What Are Non-Recurring Gains and Losses?

Significant non-recurring gains or losses deserve special treatment on the Income Statement.

On the Income statement, incoming revenues and outgoing expenses are either operating gains and losses or non-operating gains and losses.

Operating gains and losses are, not surprisingly, revenues and expenses resulting from operating in the company's normal line of business. However, operating items are accompanied on the income statement by the other major revenue and expense category, non-operating gains and losses.

In late 2015, the Income statement treatment of non-recurring items began to change under International Financial Reporting Standards (IFRS) and under country-specific GAAP. Until 2015, the major categories of non-operating items were:

- Extraordinary items

(No longer used in most countries after 2015)

- Non-recurring items

- Unusual or one-time-charges, for example, expenses for "restructuring" or "employee separation."

- One-time or unusual gains, such as proceeds for sale of land assets.

- Charges Asset Impairment or Asset Write-down, such as a write off for inventory that has become worthless, or the consequences of natural disasters.

- Financial gains and losses

(For companies not in financial services)

What is changing for the handling of these items, however, is the need to distinguish between Extraordinary items and other Non-recurring items. That distinction is no longer in use in some countries. Use of the Extraordinary Item category ended in the United States and the United Kingdom in 2015, for instance. In other countries—Canada, for Instance—the "Extraordinary" designation is still used in a few circumstances.

Historically, revenue or expense transactions that reported as "Extraordinary Items" qualified for advantageous tax treatment in many jurisdictions. The likely reason for abandoning the Extraordinary classification, no doubt, is that the rules for distinguishing between extraordinary items and ordinary non-recurring items have always proven difficult to apply to the satisfaction everyone involved. For more on this issue, see the section below: Demise of the Extraordinary Item Category.

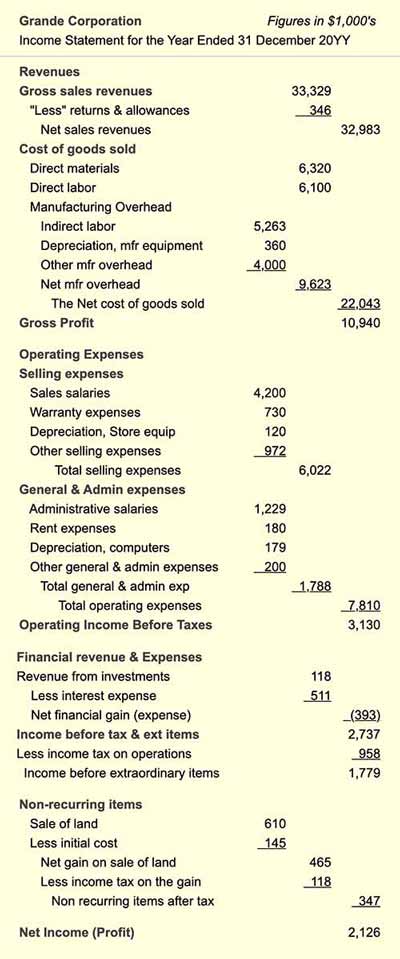

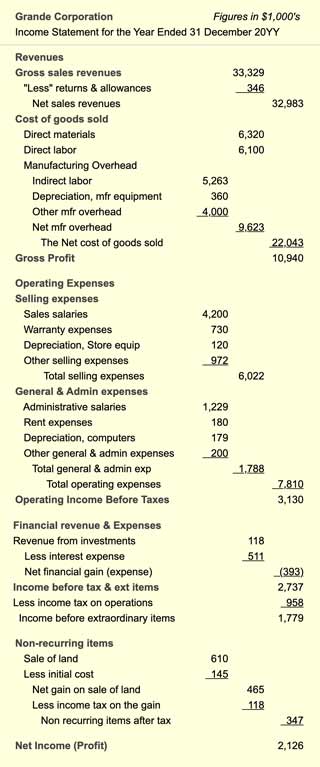

Example Income Statement Showing Non-Recurring Gains and Expenses

Exhibit 1 is an example Income statement with a typical level of detail for the Annual Report. On this example, Non-recurring items appear as the final major category. Note that until 2015, the Non-recurring item "Sale of Land" would appear as an Extraordinary Item."

Demise of the "Extraordinary item" Category

Before 2015, GAAP in most countries treated "extraordinary" items somewhat differently than other non-recurring gains and losses. As a result, before 2015, Accountants sometimes spent substantial time and effort trying to decide whether or not a given gain or loss qualified as "extraordinary." GAAP in many countries provided country-specific criteria for making the distinction, but in many cases, the rules for deciding between extraordinary and non-extraordinary called for subjective judgment or were otherwise subject to varying interpretation.

Until the first years of the 21st center, country-specific GAAP prescribed more advantageous tax treatment for extraordinary gains and losses, compared to non-extraordinary items. However, these tax-treatment differences largely disappeared over the last decade and, as a result, the reason for recognizing the special category "Extraordinary" also disappeared. The demise of the "Extraordinary Item" category was effectively the 2015 decision of the International Financial Accounting Reporting Standards (IFRS) xhibit 1. Incomebody not to recognize the extraordinary item concept.