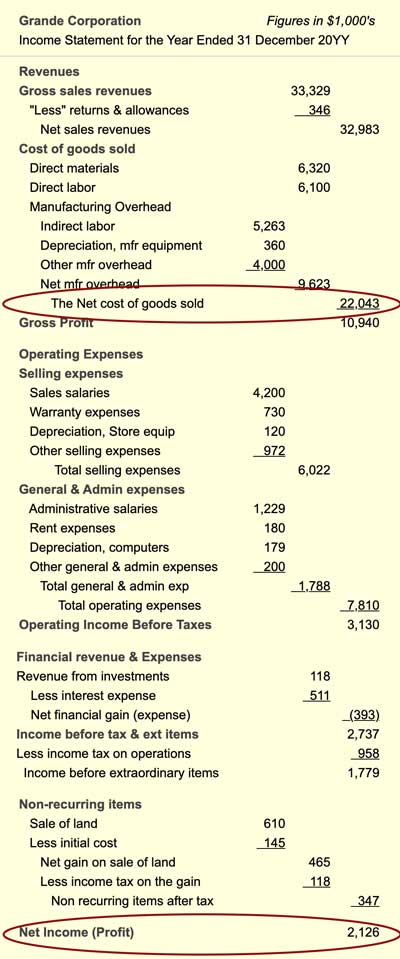

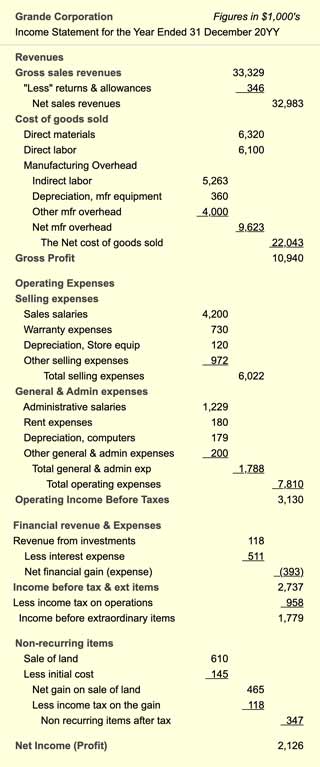

Financial metrics in the following sections use data from the Income statement and Balance sheet to address these questions.

Two Accounts Payable Efficiency Metrics: APT and DPO

Analysts use two different metrics to measure a firm's ability to manage cash flow and meet immediate payable obligations:

- Accounts payable turnover APT.

APT is a liquidity metric.The calculation returns a frequency. APT is, therefore, the number of times per accounting period the firm pays off its suppliers. - Days payable outstanding DPO

DPO is an activity and efficiency metric.

The DPO calculation returns a duration—measured in days. DPO is, therefore, the average number of days the firm takes to pay off its suppliers.

The Accounts Payable Turnover APT

Measuring pay off Frequency

The Accounts payable turnover APT metric uses income statement and balance sheet figures to measure the company's Account payable pay off performance. Note that APT is a frequency—the number of times per accounting period the company pays off its suppliers. Analysts call APT a liquidity metric because it measures the company's ability to manage cash flow and meet immediate needs.

An annual result of APT = 13.4 signals that the company pays off its "Accounts payable" bills 13.4 times per year.

Calculating Accounts Payable Turnover

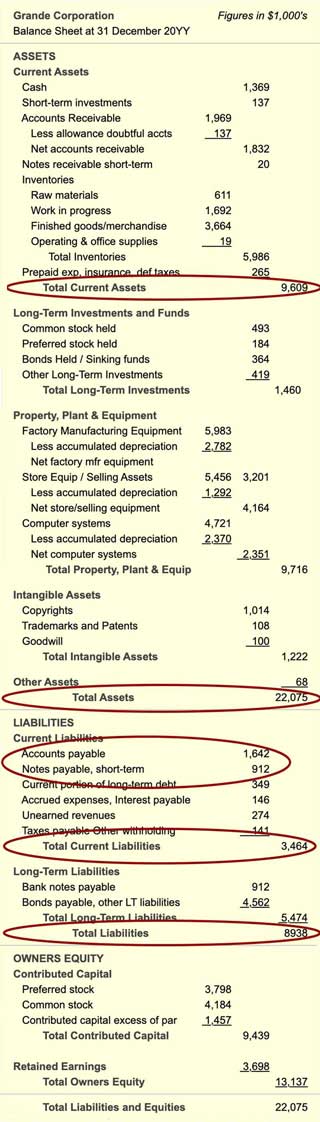

APT derives from Income statement Cost of Goods Sold and Balance sheet Accounts payable. The Exhibit 4 Balance sheet and Exhibit 5 Income statement below both include the source location of these data. For this example:

Cost of Goods Sold = $22,043,000

Accounts payable = $1,642,000

From these input data, Accounts payable turnover calculates as a ratio:

APT = Cost of Goods Sold / Accounts payable

= $22,043,000 / $1,642,000

= 13.4 payoffs / year

What Does the APT Result Mean?

An APT result of 13.4 means the firm pays off its suppliers about monthly, or a little faster. That is not surprising in a business environment where most creditors require payment "net 30 days" from receipt of invoice.

One might think that a rule for APT would be just "the higher, the better." However, financial officers will probably disagree with that rule.

- A very high APT rate could mean that the firm is having trouble obtaining credit.

- A very high APT rate could also mean that the firm is not making good use of funds (e.g., not holding onto funds that could otherwise be earning interest before pay off).

Analysts agree, however, that a much lower APT result, such as 3 - 5 payoffs per year is indeed a negative result.

- A meager APT rate could mean that the firm's creditors are extending unusually long credit terms, such as "net 60 days.

- A very low APT could also mean, only, that the firm is overdue paying its bills.

The Days Payable Outstanding Metric DPO

Measuring pay off Duration

The APT metric is a frequency, the number of payoffs per period. Analysts also refer to another measure that communicates approximately the same thing as "Accounts payable turnover," but express the result as a duration, calling it "Days payable outstanding DPO."

DPO is, in other words, a measure of time, the average number of days per pay off. A DPO result of DPO = 27.2means that the firm averages 27.2 days to pay off its suppliers.

Calculating Days Payable Outstanding

The activity and efficiency metric, Days payable outstanding (DPO) uses the same input data as the liquidity metric, APT:

- Firstly, Cost of Goods Sold from the Income statement.

- Secondly, Accounts Payable from the Balance sheet.

Alternatively, analysts find DPO by dividing the number of pays per period into the APT result.

Using Cost of Goods Sold and Accounts Payable figures from Exhibits 4 and 5, the DPO input data are as follows:

Cost of Goods Sold = $22,043,000

Accounts payable = $1,642,000

Accounts payable turnover APT calculates as follows:

DPO = Number of days * (Accounts payable / Cost of Goods Sold)

= 365 * ($1,642,000 / $22,043,000)

= 27.2 days

Also, using instead the APT figure from above as input, DPO calculates as:

DPO = Number of days / APT

= 365 / 13.4

= 27.2 days

What Does the DPO Result Mean? Where Should You Use DPO Instead of APT?

- When focusing on using resources efficiently, the DPO activity and efficiency metric version of this information is more helpful.

- When focusing on the company's liquidity, the APT frequency version is more helpful, even though both metrics convey exactly the same information.

Other Metrics Reflect Accounts Payable Balance

3 Liquidity Metrics and 2 Leverage Metrics

Other financial metrics also reflect the Accounts payable debt. In these metrics, however, Accounts payable plays a lesser role than it does in APT and DPO.

Other Liquidity Metrics Involving Accounts Payable

Several other liquidity metrics use the Balance sheet figures for Current Assets and Current Liabilities. As a Current liability, Accounts payable also contributes to these metrics.

Other things being equal, the more significant the Accounts payable component, the lower the firm's liquidity "score." Working capital, for instance, is the following difference:

Working capital = Current assets – Current liabilities

Thus, a larger Accounts payable means more substantial Current liabilities and therefore less working capital.

For more on these liquidity metrics and example calculations, see Liquidity Metrics.

Leverage Metrics Involving Accounts Payable

Two popular leverage metrics also reflect Current Liabilities debt, including Accounts payable:

- Total Debt to Assets Ratio,

or Debt Ratio

- Total Debt to Equities Ratio,

or Equities Ratio

Other things being equal, the larger the firm's Accounts payable balance, the higher the firm's leverage score. For more on leverage metrics and Debt Ratio and Equities ratio examples see Leverage Metrics.

Accounts Payable Role in Financial Structure

Accounts Payable Adds to Financial Leverage

Company funding results primarily from two kinds of sources: owners and creditors. Funds that owners supply are the firm's equities, while funds that creditor provide are the firm's liabilities.

- For some companies, owners provide the majority of funding, while for others creditors supply most.

- Analysts regard the balance of funding between these two sources as a measure of the firm's level of leverage. The greater the proportion of total funding that comes from lenders, the greater is the firm's degree of leverage.

- Analysts use leverage metrics to show how owners and creditors share business risks and rewards.

Two structures within the company's balance sheet define the company's level of leverage: Financial structure and Capital structure. Note that Accounts payable and other short-term debt:

- Are part of the firm's financial structure.

- Are not part of the firm's capital structure.

Financial structure compares the relative magnitudes of various balance sheet liabilities and equities. For a company with high leverage, therefore, total funds from lenders (liabilities) exceed total funds from owners (equities).

- In a healthy economy, when business volume is, and inflation is under control, companies benefit from high leverage. In such conditions, firms earn more with funds they borrow than they pay for debt service.

- The reverse is true when the economy is weak and business is slow. In that case, a high leverage companies spend more on debt service than they earns from the funds they borrow.

For financial structure examples, see Capital and Financial Structure.

Capital Structure vs. Financial Structures

A company's "Financial structure" differs from its "Capital structure" (capitalization) only in that "Financial structure" includes short-term liabilities, while "Capital structure does not."

- Metrics that measure leverage under financial structure (such as the total debt to equities ratio mentioned above) result in higher leverage ratings when Accounts payable is larger.

- A highly leveraged business benefits from its debt when sales are strong, and the economy is healthy. However, the debt burden penalizes the business, instead, when sales and the economy are weak.

Where is Accounts Payable on the Balance Sheet?

Example Balance Sheet

Accounts payable appears on the Balance sheet under Current liabilities, along with other short-term debts. On the end-of-period Balance sheet, Accounts payable shows the sum of all accounts (still) payable, as Exhibit 4 below shows.

Income Statement Data For Accounts Payable Metrics

Income Statement Example

Some Accounts payable metrics above use input data from the Income statement in Exhibit 5, below.