What is Activity-Based Costing?

Businesses move to activity-based costing to better understand the true costs of goods and services.

Businesses that sell goods and services have a critical need to know their costs for producing and delivering products, accurately. Accurate costing at the individual product level is essential for knowing which products are earning profits and which are selling at a loss. This information can also be crucial for pricing, production planning, and product portfolio management.

Tracking product costs is a task for the firm's cost accounts, most of whom rely on traditional costing methods. Cost accountants know, however, that these methods sometimes deliver misleading information about individual product costs. In cases where the company has reason to question the accuracy of product cost figures, many firms turn to an alternative costing method: Activity-based costing.

Define Activity-Based Costing ABC

Activity-Based Costing is a methodology for assigning costs to individual products, services, projects, tasks, or acquisitions, based on…

- The activities that go into them.

- Resources consumed by these activities.

By measuring activities and resources consumed by individual products, ABC methods essentially convert the so-called indirect costs of traditional costing methods into direct costs.

ABC contrasts with traditional costing (cost accounting), which sometimes assigns costs using somewhat arbitrary allocation percentages for overhead or the so-called indirect costs. As a result, ABC and traditional cost accounting can estimate the cost of goods sold and gross margin very differently for individual products. Contradictory and uncertain cost estimates can be a problem when management needs to know precisely which products are profitable and which are selling at a loss.

What Are the Benefits of ABC?

The move from traditional costing to ABC is usually driven by a desire to understand the "true costs" of individual products and services more accurately. Companies implement activity-based costing to:

- Identify specific products that are unprofitable.

- Improve production process efficiency.

- Price products appropriately, with the help of accurate product cost information.

- Reveal unnecessary costs that become targets for elimination.

Firms that use ABC consistently to pursue these objectives are practicing activity-based management ABM.

ABC and Traditional Costing Impact the Same Accounts

Note that the purpose of ABC is to provide information for decision support and planning. ABC by itself usually has little or no impact on the structure of the firm's financial accounting reports (Income statement, Balance sheet, or Cash flow statement). This impact is minimal because both ABC and traditional costing ultimately assign costs to the same existing accounts. The two approaches merely use different mathematics to do so.

Note especially, however, that ABC sometimes brings improvements in reported margins and profitability. These outcomes follow when ABC reveals unnecessary or inflated costs, or when ABC shows where to adjust pricing models, workflow process, or the product mix.

Explaining Activity-Based Costing in Context

This article further defines, describes, and illustrates activity-based costing using example calculations to contrast ABC with traditional cost accounting. Examples appear in context with related terms from the fields of budgeting, cost accounting, and financial accounting.

Contents

Why Do Businesses Move to ABC?

What are the Reasons for Using activity-based Costing?

The desire to improve costing accuracy moves businesspeople to adopt ABC, mainly to get closer to the true cost and true profitability of individual products and services. They move to activity-based costing for the same reasons to understand better the true costs and return on investment from projects, programs, or other initiatives.

ABC pursues these objectives primarily by making direct costs out of many of the expenses that traditional cost accounting treats as indirect costs. Examples below show how ABC does this.

Organizations that use ABC consistently and effectively are said to practice Activity-Based Management (ABM). Here, managers turn to ABC to support decisions about pricing, adding or deleting items from the product portfolio, choosing between outsourcing and in-house production, and evaluating process improvement initiatives.

The percentage of organizations currently using activity-based costing varies significantly from industry to industry. Various surveys in the period 2012-2022 report the highest rate of firms using ABC in manufacturing (20%-50%), followed by financial services (15-25%), public sector (12-18%), and communications (6-12%).

ABC vs. Traditional Cost Accounting

What Are the Differences?

The different approaches and outcomes from ABC and traditional costing are most accessible for illustration in the context of a product manufacturing example. However, the principles appearing here extend readily to a wide range of other business settings.

Example: Traditional Cost Accounting vs. ABC

For example, consider a firm that manufactures automobile parts through a sequence of machine operations on metal stock. In such settings, traditional cost accounting views "product production costs" as either direct costs or indirect costs (or overhead).

Example Sources of Direct Costs

Traditionally, "direct costs" for such firms are costs they can assign to specific product units. In product manufacturing, these might include direct materials and direct labor costs:

- Direct labor costs.

These can include the cost for person minutes or person-hours per product unit for running production machines. - Direct materials.

Direct materials costs might include costs per product unit for metal stock, fasteners, and lubricants.

Example Sources of Indirect Costs

Traditionally, "indirect costs" for such firms are manufacturing overhead expenses they cannot assign directly to specific product units. Instead, they allocate these costs to specific production runs, batches, or periods. These might include indirect costs such as the following:

- Materials purchase order costs.

Firms typically do not order materials for each product unit, but instead, for entire batch runs. They may also order supplies to cover a specific time span. - Machine set up costs.

Manufacturing firms do not set up production machines for each product unit. They are set up instead for the production run of each product model. - Product packaging costs.

Manufacturers can sometimes package multiple product units in a single package. And, they may fill numerous packages in a single packaging run. - Machine testing and calibration costs.

Manufacturing firms perform these operations regularly and often, but not for each product unit. - Machine maintenance and cleaning costs.

Firms usually perform these operations only after producing multiple product units.

Product Specific Cost Sources

For this example, consider a firm that manufactures and sells two product models, Model A and Model B. Some aspects of A and B compare as Table 1 shows:

Direct Costs Are the Same in ABC and Traditional Costing

Management must estimate the profitability of each product to decide which products to produce and sell and how to price them. These estimates, in turn, require an understanding of the full cost per unit of each product. While the direct costs per unit are easy to find, the indirect costs are less noticeable. As a result, the firm will have to uncover indirect product costs through a costing methodology—either traditional cost allocation or activity-based costing.

Direct costs are the same under both traditional costing and ABC. For direct costs, accountants measure a product unit cost for each direct cost category. The two costing methods differ, however, in the way they assign values to so-called indirect costs for products. Consequently, the two costing approaches sometimes give entirely different pictures of the profitability of individual products.

How to Use Traditional Costing

Calculate Direct and Indirect Costs in 5 Steps

Cost accountants can apply traditional costing methods to find total production costs for Products A and B in Table 1 above. In one accounting period, the firm produces and sells

- 900,000 units of product A at $3.00 each.

Product A sales revenues = $2,700,000. - 2,100,000 units of product B at $2.00 each.

Product B sales revenues = $4,200,000.

To find product gross profits and profit margins, however, accountants will use traditional costing methods to estimate total production costs per unit, and with that, gross profit margin per unit.

Traditional Costing

Step 1. Find Total Direct Costs

For this example, product manufacturing direct costs consist of direct labor costs and direct materials cost.

Step 1A. Find Each Product's Total Direct Labor Cost

The firm's accounting system carries general ledger T-accounts for each product's direct labor costs. For one accounting period, these costs are:

Product A direct labor: $450,000

Product B direct labor: $1,050,000

Step 1B. Find Each Product's Total Direct Materials Cost

The accounting system also carries accounts for each product's direct materials costs. The ledger shows these direct materials costs for the period:

Product A direct materials: $675,000

Product B direct materials: $1,050,000

Traditional Costing

Step 2. Find Direct Labor & Materials Costs per Unit

The Manufacturing organization provides product unit counts. For the current period:

Product A: 900,000 units Product B 2,100,000 units

Step 2A. Find Each Product's Direct Labor Cost per Unit

Product A Direct labor per unit:

$450,000 / 900,000 = $0.50 / unit

Product B Direct labor per unit:

$1,050,000 / 2,100,000 =

$0.50 / unit

Step 2B. Find Each Product's Direct Materials Cost per Unit

Product A direct materials per unit:

$675,000 / 900,000 = $0.75 / unit

Product B direct materials per unit:

$1,050,00 / 2,100,000 = $0.50 / unit

Traditional Costing

Step 3. Find Product Total Direct Costs Per Unit

The final step in finding product direct costs, Step 3, is simply adding individual product direct labor cost to the individual product direct materials cost. These figures are the results of Step 2, above.

Product A Direct costs/unit: $0.70 + $0.50 = $1.25 / unit

Product B Direct costs/unit: $0.50 + $0.50 =

$1.00 / unit

Direct Cost Summary, Traditional Costing

Table 2 below shows the resulting direct costs for these sales, along with the given per unit sales revenues:

Traditional Costing

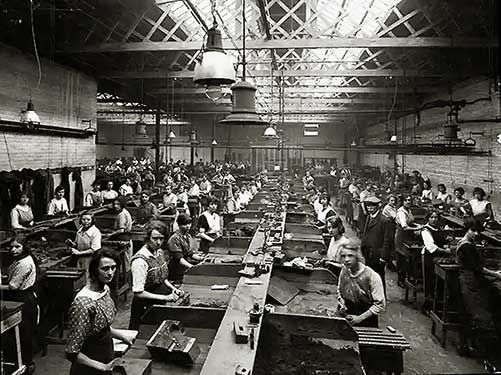

Step 4. Allocate Indirect Labor and Materials Costs

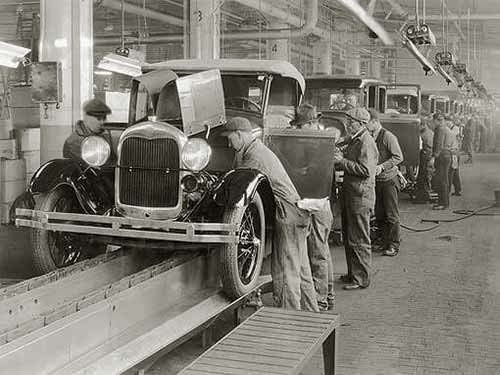

![The costs of setting up and ma]intaining production machines are indirect costs Workers who set up and maintain production machines are indirect labor.](images/activity-based-costing/traditional-costing-step-4.jpg)

![The costs of setting up and ma]intaining production machines are indirect costs Workers who set up and maintain production machines are indirect labor.](images/activity-based-costing/traditional-costing-step-41s.jpg)

The company's cost accountants will also find cost totals for the period's production support activities. In traditional cost accounting, these costs are known as overhead or indirect costs, as Table 3 shows.

The simple form of traditional cost accounting appearing here uses only the Total Indirect cost line from Table 3. Traditionally, firms allocate this cost total to each product, A or B, based on proportional usage of a given resource. The resource chosen for this purpose is usually one of the direct cost items. Note especially that this approach is also called production volume-based (PVB) cost allocation, for obvious reasons.

Indirect Components |

Prod. A & B Indirect | % of Total Indirect |

|---|---|---|

| Materials purchasing | $180,000 | 12.6% |

| Machine setups | $375,000 | 26.4% |

| Product packaging | $280,000 | 19.7% |

| Machine testing & calibration | $300,000 | 21.1% |

| Machine maintenance & cleaning | $287,000 | 20.2% |

| Total Indirect | $1,422,500 | 100.0% |

| Table 3. Indirect cost components for Traditional Costing | ||

Under PVB cost allocation, accountants allocate (apportion) the total indirect cost to Products A and B based on factors such as the proportion of the total:

- Production machine time for each product.

- Direct labor costs for each product.

- Factory floor space for each product.

Other factors may also apply. For this example, the firm's accountants chose to allocate indirect costs referring to direct labor costs.

The indirect cost total from Table 3 above is $1,422,500. The direct labor total (line 6 from Table 1) is $1,500,000. From these figures, the firm allocates indirect labor cost to each product as a percentage of the product's own direct labor cost:

Step 4A. Find Total Ind Labor Costs as % of Total Dir Labor

Indirect labor cost / direct labor cost ratio:

= $1,422,500 / $1,500,000

= 0.948 = 94.8%

- For product A, Direct labor costs are $450,00 (Table 2, line 6). The indirect cost allocation for A is therefore 94.8% of this, or $426,750.

- For product B, Direct labor costs are $1,050,000 (Table 2, line 6). The indirect cost allocation for B is therefore 94.8% of this, or $995,750.

Table 4, below, shows how this allocation produces indirect cost estimates per unit. And, the table also shows the conventional costing solutions for gross profit and gross margin for each product unit.

Step 4B. Find Indirect Cost Per Unit

Estimated Indirect cost per unit is the same for both products, $0.47 (Table 4, line 14). These two indirect costs must be equal because both products use the same allocation rate (94.8%) applied to direct labor costs, based on the same direct labor rate ($0.50/unit).

Products Compared |

Product A | Product B | Total |

|---|---|---|---|

| 9. Units produced and sold [Table 2, line 1] |

900,000 | 2,100,000 | 3,000,000 |

| 10. Total direct costs [Table 2, line 8] |

$1,125,000 | $2,100,000 | $3,225,000 |

| 11. Total indirect costs [allocation shown above] |

$426,750 | $995,750 | $1,422,500 |

| 12. Revenues per unit [Table 2, line 2 ] |

$3.00 | $2.00 | |

| 13. Direct costs/unit [ = 10 / 9 ] |

$1.25 | $1.00 | |

| 14. Indirect costs/unit [ = 11 / 9 ] |

$0.47 | $0.47 | |

| 15. Gross profit/unit [ = 12 − 13 − 14 ] |

$1.28 | $0.53 | |

| 16. Gross profit margin [ = 15 / 12 ] |

42.5% | 26.3% | |

| Table 4. Gross profit and gross margin calculation for each product, using traditional cost accounting approaches for indirect costs. | |||

Traditional Costing

Step 5. Find Per Unit Product Cost and Gross Margin.

To find product gross margins for Products A and B, the analyst calculates as line 16 of Table 4 above shows. The result is that traditional cost accounting shows:

- Product A gross margin = 42.5%

- Product B gross margin = 26.3%.

On a per-unit basis, this traditional costing finds Product A more profitable than product B.

These Product profitability results are directly comparable with the profitabilities for products A and B found in Step 6 of the Activity-Based costing example below.

How to Apply ABC Direct, Indirect Costs

Calculate in 6 Steps

This section presents an ABC version of the same product costing situation presented above as Traditional Costing. The examples show how ABC and traditional costing can yield different indirect cost estimates for the same products. This means the two approaches can also estimate product-specific profitability differently.

Finally, the examples show that ABC requires more data and a more detailed analysis than the traditional PVB allocation approach.

Activity-Based Costing

Step 1. Find Total Direct Costs

ABC costing for products A and B begins with the starting data appearing above for the traditional costing example. Data for starting the ABC analysis include:

- Units produced and sold.

- Sales revenues.

- Direct costs.

The ABC example, therefore, begins with Table 5 (an exact copy of Table 2 above).

In this ABC example, as well, Product manufacturing direct costs consist of direct labor costs and direct materials cost.

ABC Step 1A. Find Each Product's Total Direct Labor Cost

From the firm's general ledger accounts, these costs for the period are:

Product A direct labor: $450,000

Product B direct labor: $1,050,000

ABC Step 1B. Find Each Product's Total Direct Materials Cost

The ledger shows these direct materials costs for the period:

Product A direct labor: $675,000

Product B direct labor: $1,050,000

Activity-Based Costing

Step 2. Find Direct Labor & Materials Costs per Unit

The Manufacturing organization provides these product unit counts for the period:

Product A: 900,000 units

Product B 2,100,000 units

ABC Step 2A. Find Each Product's Direct Labor Cost per Unit

Product A Direct labor per unit: $450,000 / 900,000 = $0.50 / unit

Product B Direct labor per unit: $1,050,000 / 2,100,000 =

$0.50 / unit

ABC Step 2B. Find Each Product's Direct Materials Cost per Unit

Product A direct materials/unit = $675,000 / 900,000 = $0.75 / unit

Product B direct materials/unit: $1,050,00 / 2,100,000 = $0.50 / unit

Activity-Based Costing

Step 3. Find Total Direct Cost per Product Unit

For the final step in finding product direct costs, Step 3, is simply individual product direct labor cost to the individual product direct materials cost. These figures are the results of Step 2, above.

Product A Direct costs per unit: $0.70 + $0.50 = $1.25 / unit

Product B Direct costs per unit: $0.50 + $0.50 = $1.00 / unit

Direct Cost Summary, Activity-Based Costing

Table 5 above summarizes direct costs for these product sales, along with the given per unit sales revenues

Activity-Based Costing

Step 4. Activity Pools, Cost Drivers, Unit Costs.

In ABC Step 4, the analyst Identifies Indirect (or Overhead) Activity Pools, Cost drivers, and Unit Costs. The analyst, in other words, completes Stage 1 Allocation (or Batch Level Allocation).

In ABC, analysts view the indirect or overhead cost contributors as activity pools.

Activity Pools

Under Activity-Based costing, an activity pool is the set of all activities necessary for completing a task, such as (a) processing purchase orders, or (2) performing machine setups.

To cost activity pools, ABC identifies activity units that drive cost for each pool. For example:

- The total cost of for the activity pool Processing purchase orders is driven by the number of purchase orders processed.

- The total cost for the activity pool Performing machine setups is driven by the number of setups.

Step 4A. Activity Pools, Cost drivers (CDs), Unit Cost

Tables 6 A and 6B, below, list 5 Indirect or Overhead Activity Pools in producing each product unit, their cost drivers (CDs), and per-unit cost for each activity pool. For example:

Step 4B. Calculate Activity Pool Costs for Each Product

Table 6A, moreover, shows the number of CD units (activity units) used for product A, while Table 6B shows these figures for product B. From the given cost of each CD unit, calculate the total cost for each activity pool, for each product.

For example, the Activity Pool "Purchase Orders" has a Cost Driver unit cost of $1,800. Product required 75 CD units for this activity. Total Product A indirect cost for this activity pool is thus

(75)($1,800) = $135,000

Completing these calculations completes Step 4, ABC Stage 1 Allocation (Batch Level Allocation). Tables 6A and 6B summarize Step 4 data and calculations.

Product A: Activity Units, Activity Pools, and Cost Drivers

Product B: Activity Units, Activity Pools, and Cost Drivers

Activity-Based Costing

Step 5. Find Per-Unit Indirect Costs for Products

When each product's activity pool cost totals, the analyst can then calculate the cost per product unit, as Table 6C shows.

To find product unit costs, the analyst divides the activity pool cost totals by the number of product units. From Table 5, Line 1, the firm produced 900,000 units of Product A and 2,100,000 of Product B. With these figures, the analyst calculates per-product unit costs that appear in the third and fifth columns of Table 6C. For example:

For the activity pool Purchase Orders (line 17 of Table 6C):

Product A Cost per Product Unit = $135,000 / 900,000 = $0.15

Product B Cost per Product Unit = $45,000 / 2,100,000 = $0.02

Stage 2 Allocation in ABC:

Allocating Activity Pools to Product Units

|

Activity Pool | Total Indirect Cost Product A [From Table 6A] | Cost per product unit Product A | Total Indirect cost Product B [From Table 6B] | Cost per product unit Product A | Total indirect cost A+B |

|---|---|---|---|---|---|

| 17. Purchase orders | $135,000 | $0.15 | $45,000 | $0.02 | $180,000 |

| 18. Machine setups | $225,000 | $0.25 | $150,000 | $0.07 | $150,000 |

| 19. Product packaging | $180,000 | $0.20 | $100,000 | $0.05 | $280,000 |

| 20. Machine testing & calibration | $100,000 | $0.11 | $200,000 | $0.09 | $300,000 |

| 21. Maintenance & cleaning | $230,000 | $0.26 | $57,500 | $0.03 | $57,500 |

| Total | $870,000 | $0.97 | $552,500 | $0.26 | $1,422,500 |

| Table6C. Stage-2 allocation in ABC: Allocating activity pool costs to individual product units. The cost per product unit figures for product A and product B (second and fourth columns) derive d from the cost sums for each activity pool (first and third columns) divided by the number of product units produced and sold for each product (Table 2, line 1). | |||||

Activity-Based Costing

Step 6. Calculate Profitability for Individual Products.

The Activity-Based costing analyst aims to understand product costs accurately, and then understand individual product profitability accurately. The aim, in other words, is to find the true gross profit margins for individual products.

Accountants calculate individual product profitability as a gross margin based on product revenues and total product production costs.

Table 7 below summarizes these figures, using direct and indirect cost figures from ABC steps 1-5. Each table row indicates the data source and calculation, if any. and profitability calculations. Gross profit margins for Products A and B appear in Row29.

Conclusions: Activity-Based Costing Example

First Conclusion

ABC finds different indirect (overhead) costs per unit for each product. ABC results are thus unlike the traditional costing example above, where indirect costs per unit were the same for both products.

Second Conclusion

ABC analysis recognizes that product A uses more activity pool resources than product B.

Third Conclusion

On a per-unit basis, ABC finds product B more profitable than product A. The gross margin rate of 36.8% for B compares with a gross margin of 26.1% for A.

Comparing ABC and Traditional Costing

Advantages and Disadvantages to Each Approach

Costing Results from Two Approaches

Table 8 below shows the per-unit profitability estimates for each product from the examples above.

Product Profitability (Gross Profit Margin) |

Product A | Product B |

|---|---|---|

| Traditional cost allocation (Production volume-based allocating) |

42.5% | 26.3% |

| Activity-Based costing approach | 26.1% | 36.8% |

| Table8. Comparing profitability estimates from two different costing methods. Traditional costing shows product A more profitable than product B. ABC based costing shows the reverse. These differences result from the different treatment of overhead costs. | ||

Key Differences Between Costing Methods

The tables and examples above illustrate some critical differences between the costing methods:

Data and Analysis

- Activity-Based costing requires detailed knowledge of the activities and resources that go into overhead (or "indirect") support work.

- Traditional cost accounting (production volume-based allocation) requires only a total overhead cost and a simple allocation rule.

Overhead Components and Products: Differentiation vs. Aggregation

- ABC recognizes that individual overhead components can be distributed differently for different products. One product may consume relatively more maintenance resources, for instance, while another product may consume relatively fewer maintenance resources, but relatively more for machine set up.

- Traditional cost accounting typically puts "overhead" components into fewer categories, or even a single class, and uses a single allocation rate for all products.

Direct vs. Indirect Measurement

- Activity-Based costing treats overhead costs essentially as direct costs, in that cost estimates reflect actual cost driver usage for each product. These costs, in turn, can be reasonably be apportioned to individual product units.

- In traditional cost accounting (production volume-based allocation), an accurate measure of total overhead cost is accessible. However, in conventional costing the distribution of that total to individual products is based on an indirect measure of that cost.

Costing Accuracy vs. the Cost of Costing

For the profitability figures appearing in Table 7 above, the activity-based costing results may be taken as the more accurate results—more closely reflecting the "true" production costs of products A and B—than the profitability figures from the traditional costing approach. Whether or not the improved accuracy justifies the higher expense of applying this costing method, however, is something management will have to investigate and answer before committing to a comprehensive new approach to cost accounting.

What is Activity-Based Management?

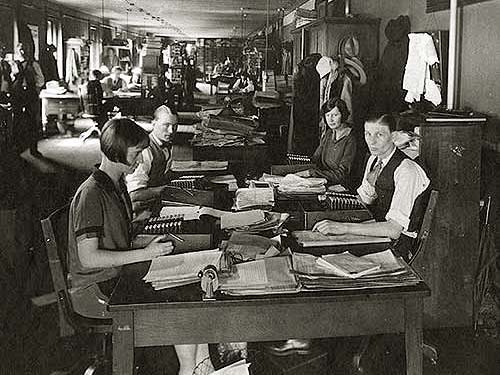

Corporate Officers will choose ABC and activity-based Management only when confident the gain in costing accuracy justifies ABC implementation costs.[Image: High-level management meeting. Photo by H. Armstrong Roberts, February 1930.]

Organizations that use activity-based costing results consistently for decision support and planning are practicing Activity-Based management ABM.

For example:

Pricing Decisions: The heart of the firm's business strategy is a business model specifying margins the firm expects and needs to earn. With accurate knowledge of product costs, the firm can set prices more accurately to achieve target margins.

Budgetary Planning: To create an operating budget for the next budge cycle, the firm must anticipate future product costs accurately. ABC shows how indirect product costs depend on production volume for each product, more accurately than traditional cost allocation methods. If the firm can predict future production volume accurately, it can also budget future costs accurately.

Adoption of ABC and ABM

A few firms began using ABC in the mid-1970s. In the years since then, the percentage of companies and other organizations using ABC increased more or less continuously, but slowly. Nearly five decades after ABC first appeared, however, the majority of companies and organizations in all industries still do not use activity-based costing, and still do not practice activity-based management.

Implementing Activity-Based Management ABM

Regarding implementation, activity-based costing requires

- Complete details on activities that go into specific products, services, and tasks.

- Complete details on the resources these activities consume (time, labor, and other goods and services).

Implementation in large, complex organizations is therefore a labor-intensive and data-intensive undertaking. However, ABC and ABM are becoming more approachable to many companies as a result of two ongoing trends.

- Firstly, recent improvements in costing software.

- Secondly, the increasing availability of data from complex, comprehensive software systems, such as enterprise resource planning (ERP) systems, manufacturing resource planning (MRP) systems, and customer relationship management (CRM) systems.

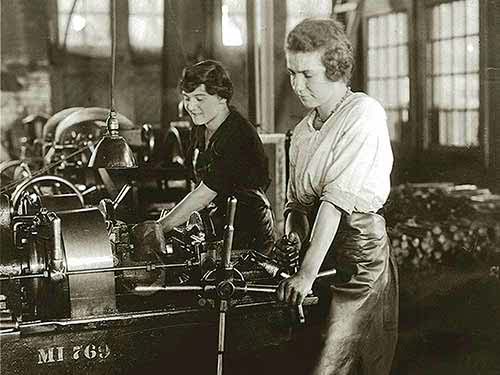

ABM Started in Manufacturing

When a few firms moved to ABC in the 1970s, the benefits of ABC were most apparent in product manufacturing settings, as the two numerical examples above show. From the start, it was clear that in such settings, the ABC is superior to traditional cost accounting for the purposes of:

- Identifying truly profitable and truly unprofitable products.

- Finding and eliminating unnecessary costs.

- Identifying and distinguishing between true value-add activities and non-value add activities.

- Pricing products so as to achieve acceptable margins.

Activity-Based Management: Moving Beyond Manufacturing

Increasingly, however, the value of more accurate costing has become more widely appreciated, leading to the application of this methodology for the purposes of:

- Budgeting and financial planning.

Organizations can anticipate overhead costs and funding needs with greater accuracy and more certainty under ABC. - Human capital management.

Firms can now direct human resources into more profitable activities under ABC. - Performance measurement.

Managers can evaluate the performance of individuals, groups, projects, initiatives, and programs, with more certainty and accuracy when they know their true costs through ABC.