What Is the Accounting Cycle?

The Accounting Cycle is complete when the business publishes financial statements for the period.

Businesses, governments, and other organizations rely on their financial accountants to maintain their accounting systems, record financial transactions, and help meet their financial reporting obligations. In an ongoing business, these activities are part of a cyclic, iterative process known as the Accounting Cycle.

Define Accounting Cycle

The Accounting Cycle is a sequence of steps or actions with an organization's financial transactions and accounts. Each iteration of the cycle runs across a complete, usually a fiscal quarter or year.

The cycle begins with the first financial transactions of the period and their entry into a journal. The cycle ends when the organization makes final end-of-period account adjustments, closes temporary accounts, and publishes financial statements for the period just ended.

The Accounting Cycle Ends Looking Backwards in Time

In most organizations, the accounting cycle runs more or less simultaneously with a separate cycle—the budgeting and planning cycle. Activities and procedures in these two cycles are mostly independent of each other, although some individual accountants may participate in both.

- The budgeting cycle looks forward in time. As a result, this cycle primarily concerns future spending and future cash inflows.

- The accounting cycle purpose is to report the state of revenues, expenses, assets, liabilities, and equities accurately as they stand after a period of activity. As a result, the accounting cycle looks backward in time.

Published Reports Mark the Accounting Cycle End

Governments and regulatory agencies almost everywhere require public companies to publish financial statements—reports—for the most recently ended annual accounting period. The financial statements that are mandatory, practically everywhere, are:

- Income Statement

- Balance Sheet (Statement of Financial Position)

- Statement of Changes in Financial Position (Cash Flow Statement)

- Statement of Retained Earnings

Public companies must also send these reports to shareholders in an Annual Report, just before the company's annual meeting to elect directors. The financial results for the period are of keen interest to shareholder owners, directors, officers, investors, competitors, industry analysts—and the firm's employees. They view these statements as the definitive report for the company on:

- The firm's financial performance across the period. For "financial performance," the primary focus is the Income statement.

- The firm's financial position at the end of the period. For "financial position," the primary focus reports are the Balance Sheet and The Statement of Changes in Financial Position.

- Ability to increase owner value. For owner value, the primary focus is the Statement of Retained earnings. This report shows how the firm's board of directors decides to distribute the period's earnings between shareholder dividends and retained earnings.

Explaining Accounting Cycle in Context

Sections below further define and illustrate accounting cycle concepts in the context of related terms, emphasizing two themes:

- Organization of the Accounting Cycle around the Chart of Accounts and the Accounting Period.

- Defining the accounting cycle with steps: (1) Financial transactions, (2) Journal entries, (3) Posting to the Ledger, (4) Trial Balance Period, and (5) Reporting Period with Financial Reporting and Auditing.

Contents

The Cycle is All About Keeping the Accounts

Each Account Has a Current Balance

The accounting cycle is "all about" managing, updating, and reporting on the firm's accounts.

The basic system building block is the account. An account in the system is merely a record of the values and value changes for a specific class of items or events. Each account has the following properties:

- An account category: Revenue, Expense, Asset, Liability, or Equity

All accounts must belong to one of these categories. - A unique account name and number

- A balance

For Asset and Expense accounts, a balance greater than zero is a debit balance. For Revenue, Liability, and Equity accounts, a balance higher than zero is a credit balance. The account balance changes, of course, with every account debit or credit transaction.

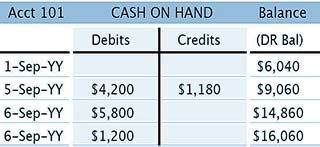

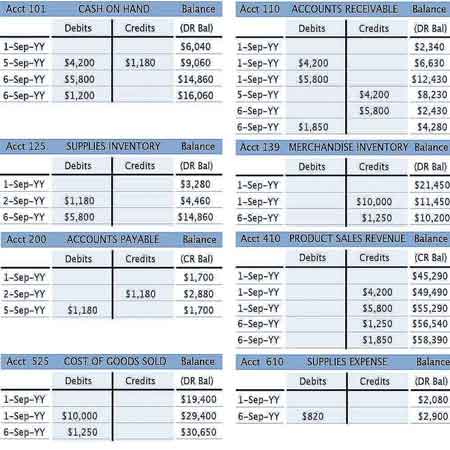

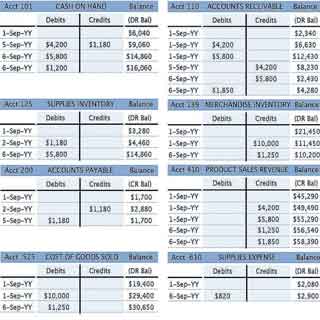

Exhibit 1, for instance, is an extract from a general ledger, showing the status and recent history for one account: Account 101, Cash on Hand. This form of account display, by the way, is called T-account format.

Figures under "Debits" and "Credits" have been posted to the T-account from the journal (see Exhibit 3, below, for sample journal transactions). Because Cash on Hand is an Asset account, it carries a so-called Debit balance. For accounts with a debit balance, debit entries increase the balance and credit entries decrease it.

The Definitive Account Inventory: Chart of Accounts

When setting up the firm's accounting system, accountants first create a definitive inventory of the system's active accounts. This inventory is mostly a simple list, known as the firm's Chart of Accounts.

The vast majority of firms worldwide, moreover, manage, track and update accounts using accrual accounting and a double-entry system. For this purpose, firms use five account categories.

- Two categories of "Income statement" accounts: Revenue and Expense accounts.

- Three categories of "Balance sheet" accounts: Assets, Liabilities, and Equities accounts.

Not surprisingly, responsibility for implementing the accounting cycle—maintaining, updating, and reporting the firm's accounts—falls primarily to the firm's accountants. The accountant's role is literally "keeper of the accounts."

What Happens During Accounting Cycle Stages?

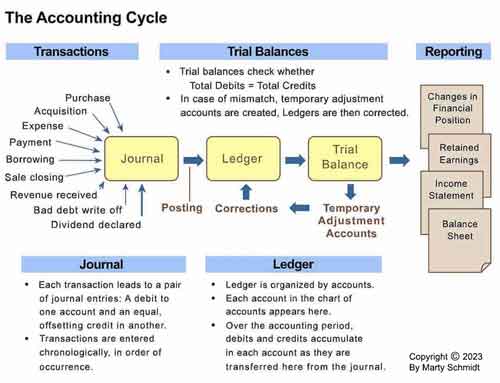

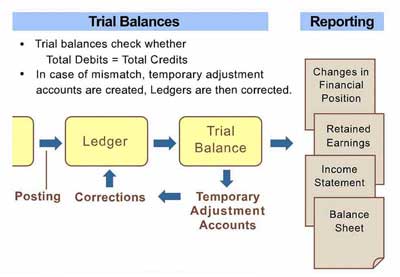

Exhibit 2 below presents the accounting cycle as information flow, starting with transactions that impact the organization's accounts and ending with the publication of financial statements.

- Note that Exhibit 2 covers one complete instance of the accounting cycle, over a single accounting period (usually a quarter year or year), and the Reporting period that follows it.

- Note especially that steps 1-3 (Transactions, Journal Entries, and Ledger Posting) occur repeatedly and continuously throughout the period almost until the period end. Firms usually take the final two steps (building a trial balance and publishing reports), only at the end.

Accounting Cycle Step 1

Financial and Non-Financial Transactions

For large and complex firms, events impact accounts occur frequently and more or less continuously. Exhibit 2 above suggests just a few of the many transactions that can ultimately impact accounting system accounts. For example, the accounting system is affected by every:

For large firms, the list of transaction types could extend to scores or hundreds of items.

Accounting Cycle Step 2

Transactions Enter the Journal

Historically when accounting systems existed entirely on paper, transactions entered the records when a bookkeeper hand-wrote entries into a journal (or daybook) soon after they occurred. It was and still is a rule that "transactions" go into the journal in the order they occur, shortly after they happen. As a result, entries in the journal appear in chronological order. In this way, should anyone ask which transactions occurred on a given day, they can turn to the journal for an answer.

Today, with computer-based systems, many kinds of transactions enter the journal without involving a bookkeeper or accountant. In retail shops, for instance, "Point-of-Sale" systems scan customer purchases during checkout. One touch of a cash register button print's the customer receipt and makes the appropriate accounting system journal entries at the same time. The firm can still enter other kinds of transactions into the journal manually, of course. Manuel entry may involve salespeople, bookkeepers, or accountants, using an onscreen form on the computer.

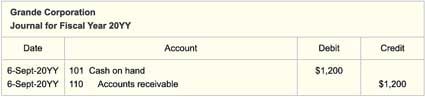

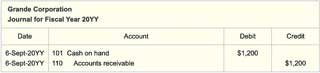

Example Journal Entries

Note in the Exhibit 1 ledger extract, above, the Cash on Hand account shows a debit entry for $1200 on 6 September.

- At the close of business on 5 September, Grand Corporation holds an Account receivable value of $1,200 from a customer who had earlier purchased goods from Grande on credit Grand created the Account receivable by invoicing the customer for $1,200 at the time of purchase.

- On 6 September, the customer pays the outstanding bill with $1,200 cash. When receiving this cash, Grande's bookkeeper makes the two journal entries in Exhibit 3:

Cash on hand and Accounts receivable are both asset category accounts. As a result, Grande's total asset base does not change when the customer pays in cash. The $1,200 value merely transfers from one asset account to another.

Accounting Cycle Step 3

Journal Entries Post to the Ledger

Entries in the journal accumulate chronologically—in the order they occur. The ledger, however, organizes entries by account. Cycle step 3, posting, is the process of transferring journal entries to their accounts in the ledger.

Exhibit 4, below, show the ledger versions of eight accounts. Note that the T-accounts in Exhibits 1 and 4 show only one week of transaction histories. The full ledger, of course, would include the entire accounting period history.

The firm's General Ledger contains all active accounts from the Chart of Accounts. As a result, once journal entries transfer (post) to the ledger, anyone can ask for the current balance in any of the firm's accounts. Note that they turn to the "ledger" for an answer.

Historically, with paper-based accounting systems, journal entries and ledger postings were hand-written entries made by bookkeepers and accountants. With hand-written entries, "Posting" occurred periodically, but not necessarily every day. Note, however, that computer-based accounting systems have brought the first three stages of the accounting cycle closer to being a continuously ongoing process. It is usual now for accounting system software to capture journal entries and post them to the ledger automatically and continuously.

Accounting Cycle Step 4

Error Checking and the Trial Balance Period

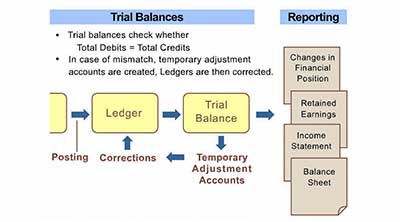

The accounting cycle continues until shortly before the period end. At this point, accountants create a trial balance from ledger entries. Exhibit 5 below is an excerpt from Exhibit 1, focusing on the trial balance positioning between ledger posting and the financial statement reporting.

The Trial Balance Error Check: Does the Sum of Debits Equal the Sum of Credits?

The name trial balance derives from one kind of error-check in this period. By the rules of double-entry accounting, the sum of all debits made during the period must equal the total of all credits. A mismatch between these sums indicates the presence of a transaction error somewhere in the system.

Reconciliation and Other Error Checks

The firm performs other kinds of error-checking during this period as well. With the reconciliation process, for instance, they ensure that the firm's bank cash account balances—as the bank reports them—agree with the firms own accounting system. And, they confirm that the firm's liability accounts for bank loans agree with the lender's account statements.

Temporary Adjustment Accounts While Searching for the Error Source

When it becomes clear an error exists somewhere in the system, accountants may create "temporary adjusting accounts" to restore the balance between total debits and total credits immediately. The objective then is to uncover the underlying errors, correct the errors, and close temporary adjusting accounts before the trial balance period ends.

When nearing the end of an accounting period, and closing the accounting cycle, the firm also tries to close other temporary accounts. A balance in an Accrued revenue account, for instance, indicates the firm has delivered purchased goods or services to a customer, but the customer, but the customer has not yet paid nor received a bill. Near the end of the trial balance period, the firm will bill the customer so that it can move the temporary Accrued revenue balance to another current assets account, such as Accounts receivable, or even Revenues received.

Accounting Cycle Step 5

The Reporting Period

The final steps in the accounting cycle are preparing and publishing the period's financial reports. Publishing must occur after the accounting period closes, of course, because the published statements cover account activity through the final day of the period. Publishing may not happen, however, until the firm allows time for several kinds of final adjustments and auditing. Note that the time between closing the reporting period and the date the firm authorizes statements for publishing—the fifth step in the accounting cycle—is called the reporting period.

In the final weeks of the accounting period, however, the firm's accountants will brief corporate officers and directors privately on the financial results they expect to publish at the end of the Reporting period.

Moreover, if the actual financial results are likely to be much better, or much worse than investors and analysts are expecting, corporate officers themselves may signal a warning to the investment community and the press. The purpose is to avoid the appearance of misleading the public. In such cases, the firm has good reason to move public expectations closer to the actual results they will soon publish.

Four Mandatory Statements

Governments, regulatory bodies, and tax authorities in most countries require public companies to produce and file four mandatory statements.

- The Income statement.

- The Balance sheet (or Statement of financial position).

- The Statement of changes in financial position (or Cash flow statement).

- The Statement of retained earnings.

Auditing Before Publishing

Public companies must obtain an auditor's opinion on their financial statements before they publish and send them to shareholders in an Annual Report, or regulatory bodies, or governments. Companies ensure impartiality by engaging independent third-party auditors—hired by the firm, but not working as employees of the audited firm.

The auditor's opinion does not judge the financial position of the reporting firm. Nor does it otherwise interpret economic data. Instead, the "opinion" answers two specific questions:

- Do the statements conform to Generally Accepted Accounting Principles (GAAP)?

- Do they fairly represent the entity's financial accounts?

Before issuing an opinion, auditors review the firm's accounting practices, financial data sources, and account transaction histories. From this, the best possible audit outcome is an auditor's opinion of Unqualified. This opinion means the auditor fully endorses a "Yes" answer to the above two questions.

Solution Matrix Ltd® 292 Newbury St Boston MA 02115 USA

Phone +1.617.849.8478 • Contact Form • Privacy Policy • About Us • Sitemap

Terms of Service • Refunds • Customer Service • Safety & Security

Copyright © 2004–2024 by Solution Matrix Ltd • All Rights Reserved