What is TCO for Assets and Acquisitions?

Purchase price and ownership cost can be very different for certain acquisitions.

Everyone in business knows that acquiring assets can become a costly undertaking. Asset ownership brings purchase costs, of course, but owning also brings costs due to installing, deploying, using, upgrading, and maintaining the same assets. These after-purchase costs can be large, and they are not always obvious at the time of purchase.

One goal in asset acquisition, therefore, is to avoid unpleasant cost surprises during asset life cycle by ensuring that all likely ownership costs are anticipated, before making acquisition decisions. This is the purpose of total cost of ownership analysis.

Total Cost of Ownership TCO Definition

Total cost of ownership TCO is a form of cost analysis that aims to uncover all the likely costs that follow from owning certain kinds of assets or certain acquisitions during ownership life.

TCO analysis attempts to reveal and summarize ownership costs that are obvious and known to all before purchase, but also the full range of so-called "hidden costs" which are easy to overlook.

TCO analysis sometimes finds a substantial difference between purchase price and total life cycle costs. This difference can be vast when ownership covers a long time span. As a result, TCO analysis sends a powerful warning to corporate buyers, capital review groups, and asset managers:

Consider TCO first instead of purchase price alone when making purchase decisions!

Who Uses TCO?

Businesses that purchase or manage large computing systems have had a keen interest in TCO since the late 1980s. At that time, IT industry analysts began publishing studies showing a large difference between IT systems prices and comprehensive system ownership costs. Not surprisingly, findings soon got the attention of IT vendor marketers and salespeople.

Competitors of IBM, for instance, used their own TCO results to argue that IBM systems were needlessly expensive to own and operate. This kind of argument is possible because the five-year total cost of ownership for substantial hardware and software systems—from any vendor—can be five to ten times the hardware and software purchase price.

Today, TCO analysis supports purchase decisions for a wide range of assets. These include especially items with significant maintenance and operating costs across ownership life. The total cost of ownership is, therefore, at center stage when leaders face purchase decisions for large IT systems, vehicles, buildings, laboratory equipment, medical equipment, factory machines, and private aircraft, for instance.

As a result, TCO for these assets is a central focus in …

- Budgeting and planning.

- Asset life cycle management.

- Prioritizing capital purchase proposals.

- Evaluating capital project proposals.

- Vendor selection.

- Lease vs. buy decisions.

Understanding and Using TCO Analysis in Context

Sections below focus on three themes:

- First, the nature and purpose of total cost of ownership analysis.

The definition of "ownership life" receives special attention. TCO lifespan may reflect the acquisition's economic life, service life, depreciable life, or accounting life. The lifespan may also cover an arbitrary number of years. - Second, a step-by-step guide to calculating total cost of ownership.

The 6-step TCO process appearing here has proven uniquely successful achieving TCO results that meet the TCO definition (above): "TCO is an analysis meant to uncover all the lifetime costs that follow from owning certain kinds of assets. - Thirdly, the interpretation and use of TCO results.

Final sections focus on the role of TCO results in business planning and decision support.

Contents

TCO Covers Ownership Life

But How Long is Life?

Cost of ownership analysis attempts to uncover both the "obvious" costs and the so-called "hidden" costs of ownership across the full ownership life cycle of the acquisition. Usually, however, there is room for judgment and different opinions on the appropriate lifespan to analyze.

In specifying ownership life for the analysis, owners may consider several other "lives" that are in view:

- Depreciable life.

The number of years over which owners charge depreciation expense for an asset is its depreciable life. Accounting standards and local tax laws prescribe what this expense should be each year. Impacts due to this expense include the following:- Lower book value for the asset.

- Lower taxable income (lower profit)

- Tax savings for owners, due to the lower reported income.

- Economic life.

The number of years that the asset returns more value to owners than it costs to own, operate, and maintain. When these costs exceed asset returns from, the acquisition is beyond its economic life. - Service life.

The number of years the asset is actually in service. - Accounting life.

The number of years the asset impacts the organization's accounts.

All of the above lives may be different, and all may contribute to the owner's judgment as to the length of the ownership life. Also, however, the lifespan in view for the TCO study may also depend on the owner's purpose for the analysis.

TCO for Budgeting, Planning, or Decision Support.

Owners sometimes declare that "ownership life" is the length of time that ownership has a financial impact. Analysts usually apply this rule in two cases: Firstly, when TCO analysis supports budgeting and planning activities, and secondly when TCO supports strategic decision making. In these cases:

- Ownership life starts when the acquisition begins causing costs. Note especially, this may occur before the asset arrives or goes into service (see the "hidden cost" categories in the next section).

- Ownership life ends when the asset has no financial impact of any kind. "No financial impact" means that all costs due to disposal or decommission have are past, and the asset no longer causes expenses of any kind, and no longer contributes to the balance of a balance sheet asset account.

TCO for an Arbitrary Number of Years

Alternatively, TCO analysis may cover an arbitrary number of years, for example, three years, five years, or ten years. This approach is usual when:

- The TCO analysis purpose is to help choose a vendor from competing proposals.

- The TCO analysis helps prioritize capital spending proposals that are competing for funding.

- Actual economic life or service life of the acquisition is uncertain.

- The firm's asset life cycle management policies and practices dictate specific life spans for classes of assets.

How to Calculate TCO in 6 Steps

Uncover All the Hidden and Obvious Lifecycle Costs

The TCO analysis tries to ferret out all of the lifetime costs that follow from a decision to own something. For most asset classes, some of these costs are "obvious," known to all before purchase, while other costs are "hidden," or less obvious before purchase. Sections below present a six-step TCO process for approaching this objective with a systematic search plan that aims to uncover every cost impact that follows from the acquisition.

A proper TCO analysis is, in fact, a special instance of a business case cost-benefit analysis that includes only cost items. The TCO business case does not consider business benefits from ownership other than cost savings and avoided costs.

Businesspeople familiar with the Solution Matrix Ltd 6D Business Case Framework will recognize the 6-step TCO process below as a special application of the 6D Framework. As such, this TCO Process has a 24-year proven track record, in Business firms, governments, and non-profits, worldwide.

Step 1

Describe the acquisition, define TCO lifespan.

The TCO analysis begins when the owner identifies or defines and describes two things:

Step 1A

Describe the subject—what the TCO analysis is "about."

The TCO analyst first identifies the subject of analysis. TCO is often about the acquisition of costly assets, such as vehicles, machines, buildings, or computer systems. However, the TCO concept is equally useful for estimating the full cost of owning such things as service contracts, licenses, rights to patents, or ownership of intangible assets such as trademarks or intellectual properties.

Step 1B.

Define the length of ownership life for analysis

Analysts almost always define ownership life in years, giving specific starting and ending dates. The analyst may choose to base analysis ownership life on any of the following:

- Depreciable Life

- Economic Life

- Service Life

- Accounting Life

- Arbitrarily Specified Lifespan

For more on choosing an ownership lifespan for the TCO analysis, see the section above "TCO Covers Ownership Life".

Step 2.

Identify Ownership Cost Category Impacts

The TCO analysis continues when the analyst identifies essential cost categories likely to have cost impacts due to ownership. To be sure the study includes all relevant costs, TCO analysts consider two kinds of cost categories. These are, firstly, obvious costs, and secondly, "hidden" costs.

Step 2A.

Identify Obvious Costs For Analysis

"Obvious" costs in TCO are the costs familiar to everyone during planning and vendor selection, such as:

- Purchase cost: The actual price.

- Maintenance costs: These are due to warranty costs, maintenance labor, contracted maintenance services or other service contracts.

Step 2B

Search Out the "Hidden Costs"

The so-called "hidden" costs are the less apparent costs due to ownership—spending needs that are easy to overlook or omit from acquisition decisions and planning. Spending needs of this kind can be substantial and real, nevertheless. The discovery that hidden costs for certain assets can be significant is the reason TCO analysis exists.

All hidden costs that turn up in TCO analysis belong in the TCO summary if both conditions apply:

- Firstly, the necessary expenditures are indeed due to the decision to own something.

- Secondly, the costs are material (large enough to matter).

Hidden Costs May Include:

- Acquisition costs: These can include many kinds of spending due to identifying, selecting, ordering, receiving, inventorying, and purchasing. Any of these costs can signal the start of ownership life for the analysis.

- Upgrade, Enhancement, Refurbishing costs.

- Reconfiguration costs.

- Setup and Deployment costs: Costs due to configuring space, transporting, installing, setting up, integrating, and outside services.

- Operating costs: For example, expenses for human operator labor, or energy costs and fuel costs.

- Change management: costs: For example, expenses for user orientation, user training, and workflow or process change.

- Infrastructure support costs: For example, the costs of heating, lighting, cooling, or IT support costs due to asset acquisition.

- Environmental impact costs: For example, expenses for waste disposal, clean up, and pollution control. These may also include charges for "environmental compliance" reporting.

- Insurance costs.

- Security costs:

- Physical security: For example, expenses for building locks, secure entry doors, closed-circuit television, and security services.

- Electronic security: For example, the costs of security software, offsite data backup, and disaster recovery services.

- Financing costs: For example, fees for loan interest and loan origination.

- Disposal / Decommission costs.

- Depreciation expense tax savings (a negative cost).

The list of hidden cost categories above could, of course, extend further for many kinds of acquisitions.

Where Do You Find the TCO Cost Categories?

TCO analysis uncovers obvious and hidden costs when the analyst anticipates cost impacts in all the categories above—and sometimes more. The analyst, in other words, creates an inventory of cost categories. Consequently, the analyst begins finding cost categories by interviewing those familiar with the asset's usage.

Also, suggestions for finding relevant cost categories may come from other sources, including:

- Firstly, the owner's experience with other assets in the current setting or another setting.

- Secondly, local policies for asset life cycle management.

- Thirdly, industry standards. These may come from publishing consultants as well as professional standards organizations.

- Fourthly, vendor recommendations and vendor experience.

- Fifthly, published TCO analyses from other analysts and publishing consultants.

- Sixthly, project plans for using the asset. These should include, at a minimum, resource requirements for labor and energy. Project plans should also include a complete work breakdown analysis.

- Finally—and very importantly—the firm's long-range business plan. Cost estimating sources in the business plan include the firm's business model, with revenue and cost forecasts for significant categories. And, the business plan should also anticipate cost trends due to inflation, price changes, customer demand, technology, and government regulation.

Do TCO Results Reflect Subjective Judgements?

Merely naming the cost of ownership subject does not fix boundaries for the analysis.

The analyst must still decide and communicate which items belong in the TCO study analysis and why. Consider, for example, the case when TCO analysis applies to a potential IT system acquisition.

- IT TCO comparisons from publishing analysts tend to focus narrowly on costs due to purchase, maintenance, and straightforward operating expenses. Here the emphasis is on comparing different vendor solutions fairly.

- IT TCO analyses from salespeople, consultants, or managers for specific settings usually have a broader scope, aiming at a more inclusive total lifetime cost. These analyses have a more extensive range because This is because these analyses intend to predict budget impacts accurately. Also, these analyses may have to compare TCOs for entirely different kinds of possible actions.

In each of these situations, the TCO analysis serves a different purpose, and each calls for a particular cost model (see next section). When using TCO results, remember that analyst judgment plays a role choosing which cost categories belong in the analysis and which do not. Analysts are free to choose cost classes that best serve the purpose of decision-makers and planners.

In conclusion, when a TCO analysis compares different scenarios or action plans, be sure that all "analysis scenarios" use the same TCO cost model.

Step 3

Structure TCO cost model: Heart of the Analysis

The TCO analysis continues by designing a comprehensive cost model that covers the TCO subject through ownership life, designed especially to support decision maker needs.

Step 3A

Define cost categories as two-dimensional array

Making the step from a complete inventory of "obvious" and "hidden" cost categories, to a comprehensive cost model, requires the analyst to look for specifics in these areas:

- Firstly, the kinds of resources appearing in each of the cost categories.

- Secondly, activities due to ownership, in each of the cost categories.

Why does the analyst invest time and effort in going beyond the list of cost categories to organize them as a cost model? There are two reasons for the model:

- Firstly, remember that a "list" is only that. It does not by itself communicate completeness. In a successful TCO cost model, however, inclusiveness is self-evident to both the analyst and to those who use TCO results.

- Secondly, the cost model structure provides a framework for a very informative kind of cost analysis in its own right. Sections below show how the cost model itself reveals spending issues that are not obvious in the TCO cash flow statement.

For more on cost modeling (resource-based modeling and Activity Based modeling) see Business Case Essentials.

Step 3B

Define one axis for resources, another for life cycle stages

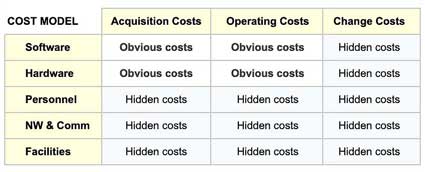

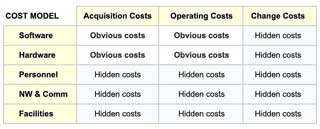

The cost model in Exhibit 1 below is a two-dimensional matrix whose cells represent categories that could have cost impacts due to ownership. Here, for example, is a TCO model for an IT system acquisition.

Note that the vertical axis represents IT Resource categories while the horizontal axis represents IT Life Cycle Stages. The model design succeeds when it achieves two objectives:

- Firstly, each axis covers the complete set of cost classes for one dimension: (1) Resources or (2) life cycle stages. Each includes all categories on that dimension that are useful to decision makers and planners.

- Secondly, the cost categories (or classes) capture apparent costs and also the less obvious hidden costs.

The two axes, that is, should convey self-evident completeness. If they do, there should be no unpleasant cost surprises later, during implementation. The analyst should never have to answer questions such as: Why didn't you include this? Or that?

Examples below show that the choice of cost categories for each axis gives the model power for analysis and communication.

Step 4

Add Individual Resources, Activities to Cost Model

The TCO analyst continues by adding the names of resources to each cell. Resource items that go together in a cell belong together for two reasons:

- First, owners plan and manage together all resource items in a cell.

- Second, various resource items in a single cell may have the same cost drivers.

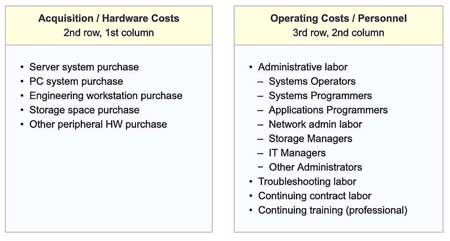

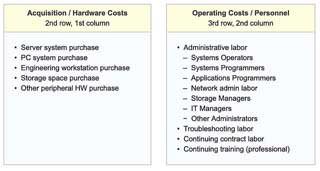

For example, consider planning an IT system acquisition. For analyzing TCO in this case, two of the cost model's cells hold lists of the named resources shown in the two example cells in Exhibit 2 below:

Other cells in the same model have similar resource lists. As a result, the full model helps assure TCO analysts and owners that every relevant cost item due to ownership is in view. In this way the model helps show everyone that the analysis excludes costs that are not due to owning. And, the following sections show how the model serves as a powerful tool for analyzing life cycle costs. The following sections explain how the model serves as a powerful tool for analyzing and controlling life cycle costs.

Finally, the cost model helps assure everyone that scenario comparisons are fair and objective. One model can do this if the single model design covers all relevant costs in all scenarios. Of course, some items may have 0 values in one TCO scenario and non-zero values in others. As a result, using one model with the same cost categories for all TCO scenarios shows everyone that comparisons between TCO scenarios are fair2.

Step 5. Estimate Cash Inflows, Outflows

Forecast Cash Flow for Each Item in Each Scenario

The TCO cost model (above) provides the TCO analyst with a list of cost items—the contents of all the model cells.

Step 5A. Replicate Cost model structure and items for each scenario

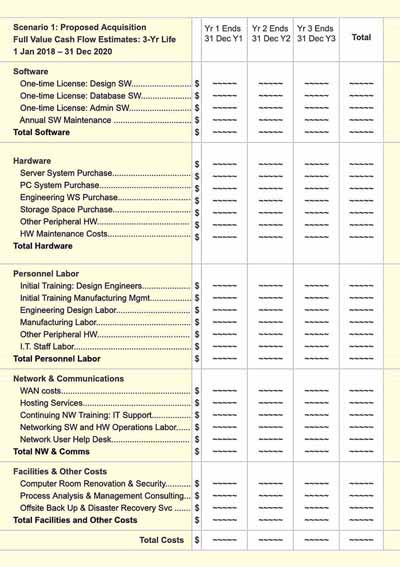

With cost categories and cost items from the cost model, the analyst can build the primary analytic tools in the TCO study:cash flow statements for each scenario.

Exhibit 4 below shows cash flow statement structure. Note especially that many line items from the model are omitted here, to show the structure clearly.

The cash flow statements are in one sense children of the cost model. This description is helpful because it is a reminder that cash flow statements take line items from the model and thus retain some of the model's structure. In brief, the cash flow statements have the parent model's vertical axis categories. However, in the horizontal dimension, the statements present a timeline covering the TCO analysis period instead of life cycle stages. The task for the TCO analyst is to estimate cost figures for each year, due to each item, for all scenarios.

Example: Consider Two Possible Scenarios

- Proposal: System Acquisition

- Business as Usual

The "Business as Usual" scenario is an important part of any TCO analysis. It recognizes that owners will still spend money on many of the same IT cost items, even without the new system. As a result, the "Business as Usual" scenario, therefore, serves as a basis for comparison. In fact, the baseline provides the only way to measure cost savings and avoided costs. For this reason, the TCO analyst uses scenarios 1 and 2 to construct a third scenario:

- The Incremental Scenario.

This scenario shows the cost differences between corresponding line items on "Scenario 1" and "Scenario 2." Note again that all three cash flow scenarios have the same structure (as above) because they all derive from the same cost model.

Step 5B Estimate Cash Flow for each item in each scenario

With the full set of scenarios in place, the analyst can then estimate cost figures for each cost item, for each scenario, looking forward to each year of the analysis.

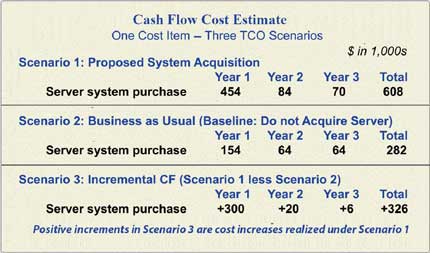

Exhibit 4 below, for example, shows analyst estimates for just one cost item: Server System Purchase.

Methods for making these estimates are beyond the scope of this article, but very briefly, the analyst will use several kinds of information to make these estimates. For the IT example, the analyst forecasts cost drivers for each item, under each scenario. These may include, for example, costs due to the numbers of users, transaction volumes, and storage space needs. The analyst will also consider information from the vendor, experience with similar systems in other settings, and industry standards and guidelines.

Step 6. Summarize CF Totals, Financial Metrics

Finally, the TCO Analyst uses the "bottom line" cash flow statement totals compare scenarios using standard financial metrics, such as

And, if the Proposal scenario shows cost savings, or avoided costs, relative to "Business as usual" costs, the analyst can apply investment metrics to the incremental cash flow values, such as:

For more on these metrics, see the articles linked to their names above.

Cost Savings Appear in the Incremental Cash Flow Statement

When Proposal Scenario costs in some areas are lower than the corresponding Business as Usual Scenario costs, the Incremental cash flow statement, therefore, shows cost savings in these areas. As a result, cost savings are the same as cash inflows.

When cost savings are present, the analyst can approach the incremental cash flow statement with investment-oriented metrics such as return on investment, internal rate of return, and payback period. All of these metrics require cash inflows as well as outflows. And, these appear only on the incremental statement.

TCO Cost Savings and Financial Metrics

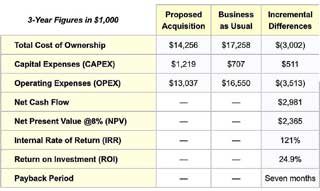

In that case, a TCO analysis summary might include an array of financial metrics that looks like Exhibit 5.

Positive values indicate cost savings under the Proposal scenario relative to Business as Usual. Those who want to understand fully the basis for these metrics from must review all three cash flow statements.

The TCO results above seem to show a clear advantage for choosing the Proposal Scenario over Business as Usual. However, the analyst's work continues. After reviewing the above, for instance, questions such as the following will arise.

" If we implement the Proposal Scenario Acquisition...

- Which cost areas represent the most significant risks? And which, therefore, need full management attention?

- Which cost areas are most important in driving overall TCO results?

- What can we do to control and minimize costs?"

The analyst addresses such questions by returning to the cost model itself (next section).

Example TCO Results and Scenario Comparisons

Cost model categories for the cost model rows and columns were chosen to represent cost areas that need careful planning and control over a period. Once the scenario cash flow estimates exist (previous section), the analyst can use the model to show cost dynamics not easily seen in the cash flow statements.

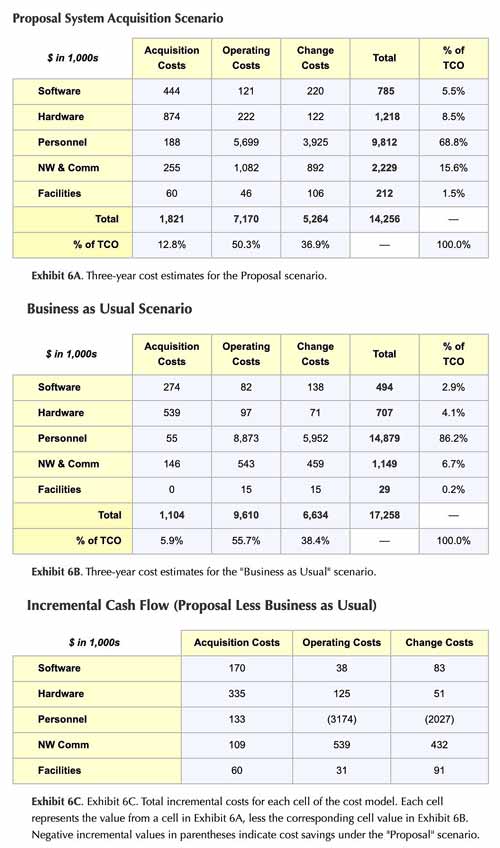

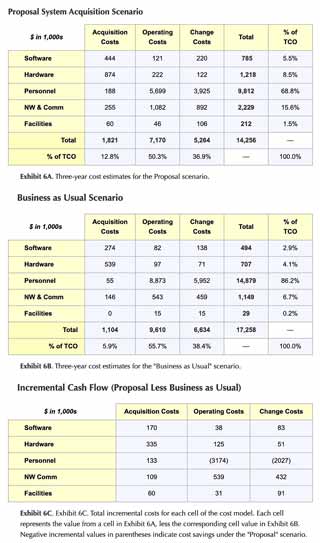

Here, the cost model cells in Exhibits 6A, 6B, and 6C hold 3-year totals for items in each cell. The figures that go into each sum, of course, come from the cash flow statements.

The analyses in these three tables provide a wealth of useful information that management can put to good use, regardless of which scenario they choose to implement. The next section discusses just a few of the messages brought out by the cost model analysis.

What Does TCO Analysis Tell You?

TCO Analysis Can Uncover "Hidden" Costs of Ownership

TCO can bring out so-called "hidden" costs of ownership. In this example, owners chose to include all the essential costs from system acquisition, including labor costs for people who use or support the systems.

When deciding whether or not to acquire a new system, it is easy to focus excessively on hardware and software costs. Leaders should focus instead, however, on the Personnel costs that come with the system. These "People costs" are 68.8% of the TCO. As a result, how the firm trains, employs, and manages these employees will ultimately play a more significant role in determining the actual cost of ownership than other factors, such as the choice of HW or SW vendor.

Potential Problem Alerts

TCO can help spotlight potential cost problems before they become real problems.

In the IT world, for instance, change costs can often exceed forecast and budget. These typically include expenses for upgrading, adding capacity, reconfiguring, adding users, migrating to different platforms, and so on.

All of the change cost items in this model could appear instead under either of two cost column headings, Acquisition or Operating costs. Here, however, the analysts chose to focus on change costs by giving them a Change cost column of their own. As a result, it is easier to measure, plan, and control expenses specifically due to change. Note especially in this example, change costs represent between 35 and 40% of total cost of ownership in both scenarios.

Identify Cost Savings and Avoided Costs

An Incremental Cash Flow Statement Finds Cost Savings and Avoided Costs.

In this example, Proposal Scenario costs are more substantial than Business as Usual Costs in almost all cells of the cost model. "Business as Usual" costs are higher in only two cells: Personnel Operational Costs and Personnel Change Costs. Here, however, the Proposal Cost Savings show up as substantial negative numbers in the incremental cost model summary. Those two cost savings are more than enough to give the Proposal Scenario a considerable TCO advantage.

TCO is Blind to Business Benefits

Except For Cost Savings and Avoided Costs

TCO analysis is not a complete cost-benefit analysis because TCO tries to uncover ownership costs, but it is blind to other kinds of business benefits due to acquisitions, projects, or initiatives. Since TCO sees only costs, it takes no account of benefits such as higher sales revenues, faster information access, greater operational capability, competitive gains, or higher product quality.

As a result, when TCO is the primary focus in decision support, decision makers are assuming the following:

- Benefits other than cost savings are more or less the same for all options.

- And, the options differ only in cost.

TCO analysis itself says nothing about the validity of that assumption. When the owner believes different solutions may bring different business benefits, a complete cost-benefit business case analysis may be appropriate.

In brief, TCO analysis can find only two kinds of business benefits:cost savings and avoided costs. Either of these benefits can show up when comparing TCO for different scenarios. The example above shows, for instance, that when TCO is less under a "Proposal" scenario and greater under a "Business as Usual" scenario, the results are cost savings under the "Proposal" scenario.