What is an Operating Expense?

Most routine expenditures in business are operating expenses (OPEX). Businesses plan, authorize, and budget OPEX differently from capital spending (CAPEX).

In business, the term operating expense (OPEX) appears in budgeting and spending, but also as an Income statement term in financial accounting.

In brief, "operating expenses" include most expenditures for operating the firm's usual line of business—expenditures that are not capital spending. Operating expenses do not result in capital assets. Instead, they serve entirely for, not surprisingly, operating the business.

Explaining Operating Expense in Context

This article further defines and explains Operating Expense in context with related terms and concepts.

Employee wages and salary expenses in many organizations account for a large percentage of the operating budget. [Photo: Imperial Tobacco Company employees packaging cigarettes, Bristol, 1930 ]

Sections below focus on three themes:

- First, Operating Expenses an expense category in financial reporting, especially for the Income Statement.

- Second, the role of Operating expenses in creating tax savings for firms that pay taxes on operating income.

- Third, using the concept Operating Expense in budgeting and planning spending.

Contents

- What are operating expenses (OPEX)?

- Define your terms! What does "operating expense" mean?

- Operating expense role in budgeting and spending.

- Operating expense role on the Income statement.

- How do operating expenses bring tax savings?

- Example Income statement with operating expenses.

Related Topics

- The term expense for budgeting and financial reporting. SeeExpense.

- For complete coverage of concepts in budgeting, see the article Budget.

- For an explanation of the Income statement, see Income statement.

What Does Operating Expense Mean?

Define Your Terms!

In everyday usage, people make little or no distinction between the terms cost, expenditure, and expense. Outside of the business setting, these terms all suggest spending money to purchase something. Outside of business, people use these terms more or less interchangeably

To businesspeople, however, the terms have different meanings, especially in accounting, finance, and budgeting. As a result, people working in these areas need to understand precisely the meaning of each. It is not easy, for instance, to define "operating expense" accurately without this understanding.

Cost vs. Expenditure vs. Expense

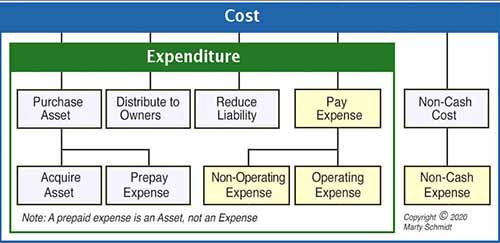

Start with the most inclusive of these terms, cost. All of the events Exhibit 1 below (light blue and yellow cells) are in fact costs. Businesspeople sometimes define Cost simply as the monetary amount they use to pay for something. However, a definition that is more useful for business analysts is the following:

Define Cost

A cost in business is an outcome that works against meeting business objectives.

Describing cost in this may seem awkward at first, but the definition is useful because it communicates precisely the single characteristic that all "cost" outcomes in business have in common.

The definition also provides a straightforward approach for measuring and valuing "cost" outcomes of all kinds—financial and non financial. For more on valuing business costs and benefits, see the article Business Benefits.

Note that most of the cost events in Exhibit 1 also appear under the heading "Expenditure." An "expenditure" is merely a monetary cost the firm pays, usually with cash. An expense is one kind of expenditure, but there are several other kinds as well.

Businesses use cash expenditures for at least four different purposes:

- First, to purchase assets.

- Second, to reduce liability (e.g., pay off a loan).

- Third, to distribute funds to shareholder owners (e.g., dividends).

- Fourth, as a cash expense (e.g., to pay employee wages).

The Meaning of Expense and Operating Expense

Accountants and financial specialists define expense and operating expense as follows:

Define Expense and Operating Expense

In accounting and finance, an expense is a decrease in owner's equity due to using up assets.

Expenses that businesses incur for operating their core line of business are operating expenses. For instance, employee wages, inventory handling costs, and expenditures for office supplies are operating expenses.

The formal definition of "expense" refers to two balance sheet categories: (1) Owner's equity and (2) Assets. Notice that every expense involves using up one kind of asset or another. It is the depletion or using up of assets that differentiates "expenses" from other kinds of cost events.

- An expense for office supplies, for instance, uses up cash assets. Spending for office supplies is an operating expense.

- Purchasing a capital asset (such as a factory machine) results in an asset that decreases book value over time through depreciation expense. Depreciation is "noncash expense" and usually an "operating expense" as well.

- A prepaid expense, such as prepaid floor space rent, is an asset that turns into an ordinary cash operating expense as the occupancy period passes.

Operating Expenses and Noncash Expenses.

Sections below show how to classify expenses in two different ways.

- Firstly, expenses are either "operating expenses" or "non-operating expenses."

- Expenses for operating the firm's core line of business are operating expenses. Employee wages, inventory handling costs, and expenditures for office supplies are operating expenses.

- Expenses incurred outside the core line of business are called, not surprisingly, non-operating expenses. For instance, a retail merchant paying interest on a bank loan is paying a "non-operating expense."

- Secondly, expenses are either cash expenses or noncash expenses.

- Depreciation, for instance, is an expense because it reduces "book value" of a Balance sheet asset.

- Depreciation is also a noncash expense because it does not involve a cash payment. Noncash expenses use up assets other than cash.

- When depreciation and other noncash expenses occur in the core business, they are "operating expenses."

Operating Expense Role in Budgeting and Spending

Understanding the OPEX Budget

In brief, most routine expenditures a firm makes in normal business operations are operating expenses, except for the few cases named above (e.g., asset purchase). Operating expenses typically represent spending for such things as:

- Employee pay and overhead.

- Contract labor.

- Office space rental or lease and utilities costs).

- Employee travel and training expenses.

- Computer maintenance expenses.

- Marketing communication and advertising.

- Telephone, Internet services, heating, electricity, and other utilities.

- Insurance costs.

- Outside consultant fees.

- Office supplies.

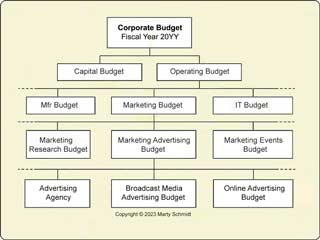

The Operating Expense (OPEX) budget in the budget hierarchy

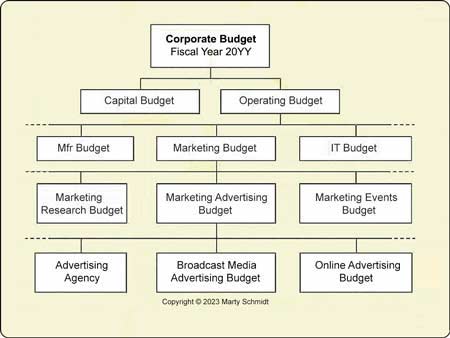

Budget planning begins with high-level budgets, primarily the entity-wide capital and operating budgets.

- Many firms plan the capital budget on a company-wide basis, choosing not to divide it further by organization. Individual items for the high-level capital budget may nevertheless appear in categories. And, these may represent significant components of the firm's asset structure, such as"Inventory purchase."

- On the other hand, large firms almost always plan spending and revenues for the operating budget in the framework of a budget hierarchy.

- Individual items in the top level operating budget may carry the names of departments or groups, such as "Marketing." Or, items may name essential roles, such as "General management and administration."

- In the budgeting process, senior managers first set spending levels for higher level categories such as the "Marketing Budget." Then, Marketing managers further apportion this into lower level budgets for areas such as market research, advertising, and events.

The two top-level budgets together cover almost all spending for the entire entity. Note, however, that many firms also plan additional small budgets for non-operating expenses, or "emergency contingencies." These latter kinds of budgets usually play a minor role in business budgeting.

Exhibit 2 shows a few of the levels in one firm's budget hierarchy:

Operating Expense Role on the Income Statement

Significant Expense Item Categories

Significant categories of expense items may appear on the Income Statement as follows:

- Cost of Goods Sold

The costs of creating products or services for sale - Operating Expenses – Selling Expenses

The costs of selling products or services - Operating Expenses – General and Administrative Expenses

Overhead, support, and management costs from across the company.

- Financial Revenues and Expenses

These include revenues from invested funds and costs from financing borrowed funds, for firms that are not themselves in banking or financial services. - Extraordinary Items

These may include significant gains or losses from selling land or significant assets, or from actions restructuring the company (for example, the expenses of laying off part of the workforce).

All of these categories may include "operating expenses" in the budgetary sense.

Note especially that "Operating expenses" refers to one or two major Income statement categories: The second and third bullet points above.

- This category typically appears beneath the Gross profit line but above Extraordinary items and Financial income/expenses.

- The category sometimes appears under the name Selling, General, and Administrative Expenses, or SG&A.

- And, that sometimes divides into two sub-categories: Firstly Selling Expensesand secondly, General and Administrative Expenses.

In any case, Income statement "Operating expenses" (SG&A) do not impact reported Gross profit or Gross margin because they appear below the Gross profit line. However, these operating expenses do affect profits and margins below them: Operating profit, Operating margin, Net profit and Net profit margin.

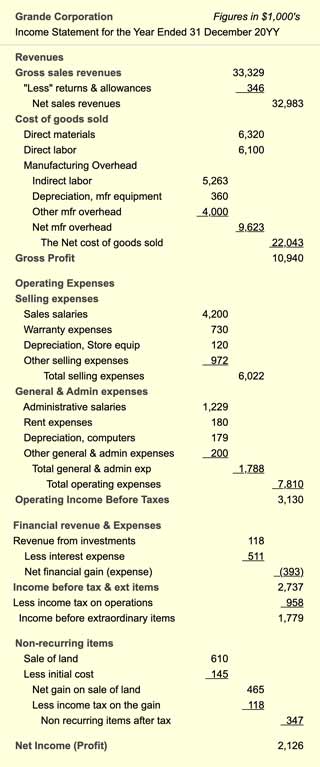

Exhibit 1 below shows a sample "Income Statement" with entries in the significant statement categories, including Operating Expenses.

How Do Operating Expenses Bring Tax Savings?

An operating expense does bring some tax savings. The "expense" lowers reported income and, as a result, that reduces the income tax liability. Specifically:

Tax Savings on Expense = Expense x Tax Rate

For example, consider a company that is taking in $100 revenue with a 30% tax rate on operating income.

- As a result, the firm pays taxes of $30 on $100 revenues, if it has no expenses.

- If, however, the firm incurs expenses of $60 to produce the $100 revenues, its income for tax purposes is $100 less $60, that is, $40. As a result, the 30% tax would apply only to $40 for a tax of $12. That is a tax savings of $30 - 12 or $18, or:

Tax Savings on Expense = $60 x 30% = $18

Example Income Statement With Operating Expenses

The Income Statement Equation: Income = Revenues – Expenses

Exhibit 3, below, shows an example Income statement with typical detail for an Annual Report.