What is Cost-Benefit Analysis?

Cost-Benefit Analysis CBA studies compare likely costs from an investment or action with the likely business benefits.

The Cost-Benefit Analysis concept appears center-stage in business planning and decision-support settings. Financial officers, budget directors, and review boards typically ask for a "cost-benefit analysis" to support funding proposals. Strategists may want to review a "cost-benefit study" before committing to strategic objectives. The question, always, is whether or not the parties involved really know what they are asking for.

Frequent usage notwithstanding, the term by itself is close to meaningless—unless the discussion also points to specific information needs and names a specific methodology.

Define Cost-Benefit Analysis

The term Cost-Benefit Analysis (CBA) has no precise or standard meaning beyond the idea that the study is going to …

- Summarize cost and benefit consequences of an action, decision, or investment.

- Weigh total benefits against total costs.

The term does not have a standard spelling. The forms Cost Benefit, Cost-Benefit, Cost/Benefit, and Benefit/Cost, for instance, appear often.

In other words, "Cost-benefit analysis," refers to the general purpose or motivation for a particular study, not to a specific methodology or outcome.

Define the Outcomes, Name the Method

The businessperson tasked with producing a "cost-Benefit Analysis" must take care to find out exactly what decision-makers, planners, or other stakeholders expect in the analysis results. If they expect the analyst to return with useful results, they must first describe clearly how they will use the results for specific decisions, plans, or other actions.

Once stakeholder information needs are established, the analyst can design a "cost-benefit study" using known methods from one of the following categories:

- Investment Analysis.

- Business Case Analysis.

- Total Cost of Ownership Analysis.

Following sections show how each of these approaches qualify as "Cost Benefit Analysis."

Contents

Standard Forms of CBA

Popular methods that qualify as cost-benefit analysis appear under several classifications: (1) Investment Analysis, (2) Business Case Analysis, and (3) Cost of Ownership Analysis.

These forms of CBA share the same general objective: Predict (or summarize the financial impacts and other business consequences of an action and compare the gains (benefits) to the costs.

The standard methods differ, however, with respect to

- How they define "cost" and "benefit" in practical terms.

- Which kinds of costs and benefits are included for analysis.

- Which financial metrics are important for decision-makers and planners.

1. Investment Methods as CBA

- Can we justify the spending decision in financial terms?

- Is the action or investment profitable?

- When will the acquisition pay for itself?

Several forms of Investment analysis address these questions. They serve the CBA purpose in this context for this reason: Businesspeople sometimes take the view that every instance of business spending is a business investment.

Many apply these methods to traditional investments such as stock shares or bond holdings. However, they also use the same investment metrics to evaluate spending for capital acquisitions, project approvals, business alliances, product launches, infrastructure upgrades, maintenance services, hiring, and more, all of which are, arguably, business investments.

Investors expect investments to produce returns that justify their cost.

Define Financial Justification CBA

Financial officers and other decision-makers declare an investment or purchase financially justified if it meets one or more pre-designated justification criteria. Spendidng is justifiied if it…

- Produces returns that exceed investment costs.

- Has the highest profitability (ROI) of available options.

- Delivers gains at an acceptable rate of return (e.g., IRR).

Financial officers sometimes add additional justification criteria, as well.

Decision-makers may declare spending justified if it …

- Avoids or prevents other substantial costs.

- Is the least costly solution available.

- Has an acceptably short payback period.

- Has the greatest net cash flow or NPV of available options.

- Brings break-even business volume faster than other options.

- Lowers financial risk to an acceptable level at acceptable cost.

Depending on their objectives for investment, decision-makers choose one or more of these criteria as the current meaning of financial justification.

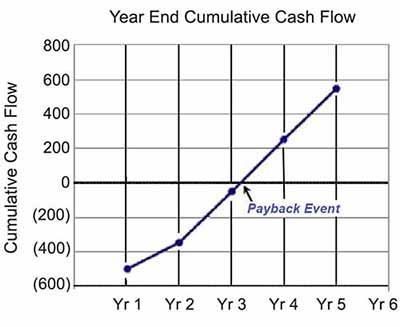

Exhibit 1 shows illustrates the Payback Period Concept. Financial officers may declare that an investment has financial justification if it promises payback in less than a designated time.

Where to Go from Here for CBA Help

Follow these links for explanation, calculation, and examples of CBA investment analysis methods:

2. Business Case CBA: Recommend Which Action?

Businesspeople rely on the form of CBA known as Business Case Analysis to address questions such as these:

- Can you prove the chosen action is the better business decision?

- What is the probability we actually see the forecast costs and benefits.

- In quantitative terms, what are the major risks to reaching objectives?

Business Case Analysis is the CBA method of choice for such questions, for those seeking budgetary funding, project approval, capital spending, or top-level backing. Business case support for proposals of all kinds is now mandatory, nearly everywhere.

Decision-makers and review committees begin with this basic BCA principle: The business case must meet stakeholder information needs. In practical terms, this means they look for two kinds of information in the CBA business case report.

Forecasts

The business case asks "What happens if we take this action, or that action?" The case-builder must answer with trustworthy forecasts in CBA terns—business costs, business benefits, and business risks.

Proof

BCA results "make the case" by showing reviewers why the recommended action is the better business decision. The advantage goes to case builders who can prove your case with the same principles of reasoning and evidence that deliver decisive proof in the law court and the science lab.

Where to Go from Here

For more on business case cost-benefit anaysis see these online articles.

3. Total Cost of Ownership CBA: Find Hidden Costs

Total Cost of Ownership TCO is a form of CBA designed specifically to address such questions.

- We know the obvious costs but how large are the hidden costs?

- What are the chances we have nasty cost surprises over time?

- Will the proposed action result in cost savings?

The TCO analysis aims to uncover all the costs—the obvious costs but also the "hidden"costs—that follow from owning certain kinds of assets or other acquisitions, during ownership life. Another name for TCO is asset life-cycle cost.

Acquiring items such as vehicles, aircraft, factory machinery, laboratory instruments, or medical equipment brings purchase costs, of course, but owning also brings costs due to installing, deploying, using, upgrading, and maintaining the same assets. These after-purchase costs can be substantial.

Consequently, for many kinds of assets, TCO analysis finds a significant difference between purchase price and total life-cycle costs. The difference can be especially large when ownership covers an extended time span. As a result, TCO analysis sends a powerful message to corporate buyers, capital review groups, and asset managers:

Consider TCO first instead of purchase price when making purchase decisions!

Where to Go from Here

For a complete introduction to Total Cost of Ownership analysis and step-by-step guidance for completing a TCO study, see the article:

Solution Matrix Ltd® 292 Newbury St Boston MA 02115 USA

Phone +1.617.849.8478 • Contact Form • Privacy Policy • About Us • Sitemap

Terms of Service • Refunds • Customer Service • Safety & Security

Copyright © 2004–2024 by Solution Matrix Ltd • All Rights Reserved