What Are Direct and Indirect Labor Costs?

Understanding the cost contributions of direct labor and indirect labor is crucial in budgeting , planning, and reporting.

The concepts Direct Labor and Indirect Labor are central to managing companies that produce and sell products and services. These companies depend on having detailed, accurate knowledge of their own product and service delivery costs in order to maximize operating efficiency and profitability.

Understanding how to manage, control, and report direct and indirect labor costs is key to operating efficiency, and maximum profitability. These costs are major contributors to the cost of producing and delivering the firm's goods and services, and play a central role accounting, budgeting, planning, and financial reporting.

Define Direct Labor, Indirect Labor

Direct Labor costs are expenses that tie directly to production of specific finished goods units or delivery of specific services.

- An assembly line worker's labor installing windows on automobiles, for instance, is direct labor on particular vehicles.

- A hairdresser cutting and styling hair is the salon's direct labor for services to individual clients.

Indirect Labor (or Overhead), on the other hand, usually refers to production support or service delivery support costs, labor costs not easily linked to specific units. or specific clients.

- traditional cost accounting sees the mechanic repairing assembly line machinery as indirect labor and a manufacturing overhead cost.

- For the hair salon, indirect labor includes the work of supervisors, the receptionist, and cleaning personnel. These employees are indirect labor because they do not deliver services directly to individual clients

The Role of Indirect and Direct Costs in Business

Understanding the cost contributions of direct labor and indirect labor is crucial in budgeting and planning activities. However, these concepts are also center stage in several other areas:

- Understanding the profitability of individual products and services. For more on profitability analysis, see Profitability.

- Setting prices. See the article Pricing for more on the role of labor costs in specific pricing models.

- Evaluating financial accounting reports—especially the income statement. See Income Statement, for a complete introduction to income reporting.

- Estimating costs for business case analysis (including cost/benefit, financial justification, the total cost of ownership, and return on investment analyses). See the article Business Case for more on estimating labor costs for the business case.

Explaining Direct and Indirect Labor in Context

Following sections further explain direct and indirect labor classifications in the context of related terms and concepts, focusing on three themes:

- The role of Direct and Indirect labor categories in financial reporting.

- How traditional cost allocation methods assign value to indirect expenses.

- How Activity Based Costing serves as an alternative costing approach, essentially turning indirect costs into direct costs.

Contents

- What are direct and indirect labor costs?

- Direct vs. indirect labor in financial reporting. Income statement expenses?

- What is the role of direct and indirect labor costs in the business case?

Related Topics

- For more on reporting direct and indirect costs, see Income Statement.

- For an alternative to traditional costing, see Activity-Based Costing.

- See Cost Allocation for an introduction to measuring indirect costs in traditional costing.

- For more on reporting manufacturing overhead and administrative overhead, see Overhead.

Reporting Direct and Indirect Labor Expenses

Income Statement Expenses

Product and Service Production Costs

In financial reporting, both labor categories contribute to the cost summary of product production costs. For companies that produce and sell goods, this cost summary appears on the income statement as Cost of goods sold (COGS). However, firms that sell services, usually call the equivalent service production costs Cost of Services. And, firms that sell both goods and services may call these costs Cost of Sales.

Direct and Indirect Labor Costs are Product Production Expenses

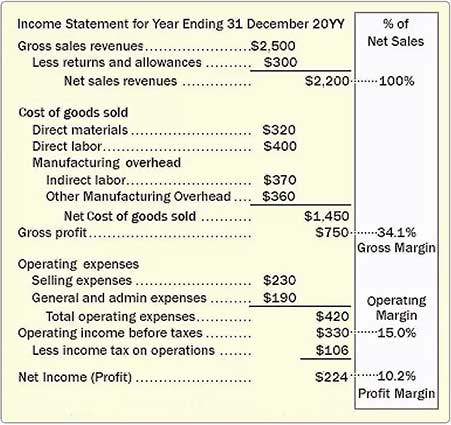

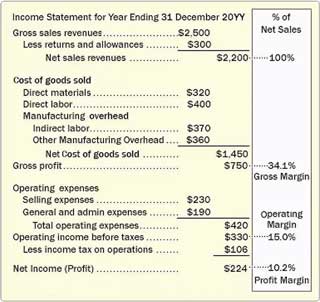

Companies that manufacture and sell goods usually report direct and indirect labor costs under COGS, as the simple income statement below shows. And, just below COGS, Gross profit derives as net sales revenues minus COGS. Note that gross margin is gross profit, expressed as a percentage of net sales.

As a result, direct and indirect labor also impact operating income and net income in the example below.

Such information is crucial for managing products and product portfolios effectively. The product production cost structure is vital, for instance, for setting product strategy, pricing decisions, and product lifecycle management.

- For product Gross profits, firms estimate actual sales revenues and actual direct labor costs rather directly.

- In traditional cost accounting, however, companies often resort to indirect measures for estimating the indirect costs. When indirect labor supports multiple products or product lines, however, they may estimate indirect costs using somewhat arbitrarily allocation rules. As a result, such rules calculate indirect labor costs as percentages of another cost (a direct cost) which they can measure easily.

Activity Based Costing Alternative

Many companies have started using Activity-Based Costing (ABC) as a means of turning some of the traditional indirect cost items into direct costs. See Activity Based Costing for an introduction to this approach with example calculations.

For more on reporting manufacturing overhead and administrative overhead, see Overhead.

Reporting Direct and Indirect Labor Expenses

Income Statement Expenses

Direct and Indirect Labor may be essential cost categories in business case analysis. They can have a significant impact on business case outcomes in studies such as:

- General cost-benefit analysis.

- Financial justification.

- The total cost of ownership (TCO).

- Return on investment (ROI) analysis.

Decisions about asset acquisition or asset lifecycle management, for instance, may rely on a business case analysis to predict total financial costs and financial gains under different possible action scenarios. Some kinds of production-related assets bring sizeable direct labor costs and indirect labor costs for operation and maintenance over a long life cycle. Such expenditures can be excessive for factory machines, vehicles, aircraft, and buildings. As a result, direct and indirect labor costs may be the deciding factor in choosing one asset action over another.

Direct labor costs and indirect production labor costs also impact case results when the case looks forward to different product sales under different scenarios. Higher sales revenues usually require higher direct and indirect labor costs to produce additional product units. The business case analyst, in other words, projects direct and indirect labor costs for each case scenario, in accord with the scenario's sales estimates.