What is an Accounting Period?

Each business completes the accounting cycle once every accounting period by publishing financial reports.

The Accounting Period concept serves as the organizing basis for financial reporting—as practiced by businesses, governments, and other organizations, worldwide. The concept works by tying reporting obligations to the calendar.

Define Accounting Period (Reporting Period)

An Accounting Period is a pre-designated time span, during which an organization starts, executes, and completes one iteration of the Accounting Cycle. Accounting periods usually extend across a fiscal year or fiscal quarter.

All companies complete the cycle and end the period by sending reports on the period's financial activities to tax authorities. Public companies also report similarly to shareholder owners. The accounting period, therefore, is also known as the Reporting Period.

Organizations usually define their accounting periods to coincide with the fiscal year. Typically, four quarterly periods correspond to the firm's fiscal quarters, and an annual accounting period covers the entire fiscal year.

Accountants complete steps of the accounting cycle during the reporting period. The period is complete when they publish financial reports for quarter or year. [Photo: General Office, Norfolk & Western Railway, Roanoke, Virginia, 1923]

Explaining Accounting Period in Context

Sections below explain the meaning of accounting Period, emphasizing two themes:

- First, defining Accounting Period and relationship to Fiscal Year and Accounting cycle, as well as the major steps in the period.

- Second, the role of financial reporting in bringing the accounting period to a Close.

Contents

- What is an accounting period?

- When does the firm publish financial reports for the accounting period?

- What is the sequence of activities across the accounting period?

- How does the accounting period compare to the fiscal year?

Related Topics

- See Accounting Cycle for more on accounting period activities.

- See Fiscal Year for more on fiscal years and accounting periods.

Publishing Financial Reports for the Accounting Period

Which Periodic Reports Must Public Companies Publish?

Business firms publish several accounting reports, or financial statements shortly after the end of the accounting period. Their purpose is to summarize economic activity from the start to the end of the period. For companies in private industry, these include four reports:

This encyclopedia has a separate article with detailed examples for each of these:

- Firstly, the Income statement (or Profit and loss statement)

- Secondly, the Balance sheet(or Statement of financial position).

- Thirdly, the Statement of Changes in Financial Position (or Cash flow statement)

- Fourthly, the Statement of Retained earnings.

You should know that government organizations call their "Income statement" a "Statement of operations." And, some non-profit organizations call their "Income statement" a "Statement of activities."

Identifying the Accounting Period on Financial Statements

For all of these statements—except for the Balance sheet—firms identify the accounting period in view with a note immediately under the report title, with a phrase such as:

. . . for the year ended 30 September 20YY

By contrast, the Balance sheet reports on the status of asset, liability, and equity accounts at one point in time—the end of the accounting period. Firms usually write this date just under the Balance sheet title with a phrase such as:

. . . at 30 September 20YY

What is the Order of Activities in the Accounting Period?

Accounting Period Activities Run in Sequence

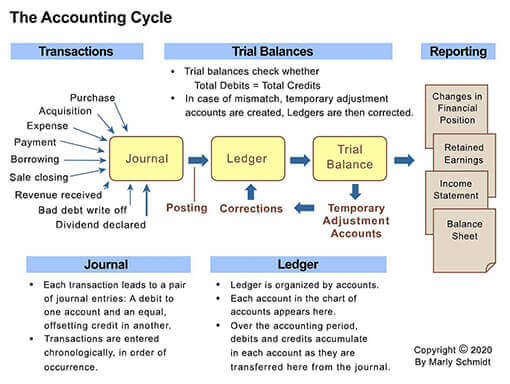

Exhibit 1 below shows the normal activities of the accounting cycle across one accounting period.

The accounting period is central to the application of the matching concept in accrual accounting."Matching" is the principle that firms report revenues in the period they earn revenues, while reporting expenses in the period they incur them.

Continuous Accounting Through Period

Historically, journals were always bound notebooks in which bookkeepers hand-wrote entries shortly after a sale closing, after incurring an expense, and after any other event that impacts the firm's accounts. Ledger posting occurred at intervals, as accountants hand wrote the same entries into another bound notebook for Accounting cycle Step 3. Standard practice was to postpone comprehensive error checking and trial balance preparation until the final weeks of the period.

Today, of course, journals and ledgers usually exist as software and data in electronic accounting systems. Bookkeepers still make transaction entries, of course, but other individuals also contribute entries as well. They generally make manual entries through onscreen forms, but many entries are also made automatically (for instance, by a point of sales system).

Software systems also automate other stages of the accounting cycle, as well. Until the middle of the Twentieth century, when bookkeeping and accounting meant hand-written notes on paper, accountants posted journal entries to ledger accounts infrequently during the accounting period. With automated systems, however, journal entries can post to the ledger continuously. And, systems check for errors, continually. Finding errors and making corrections need not wait for the end-of-cycle trial balance period.

Note that the practice of keeping accounting systems always up to date—ready for closing out at any time—is known as continuous accounting.

How Does Accounting Period Compare to the Fiscal Year?

Do These Terms Have the Same Meaning?

Public companies (companies that sell shares of stock to the public) must publish reports annually, for an accounting period that coincides with their fiscal year. In most countries, this is also the period (the year) for which tax liabilities are due.

Many companies also publish financial reports for quarterly accounting periods (three-month periods), for the benefit of shareholders, potential investors, and their management.

The Calendar Year vs. Fiscal Year and Accounting Period

Note that the accounting period "fiscal year" need not coincide with the calendar year. When a financial statement refers to "FY 2018," for instance, the reference refers to the fiscal year ending sometime in calendar 2018. The US government fiscal year ends 30 September 30, the UK government fiscal year ends 31 March, while the Australian government ends its fiscal year on 30 June. Among companies in private industry, Cisco Systems ends its fiscal year 31 July, Siemens ends the fiscal year on 30 September, and Hewlett-Packard's fiscal year ends 31 October.

Nevertheless, a majority of companies worldwide end their fiscal year accounting periods when the calendar year ends, on 31 December (for example, Ericsson, Virgin Media, and IBM).