What are the Two Accounting Equations?

The company may be doing very well or it may doing very poorly. Regardless, the balance sheet always balances.

The term Accounting Equation refers to two equations that are basic and central in double-entry accrual accounting systems. The term in fact has meaning only in accrual accounting. It does not apply in cash-based, single entry accounting.

Define Accounting Equation

Two equations provide rules that are the primary distinction between double-entry accrual accounting and cash-basis single-entry accounting.These equations, together, are known as The Accounting Equation. In double-entry accrual approach, the following two rules must hold after every transaction, throughout the accounting period:

- The first of these equations is the Basic Accounting Equation:

Assets = Liabilities + Equities. - The term Expanded Accounting Equation refers to the Basic Equation together with the second equation: Debits = Credits.

Explaining the Accounting Equation in Context

Sections below further explain Accounting Equation context with lending-related terms, emphasizing two themes:

- How the two accounting equations in fact represent two underling principles of double-entry accounting.

- Why the Balance Sheet always balances and why Total Debits always equal Total Credits.

Contents

- What are the two "Accounting Equations?"

- The Balance Sheet always balances: The Basic Accounting Equation.

- Total Debits always equal total Credits: The second Accounting Equation.

- Example Balance Sheet Structure and Contents.

Related Topics

- See the article "Balance sheet: Structure, Content, Meaning.

- For more coverage on accounts, see "Accounts, Account Transactions, and Chart of Accounts."

- For coverage of transactions in accrual accounting, see "Debits and Credits in Accrual Accounting."

- For an explanation of double-entry accounting, see double-entry Accounting Systems.

The Balance Sheet Always Balances

The Basic Accounting Equation

Firstly, the Basic Accounting Equation is another name for the Balance Sheet Equation, a simple summary of Balance sheet properties:

Assets = Liabilities + Owners Equities

The three elements of this equation Assets, Liabilities, and Owner's equities are the three major sections of the Balance sheet. Through the use of double-entry bookkeeping, bookkeepers and accountants ensure that the "balance" always holds (both sides of the equation are always equal).

Example: Maintaining the Balance

Consider a purchase by a retail merchant, Woofer Pet Supplies. On 2 September, Woofer purchases pet food merchandise inventory from its supplier, Ajax Wholesale Feed Company. Ajax charges Woofer $1,180 for the order. Woofer does not pay Ajax immediately, however. Consequently, Ajax gives Woofer an invoice marked "Payable" for that amount. Woofer's bookkeeper or accountant, therefore, makes two journal entries for the purchase:

- Woofer creates a new "account payable" and adds (credits) its value to Accounts payable. Note especially that Accounts payable is a liabilities account, and therefore its balance increases with a credit transaction.

- The second entry required in a double-entry system is a simultaneous debit to the asset account, Merchandise Inventory. Asset account balances increase with a debit transaction.

Exhibit 1 below shows how these transactions appear in the buyer's journal.

| Woofer Pet Supplies Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 2-Sep-20YY 2-Sep-20YY |

103 Merchandise Inventory 200 Accounts payable |

$1,180 | $1,180 |

Exhibit 1. The buyer purchases merchandise inventory on credit, making two journal entries. Firstly, the buyer debits (increases) Merchandise Inventory, a Current assets account. Secondly, the buyer credits (increases) a Current liabilities account, Accounts payable.

The Merchandise inventory account is on the Assets side of the Balance sheet, while Accounts Payable is on the "Liabilities + Equities" side. Adding the same $1,180 to each side, of course, maintains the accounting equation balance

Now note that on 5 September, Woofer pays the amount due Ajax, using a debit card transaction to Ajax for $1,180. double-entry accounting requires that Woofer's accountant or bookkeeper make two more entries in the accounting system journal simultaneously:

- Woofer decreases (debits) the Accounts Payable account balance FOR $1,180

- Woofer decreases (credits) one of its Current Assets accounts, Cash, for the same amount, $1,180. (Note that accountants treat the debit card transaction as a cash transaction).

| Woofer Pet Supplies Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 5-Sep-20YY 5-Sep-20YY |

200 Accounts payable 150 Cash |

$1,180 | $1,180 |

Exhibit 2. The buyer pays cash to cover a debt to the seller with two transactions. Firstly, the buyer debits (decreases) accounts payable, because the debt is now settled, and secondly, the buyer credits (decreases cash) for the amount of the payment. These two decreases occur on different sides of the Balance sheet, maintaining the balance.

Again, the Accounting Equation Balance holds.

Total Debits Always Equal Total Credits

Accounting Equation Second Meaning

The term Expanded Accounting Equation represents an extension of the "Basic Equation" to include another fundamental rule that applies to every accounting transaction wherever firms use double-entry bookkeeping:

Debits = Credits

The equation summarizes one result of using making double-entry debits and credits correctly.

- Firstly, Debit-Credit equality must hold for every event that impacts accounts. The Journal entries in Exhibits 1, 2, and 3 illustrate this equality. Every transaction brings a credit entry in one "account" and an equal, offsetting debit entry in another.

- Secondly, across any specified time span, the sum of all debit entries must equal the total of all credit entries. System-wide debit-credit equality must hold, given the same balance applies for every pair of "entries" that follows a transaction.

Accounting Equation 2 serves to provide an essential form of built-in error checking for accountants using a double-entry system. Near the end of each accounting period, a short time span covers the so-called "trial balance period." At this time, accountants summarize the period's debits and credits for all active accounts in the general ledger. A mismatch between debit and credit totals in this trial balance usually means that one or more transaction postings from "journal" to "ledger" are either in error or missing.

See the article Trial Balance for more on the use of Accounting Equation 2 for error checking during the trial balance period.

Example: Total Debits Equal Total Credits

Note, by the way, that the two offsetting entries that follow a single transaction do not need to occur on opposite sides of the Balance sheet. For example, a cash flow transaction to purchase an asset brings a "credit" to one asset account, "Cash on hand" (a credit decreases an asset account) and an equal, offsetting "debit" to another asset account, perhaps "merchandise inventory" (a debit increases an asset account).

Exhibit 3, below shows how such transactions can appear in the buyer's journal. In this case (Exhibit 3), Woofer Pet Supplies buys pet food inventory with a cash payment made immediately with the order.

| Woofer Pet Supplies Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 30-Sep-20YY 30-Sep-20YY |

103 Merchandise Inventory 150 Cash |

$2,400 | $2,400 |

Exhibit 3. The buyer purchases the merchandise inventory with cash and makes two journal entries. Firstly, the buyer debits (increases) Merchandise Inventory, a Current assets account. Secondly, the buyer credits (decreases) the Cash account, another Current asset account.

The Merchandise inventory account is on the Assets side of the Balance sheet, and Cash is $2,400 from another Assets account maintains "Balance Sheet balance" and the Debits = Credits equality.

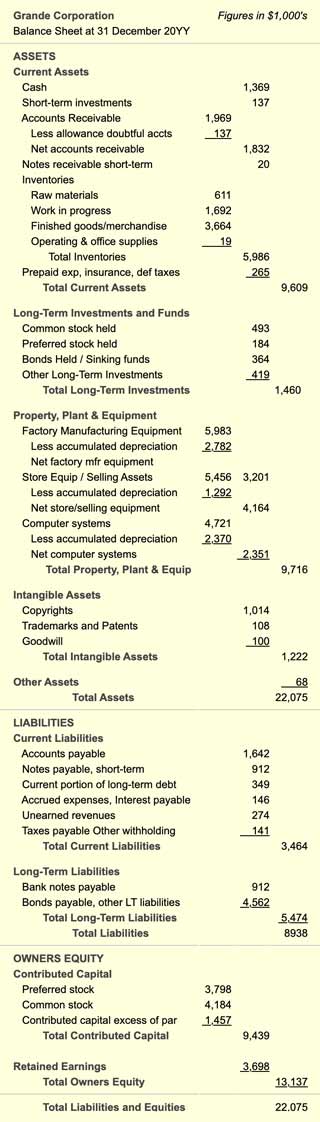

Example Balance Sheet Structure and Contents

Detailed Example

The Balance sheet stands as a detailed representation of the Accounting Equation:

Assets = Liabilities + Equities.

Exhibit 4 illustrates the equation with a detailed example Balance sheet.