What are Retained Earnings?

Business firms exist—in principle—to create owner wealth. They build value (equity) by directing profits into Retained Earnings.

After a successful earnings period, a company, can (at the discretion of its board of directors) pay some of its income to shareholders, as dividends, and keep the remainder as retained earnings. These add to the firm’s accumulated retained earnings, which appear on the Balance Sheet under Owners Equity. The Statement of Retained Earnings serves as a GAAP-compliant method for reporting the disposition of the firm's earned income in this way.

Define Statement of Retained Earnings

Public companies publish a set of mandatory financial reports after the close of each reporting period. These including the Statement of Retained Earnings. This statement shows…

- The portion of the period's net income the firm will add to its total retained earnings. This total appears on both the Balance sheet and the Statement of Retained Earnings.

- Secondly, the portions of the period's net income the firm will pay to owners of preferred and common stock shares as dividends.

The Retained Earnings statement is one of the four primary financial statements that public companies must publish quarterly and annually. The other three mandatory statements are the Balance Sheet, the Income Statement, and the Statement of Changes in Financial Position.

Who Uses the Statement of Retained Earnings?

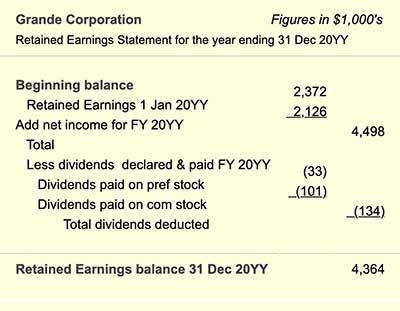

"Retained earnings" is usually the briefest of the mandatory statements, often just a few lines. The short example in Exhibit 1, below, is typical. However, for investors and shareholders, Retained earnings is arguably the most important of the four. It is crucial because Investors hope that stock ownership will reward them either from dividends, or from increases in stock share price, or both.

- Investors regard some mature, established firms, as reliable sources of dividend income.

- When firms are undergoing rapid growth and expansion, by contrast, they typically bypass dividend payment entirely and direct all income into retained earnings. Here, investors hope to benefit from rising share prices.

Investors will, therefore, look to a firm's current and previous Retained earnings statements:

- Firstly, to predict future dividend performance.

- Secondly, as one of several factors to consider for predicting future share price growth

Explaining Retained Earnings Statement in Context

This article further defines, describes, and illustrates Retained Earnings in context with related accounting concepts, focusing on four themes:

- First, sources of Retained Earnings.

- Second, example Statement of Retained Earnings.

- Third, Retained Earnings impact on other financial statements.

- Fourth, sources of Published Retained earnings figures for Public companies.

Contents

- What are "Retained earnings" and the "Statement of Retained Earnings?"

- How do Profits Serve as the Source of Retained Earnings?

- Where do companies publish the statement of retained earnings?

- Example statement of retained earnings.

- How do retained earnings impact other financial statements: Income statement, Balance sheet, and cash flow statement (SCFP).

Related Topics

- The article Dividend explains in more depth the role of dividends in financial statements.

- See the article Owners Equity, for more on the Equity role on financial statements.

- The article Trial Balance explains in more detail how earnings transfer to the Retained Earnings Statement.

- For more on other significant financial reporting statements, see these articles:

How Do Profits Serve as the Source of Retained Earnings?

For financial accounting purposes, a profit making company can do only two things with earnings:

- Firstly, distribute to shareholders (the owners) as dividends.

- Secondly, keep some or all of the profits as retained earnings.

Many companies divide profits for both uses each year.

Analysts sometimes call the Statement of retained earnings the "bridge" between the Income statement and Balance sheet. The "Retained Earnings" statement shows how the period's Income statement profits either transfer to the Balance sheet as retained earnings, or to shareholders as dividends.

The Statement of Retained Earnings Equation

The essential Statement of retained earnings equation is as follows:

Net income = Preferred stock dividends paid

+ Common stock dividends paid

+ Retained earnings

Or, equivalently

Retained earnings

= Net income

– Preferred stock dividends paid

– Common stock dividends paid

Retained earnings, in other words, are the funds remaining from net income after the firm pays dividends to shareholders. Each period's retained earnings add to the cumulative total from previous periods, creating a new retained earnings balance.

Is it Posible for Dividends to Exceed Net Income?

Note incidentally, that a few firms sometimes declare dividend totals that exceed the firm's reported net earnings. In principle, a firm can sometimes do this without having to reach into its cash reserves or borrow. For these firms, borrowing is not necessary because, in reality, they pay dividends from the firm's net cash inflows for the period, and these can be greater than Net income. This difference, In turn, is possible because Net Income can be reduced by noncash expenses such as depreciation, or bad debt expense, while the same noncash expenses do not reduce the firm's net cash flows.

Retained Earnings Statement Example

The example statement of retained earnings in Exhibit 1 belongs to the same set of related company reporting statements appearing throughout this encyclopedia. The complete set also includes examples of the Income Statement, Balance Sheet, and Statement of Changes in Financial Position (Cash Flow Statement).

Business Firms usually publish a Statement of Retained Earnings just after the end of every fiscal quarter and year.

For shareholders and the general public, the most accessible version is the edition in the firm's Annual Report to Shareholders. Public companies publish and send this report to shareholders before their annual meeting to elect directors. Shareholders typically receive printed copies by mail, but these reports are also available to everyone on the firm's internet site. Annual Reports and financial statements usually appear under site headings such as Investor Relations, or Investor Services.

For the Annual Report, the firm is legally responsible for publishing a retained earnings statement and other statements that serve two purposes:

- Firstly, to enable shareholders to make informed decisions when electing directors.

- Secondly, to enable shareholders and investors to evaluate the firm's recent financial performance and prospects for future growth. This information is crucial for supporting decisions on holding, buying, or selling stock shares.

Firms also publish financial statements that serve different audiences and other purposes. For more on financial statement audiences and purposes, see Materiality Concept.

Retained Earnings Impact Other Financial Statements

The Statement of retained earnings is the shortest of the four primary financial accounting statements, but it provides the clearest illustration of the interrelated nature of these statements. Every entry in the example above also appears on another of the fundamental financial statements.

- The retained earnings beginning balance appears on the previous period's (end of period) Balance sheet, under Owner's Equity.

- The net income figure is, of course, the "bottom line," or net profit figure from the current period's Income statement

- The dividend payments for preferred and common stock shareholders also appear on the current period's Statement of changes in financial position (SCFP, or cash flow statement), under Uses of Cash.

- The end of period retained earnings balance also appears on the current Balance sheet (statement of financial position) under Owner's Equity.