Benefit Value Starts With a Practical Definition

Reaching objectives has value. That principle is key to valuing business outcomes of all kinds as business benefits.

How do you answer questions like these: What is this benefit worth, in real money? What's the business value of this or that benefit? To answer such questions, business analysts start by defining business benefit this way:

Define Business Benefit

A business benefit is a tangible outcome of an action or decision that contributes towards reaching one or more business objectives.

That definition serves well for many business planning, decision support, and other analysis needs. Defining business benefits by referring to business objectives provides a practical basis for measuring, valuing, and comparing all benefits—financial and nonfinancial.

Financial Benefits and Nonfinancial Benefits

The business benefit concept is central in strategic planning, cost/benefit studies, and business case analysis. For these tasks, business analysts evaluate investments and actions by anticipating likely cost and benefit outcomes. People new to these activities learn quickly, however, that some kinds of benefits are easier to measure and value than others.

- Businesspeople readily accept positive financial outcomes as business benefits. These are easy to measure in terms of cost savings, revenue growth, cash inflows, or profits.

- Many , however, are uncertain about how to measure or value contributions to business objectives they define in nonfinancial terms. These may include, for instance, changes in key performance indicators for goals having to do with:

- Customer satisfaction

- Employee engagement

- Risk reduction

- Safety

- Branding.

- Quality of service delivery

- Company image

- Environmental quality

Understand Benefit Principles, Then Measure Benefit Value

Sections below focus on two business benefit themes:

- Firstly, defining business benefits and explaining benefit principles, or "theory."

- Secondly: Practical how-to steps for measuring and valuing all classes of business benefits.

The analyst who first learns benefits definitions and principles is ready to deliver measurements and values with credibility and legitimacy. Analysts know from experience they will probably have to explain and justify benefit values they present to stakeholders and senior managers.

Contents

Benefit Principles Part 1

Costs and Benefits: Define Your Terms!

Those working in business planning and decision-support find, over and over, they must estimate the business value of specific action outcomes before they occur. Predicting future costs and benefits this way is, in fact, the central task in cost/benefit studies and business case analysis.

- Approaching this task, some see benefits merely as "good" outcomes and costs only as "bad" outcomes.

- To others, cost means "funds flowing out," and benefit means "funds flowing in."

- Beyond this, professionals in economics, accounting, and investment services all have their ways of defining "cost" and "benefit."

Those definitions, however, have little practical value for those in business planning and decision support, or those who manage projects, programs, products, and the asset lifecycle. They need instead cost and benefit definitions that provide a practical basis for identifying, measuring, valuing, and comparing all classes of business benefits and costs.

Define Benefit and Cost in the Same Way

The need to measure and value business benefits typically occurs in the context of a "Cost/benefit analysis" or other form of "Business Case Analysis." These exercises aim to summarize the likely "costs" and "benefits" from a proposed action, and then compare costs to benefits to find the extent to which the action is a net loss or a net gain.

Business analysts use cash flow metrics such as return on investment (ROI), internal rate of return (IRR), net present value (NPV) and payback period to describe the cost-benefit comparison. Each metric compares cost to benefits in its own way, but all rely on the assumption that costs and benefits for the study are defined in the same way.

For this reason, it is worth repeating here the definition of business benefit, and adding a similar practical definition for business cost.

Define Business Benefit and Business Cost

A business benefit is a tangible outcome of an action or decision that contributes towards reaching one or more business objectives.

A business cost is a tangible outcome of an action or decision that works against reaching one or more business objectives.

These definitions may seem awkward at first, but they provide a sound way to bring both financial and nonfinancial benefits and costs into the same analysis. They are especially useful when you want to bring the full range of costs and benefits into the analysis, and when you must show that nonfinancial benefits are real and vital.

Costs vs. Expenses: Are They Interchangeable Terms?

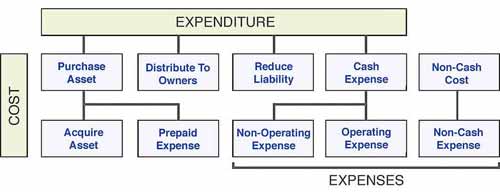

A business cost, incidentally, is not necessarily an expense. Cost is a broader term that includes expense but other kinds of outcomes or events as well. Exhibit 1, below, summarizes the types of actions that qualify as costs in business analysis.

Accountants and financial specialists define expense formally as a decrease in owner’s equity caused by using up assets. More broadly, however, other businesspeople think of "expenses" as spending, and many use the terms expense, expenditure, and cost interchangeably.

For cost-benefit analysis, however, expenses are one kind of cost, but other "costs" are possible, as well.

Benefit Principles Part 2

Financial vs. Nonfinancial Benefits: Key Terms

Any of the business objectives in view above or below may play a strategic role for a company or organization. In other words, a short-list of highest-priority goals may include both:

- Financial objectives.

Define and measure these goals in financial terms, such as cost savings, cash inflows, sales revenues, or profits. - Nonfinancial objectives.

Define and measure these goals first in nonfinancial terms. These may include changes in key performance indicators, such as accident rates, customer satisfaction survey scores, numbers of disciplinary actions.

Both kinds of objectives can be central and critical in private industry, government, and non-profit groups. Both can represent strategic goals for these groups.

Financial Objectives, Financial Benefits

Business typically state the highest level objective for profit-making companies as "earning profits." The business school professor, however, might prefer to say the goal is "increasing owner value by earning profits." In any case, companies can use profits in only two ways.

- Firstly, paying profits directly to owners as dividends.

- Secondly, keeping profits as retained earnings, thereby increasing owners equity.

Most other objectives in private industry exist—at least in principle—to support the high-level profit objective. As a result, any action outcome that arguably contributes to the profit objective qualifies as a business benefit.

The highest level objectives for government and non-profit organizations, however, are something besides "earning profits." Highest-level objectives for these groups appear in mission statements about service delivery and the populations they serve. These organizations, nevertheless, also pursue revenue and spending objectives such as these:

- Obtaining funding

- Staying within budget

- Controlling costs

- Minimizing costs

- Improving cost-efficiency

- Generating revenue (In some cases)

Outcomes that help meet goals like these are no less "financiNonfinancialal benefits" than are similar outcomes in private industry.

Nonfinancial Objectives, Benefits

Not all business objectives start with financial definitions. Business set goals for customer satisfaction and company image, for instance, defining target levels with nonfinancial key performance indicators (KPIs). Unfortunately

- Some see contributions to nonfinancial objectives like these as second-class benefits, not deserving a place in the business case or cost/benefit study.

- Others know that such benefits are essential, but still have no way to measure and value them. Or, they may not know how to compare them to "financial benefits."

As a result, some dismiss nonfinancial benefits from business case results, or else give them cursory notice at best.

Misleading Terms: Soft Benefit, Intangible Benefits

Several benefit terms commonly turn up that astute analysts find to be deceptive or imprecise. Foremost among these are soft benefits and intangible benefits. Every analyst presenting results for review should prepare to explain why such terms are unhelpful.

Soft vs. Hard Benefits

Some businesspeople label benefits as being either soft or hard. Neither term has a standard definition. However, those using these terms seem to imply that hard benefits are superior to soft benefits.

- For some, no doubt, hard benefit outcomes are certain and easy to measure, while soft benefits are neither.

- Others say soft and hard when they mean nonfinancial benefits and financial benefits, respectively.

These terms inevitably position the "soft" benefits as second-class outcomes in the eyes of many, automatically crediting so-called soft benefits with less weight or importance than hard benefits. However. it is better to avoid the terms "hard" and "soft" altogether. Instead, classify outcomes as being either financial benefits or nonfinancial benefits.

Tangible vs. Intangible Benefits

Tangible means touchable, but many speak inaccurately by saying "tangible" when they mean "financial." People sometimes say "intangible" when referring to objectives and benefits such as improvements in customer satisfaction, branding, employee morale, safety, or reduced risk. They probably do so because they believe the financial value of these outcomes is unclear.

Business objectives and benefits are indeed tangible if there is objective evidence they exist. "Tangible objectives," in other words, are "touchable." Calling a "business benefit" intangible says there is no evidence it exists and no way to measure it. The analyst's task, often, is to find credible tangible evidence for the kinds of benefits in the paragraph above.

Truly intangible benefits do not belong in strategies, business plans, business models, or business cases.

Benefit Principles Part 3

How Business Objectives Give Value to Benefits

In other words, actions and outcomes in the business setting have business value only when they contribute towards meeting business objectives. And, when contributions point to financial value, the analyst can apply investment metrics such as return on investment (ROI) or payback period.

Consequently, the search for business benefits from an action and their values begins by understanding which objectives the action addresses.

Every action that has a budgetary impact, or otherwise consumes time and resources, should have a specific business objective n view. Objectives, in fact, are the reason for actions such as these:

- Investment

- Project

- Program

- Initiative

- Strategy change

- Reorganization

- Re-engineering plan

- Process revision

- Product launch

- Partnership

- Alliance

- Merger

Business Value flows From Objectives to Outcomes

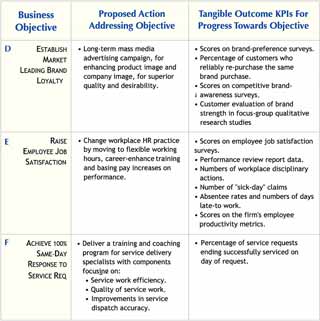

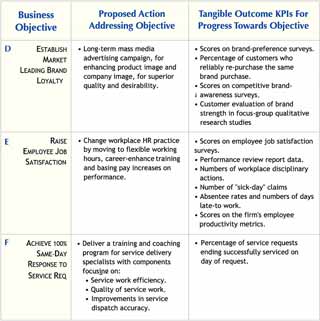

The step-by-step benefit value process below begins by associating—linking together—three things: (1) A Business Objective, (2) a proposed action to address the objective, and (3) a tangible action outcome that helps reach the objective.

Benefits Come From High and Low-Level Objectives Alike.

Benefit outcomes appear in the form of progress towards high and low-level objectives alike. For example:

- Benefit = Progress towards high-level strategic goals:

- Grow annual sales revenues by 10%.

- Become an industry leader in customer satisfaction.

- Establish brand leadership in the market.

- Become the industry leading low-cost provider.

- Benefit = Progress towards lower-level tactical objectives:

- Reduce average customer wait time on call center phone by 50%.

- Increase product mean-time-between-failure by 50%.

- Reduce office supplies expenses by 10%.

Benefits Come From All Classes of Objectives.

Business objectives that define business benefits appear in different kinds of goals. For example:

Financial Objectives

- Increase earnings per share by 25%.

- Increase profits by 10%.

- Reduce costs in specific operating areas by 20%.

Sales Objectives

- Shorten average sales cycle time by 50%.

- Increase average order size by 40%.

- Increase sales revenues by 10%.

Marketing Objectives

- Enter a new geographic market.

- Achieve industry-leading market share.

- Branding and Image objectives:

- Establish brand awareness for a new product line.

- Achieve high levels of brand loyalty.

- Achieve industry recognition for product quality.

Customer Objectives

- Exceed competitors on customer satisfaction ratings.

- Become the vendor of choice for small and medium-size businesses.

Employee Objectives

- Improve employee satisfaction survey scores.

- Reduce annual employee turnover by 25%.

Operational and Efficiency Objectives

- Provide same-day response to 100% of service calls.

- Increase annual inventory turn rate by 50%.

- Increase employee productivity by 10%.

Problems Provide Objectives

When looking for objectives that an action might address, do not overlook business problems and needs. Remember that any discussion of needs or issues likely mentions an objective. When employee turnover is high and costly, for instance, the problem points to a goal: Reduce employee turnover rate.

Problems can also provide benefit value for penalty or problem-avoidance objectives like these:

- Achieve compliance with environmental regulations.

- Reduce the risk of laboratory equipment failure.

- Improve data security.

An Action Can Address Multiple Objectives

Notice that actions for approaching one objective may help reach other goals as well. Acting to improve product quality, for instance, may also help reach targets for lower warranty service costs, branding, and customer satisfaction. The benefit (higher product quality) can receive business value from each of these objectives.

Benefit Principles Part 4

KPIs Make Nonfinancial Benefits Tangible

Nonfinancial objectives like customer satisfaction or branding can be very important or even crucial to a company's strategy. Consequently, those who want to assign values to nonfinancial benefits must find concrete ("tangible") measures for the objectives they represent. They can do this, even if they have to measure indirectly.

Objectives and business benefits having to do with customer satisfaction, for instance, are extremely important to companies in highly competitive industries. And, customer satisfaction no doubt supports other objectives such as the following:

- Customer retention

- Average order size

- Length of the sales cycle

- Repeat business

- Referral business

- Lower service costs

No one doubts that improvements in these factors lead ultimately to financial gains. Nevertheless, the objective itself—customer satisfaction—is a condition of the customer mind. Because they cannot measure that directly, some label the goal "intangible."

Example KPIs for nonfinancial objectives

Organizations typically establish KPI's and targets for essential goals having to do with such things as:

- Image and branding

KPIs may include survey scores for brand awareness, brand recognition, or brand preference. - Employee satisfaction.

KPIs may refer to employee satisfaction survey scores, employee productivity measures, turnover rates, absentee rates, or disciplinary data. - Customer satisfaction survey scores

KPIs may include customer satisfaction survey scores, product return rates, or customer complaints. They may also refer to "qualitative" research results (e.g., from customer focus groups). - Employee health, safety, and well-being

KPIs may point to employee absenteeism due to illness, on the job accident rates, or using employee services.

- Quality of service delivery

KPIs may include direct service performance measures, such as mean time to complete service requests. They may also include customer satisfaction indicators, such as survey scores or numbers of complaints.

- Product quality

KPIs may include data on warranty requests, customer complaints, or customer survey scores.

- Recognition as a "Green" organization

Many professional organizations offer membership and certification to groups or companies that meet certain "green" criteria. These stand as KPIs for green status. Also, demonstrating compliance with environmental laws and standards serves as a credible KPI for green status.

- Recognition for contributions to the community

KPIs for this objective include awards or other formal recognition from civic groups and public service organizations.

How to Legitimize, Measure, and Value Benefits

Quantify Business Value in Seven Steps

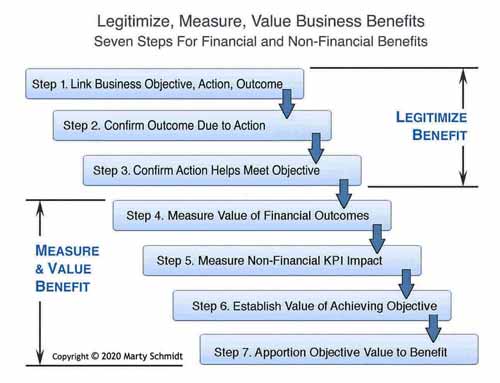

Analysts with experience know that assigning value to benefits calls for more than a single formula and more than a single measurement. Instead, benefit value results from applying a rationale—reasoning—that builds a case for the stated value, step by step.

The benefits rationale must establish four points in a particular order. The fourth point is the objective of the analysis, the assigned business value of the benefit.

Briefly, the benefits rationale:

- Firstly makes the benefit tangible and measurable.

- Secondly, shows why the benefit legitimately belongs in the analysis.

- Thirdly measures benefit impact.

- Fourthly, assigns a quantitative value to the benefit—preferably financial value.

Sections below show how to build and make the four-point case for benefit value in seven steps.

Valuing Business Benefits Step 1

Link Objective, Action, Tangible Action Outcome

Business Benefits Are All About Reaching Objectives.

Reaching objectives has value for the business. The business benefit definition starts with that premise and links an objective to an action and action outcome.

The first step in legitimizing and valuing a business benefit, then, is to connect the potentially-beneficial outcome to a business objective, and identify the tangible evidence for the outcome.

In this scenario, the potential business benefit is the tangible action outcome. Steps towards assigning value to this benefit begin with Step 1.

Step 1 Examples. Linking Objectives, Actions, and Outcomes

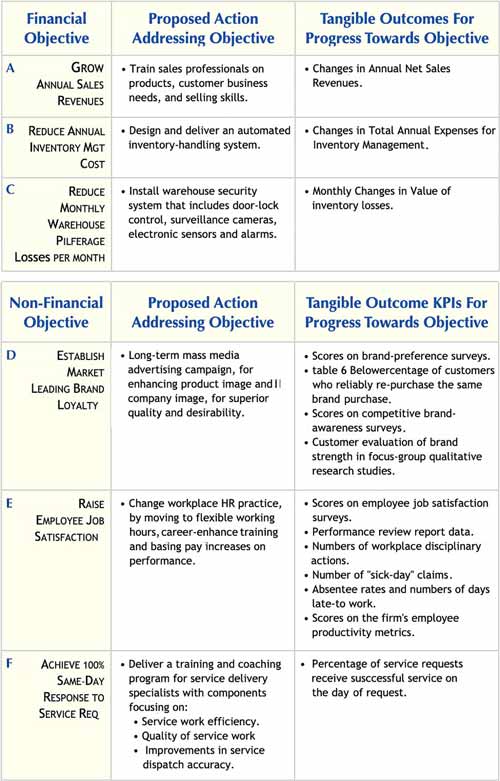

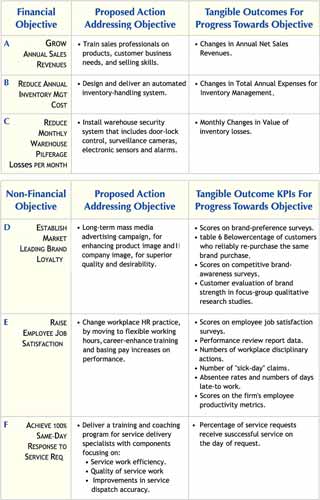

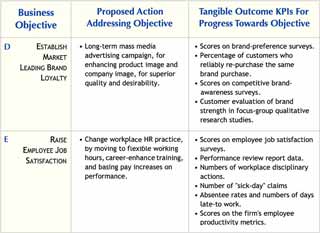

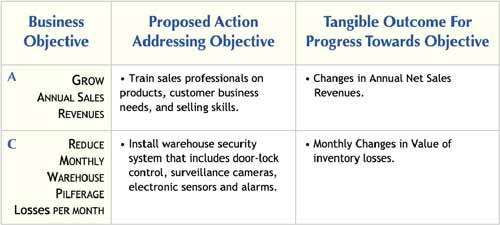

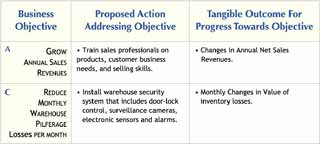

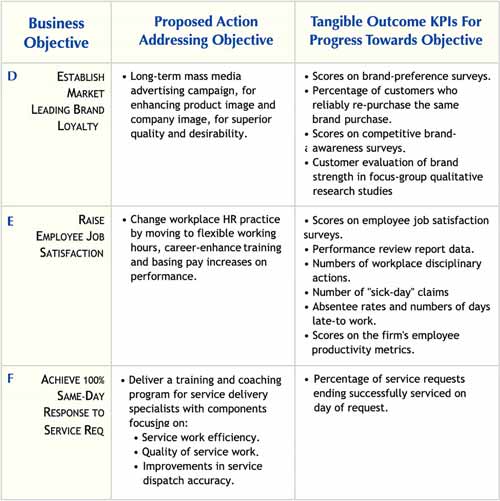

Table 1 below illustrates the kind of information the analyst needs to produce for Step 1. Notice especially that for some financial and nonfinancial objectives, the business benefit (right column) is essentially the same thing as the business objective (left column), as in Rows A, B, C, and F. For other business objectives, benefits that address the left-column objective appear as multiple KPIs in the right column, as in Rows D and E.

Valuing Business Benefits Step 2

Confirm the Outcome is Due to Action

Step 2 begins the process of legitimizing the benefit outcome from Step 1. The reasoning for measuring and valuing the benefit (Steps 4-7) is worth developing only after the analyst first shows convincingly that the benefit indeed follows from the action (Step2) and that the benefit indeed contributes to meeting the objective (Step 3).

Success in Steps 2 and 3 legitimizes the benefit value that comes with later steps.

If the analyst cannot complete Steps 2 and 3, successfully, any results from Steps 4 - 7 are meaningless.

To show convincingly that an outcome truly follows from an action, the analyst may use cause cause-and-effect reasoning, anecdotal evidence, or examples of historical precedent. Whatever the approach, the result must score high in credibility.

Step 2 is the primary reason that cost/benefit studies and business case analyses must have contributions from in the business unit. These people know the details of day-to-day operations, what motivates employees, what drives costs, and the real reasons that actions either work or do not work.

Step 2 Example: Will a highway safety program really lower the highway accident rate?

Municipal and regional governments sometimes respond to public problems with multi-part programs, trying to correct or reduce problem severity. A provincial or state government could, for instance, aim to address the accident problem rate with a safety program that has several components:

- Improving lighting and road grading at dangerous intersections.

- Improving highway signage and lighting.

- Enforcing speed limits and stop sign rules more rigorously.

- Enforcing impaired-driving laws more aggressively.

- Expanding and enriching driver-education for new drivers.

- Mandatory remedial driver-education mandatory for problem drivers.

To prove that the proposal program will very likely reduce the accident rate, the program manager must first understand the causes of the problem. The manager must then argue convincingly that each proposal step directly addresses accident causes. For example

- Some program components aim directly at known causes. Better lighting should result in fewer accidents due to darkness.

- Historical data on the relationship between speed laws and accidents is easy to find for many localities.

- The relationship between alcohol-impairment and accidents, and drug-impairment and accidents is a matter of record. However, the program manager must also show how the proposal program can truly reduce instances of these conditions.

- Other program components may already have a track record in different localities. For instance, historical data are easy to find on the impact of driver-education programs on accident rates.

Valuing Business Benefits Step 3

Confirm Outcome Helps Meet Objective

Step 3 completes the process of legitimizing the outcome as a benefit —showing that value measures for the benefit are credible and real.

A separate Step 3 is not always necessary. Sometimes, completing Step 2 also completes Step 3. Examples below show how this occurs.

In situations that do call for a separate Step 3, this third step is critical. In these cases, omitting Step 3 destroys the reasoning that establishes benefit value in Steps 4-7. Examples below also show how to decide whether or not you need Step 3.

In Step 1, the analyst links a business objective to an action and tangible outcomes from the action. Step 2 is the process of showing in convincing terms that the outcome truly follows from the action. This step, Step 3 is necessary sometimes to confirm also that the outcome helps meet the business objective.

Example Cases Not Needing Step 3

When the analyst measures the business objective and the action outcome in the same terms--by the same metric—completing Step 2 also provides the proof element for Step 3. Under those conditions, a separate Step 3 is superfluous.

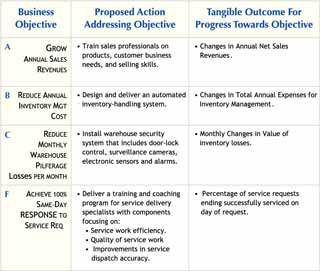

Of the six example rows in Table 1 above, four meet these conditions. Step 2 also completes Step 3 requirements for examples in Rows A, B, C, and F. These Table 1 Rows appear below as table 2:

Step 3 Examples: Cases That Do Not Require Step 3

Other times, however, the analyst cannot automatically assume that tangible outcomes contribute to meeting the business objective. This assumption is especially uncertain (a) when the business objective itself has a nonfinancial definition, and (b) the action in view has multiple tangible nonfinancial outcomes.

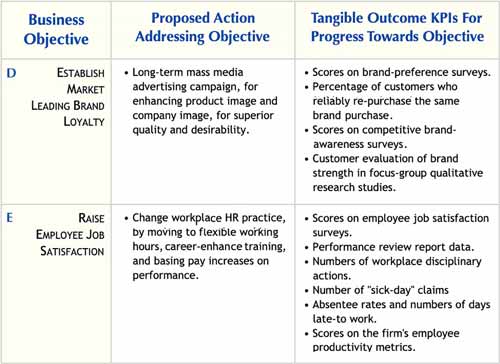

Of the six example rows in Table 1 above, two meet these latter conditions—the examples in Rows D and E. These Table 1 Rows appear below as Table 3.

A Simple Solution For Step 3: Let the Outcome KPIs Define the Objective

Examples D and E illustrate the case when organizations publish strategic objectives in nonfinancial terms. Government, Military, Non-Profit Organizations, and firms in private industry commonly publish mission statements and strategic objectives pointing to objectives like these:

- Military Readiness

- Sustainability

- Livability

- Safety

- Employee Satisfaction

- Customer Satisfaction

- Company Image

- effectiveness

- Low Risk

- Safety

- Livability

- Responsible Stewardship

Where qualities like these are strategic objectives, the organization must take one of the following options to complete Step 3:

- First present the KPI evidence for setting targets for the objective. Then link the outcome KPIs to the objective's KPI metric. Make this link in the same way that analysts complete Step 2 (above), linking outcomes to actions.

- A simpler practical solution is to declare that the set of outcome KPIs defines the metrics for the objective. The organization might declare: "For purposes of analysis, planning and evaluation, we define employee satisfaction in terms of these six key performance indicators."

Taking option 2 automatically completes Step 3 of the benefit valuation process. Organizations that want to track progress towards meeting these objectives, year to year, will keep the same KPI definitions year-to-year.

Valuing Business Benefits Step 4

Measure the Value of Financial Outcomes Directly

In Step 4, the Analyst measures and registers outcome values that appear as financial values, such as cost savings, investment returns, incoming revenues, or avoided costs.

Obviously, Step 4 applies only to financial outcomes.

Although it seems simple to measure and value financial outcomes, keep in mind two cautionary points:

Step 4—First Caution

Step 4 measures the total financial value of the action outcome. Remember that this value can differ trom the benefit value for the action. The outcome, in other words, may have several causes besides one action in view. The analyst expects to adjust the Step 4 value further, in Step 7 below, to recognize the contributions of multiple actions.

Step 4—Second Caution

Financial benefits should represent net value gains, not gross cash inflow. Analysts often designate Sales Revenues as a business benefit. For cost/benefit or business case studies, however, they should replace this benefit with Net gains from sales increase or Net profit from revenue increase.

This action recognizes that increasing sales revenues also increases some costs—product production costs, distribution costs, costs of selling, and income taxes, for instance.

Step 4 Examples: Measure Value of Financial Outcome

Table 4 shows how two example benefits from Table 1 point to tangible financial outcomes as possible benefits for actions in the middle column.

Example Case A: Valuing Changes in Sales Revenues

The size of a sales revenue increase is easy to calculate as the difference between revenues one year and revenues the next year. Consider the auto dealer in Example A who ran a year-long marketing campaign in Year 2. The campaign objective was to grow sales revenues for the business.

– Sales Revenues Year 1: $43,500,000

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

Sales Revenue Increase: $11,400,000

The analyst must also find the total additional costs that came with the revenue increase. For this example, these include costs for selling the additional units:

Selling cost (sales commissions): $1,400,000

Additional administrative expense: $400,000

Net cost of trade-in allowances: $820,000

Marketing program cost: $1,000,000

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

Total additional Costs: $6,820,000

This total enables the analyst to find the benefit value for the increased revenue outcome:

– Total additional Costs: $6,820,000

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

Net benefit value: $4,580,000

With this calculation, the analyst settles the financial value of the benefit (increased sales revenues)

Ths step establishes Net benefit value as $4,580,000.

However, the portion of this benefit value to credit to the action in view (the marketing campaign) is still uncertain. The benefit may be due to several actions. In Step 7, below, the analyst may choose to apportion the total benefit value ($4,580,000) among several contributing actions.

Example Case C: Valuing Reductions in Warehouse Pilferage Losses

Business owners in example Case C took action aiming to reduce unacceptably high inventory losses. They installed a state-of-the-art warehouse security system that includes (1) door-lock controls, (2) surveillance cameras, and (3) electronic sensors and alarms. The system began operating at the end of July. At the end of August, the analyst calculated the first monthly change in loss value follows:

– August pilferage loses: $110,000

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

Pilferage loss reduction: $310,000

This calculation settles the monthly pilferage loss reduction benefit value as $310,000. Before calculating an ROI for the security system, however, the analyst will report the Step 4 result to owners with two cautions:

- Caution: The step 4 result may be due to multiple actions beyond installing a new security system.

For instance, the firm also may have warned warehouse employees, loading dock workers, their managers, and their security personnel that they are under new and more rigorous monitoring. The firm may have warned shippers and other delivery services that inventory accounting is now more accurate and under continuous tracking.

Benefit value credit to the security system will have to wait until Step 7, where multiple actions may have to share credit for the Step 4 value ($310,000). - Caution: Security specialists know that benefits from security actions may recede over time. Burglars, shoplifters, untrustworthy employees, and dishonest shippers constantly improve their ability to diminish the effectiveness of security systems.

The analyst should wait several months, at least, before declaring a definitive ROI for the security system.

Valuing Business Benefits Step 5

Measure Outcome Impact on Nofinancial KPIs

In Step 4, above, the analyst measures action impact on financial outcomes. In Step 5, the analyst measures action impact on outcomes that are nonfinancial Key Performance Indicators (KPIs).

Notice the important differences between Step 4 and Step 5 Outcomes:

- Step 4 produces financial figures—for benefits the analyst defines in financial terms. Step 4 measures value for financial benefits in Example cases A, B, and C from Table 1

- Step 5 measures changes in KPIs that follow an action. The analyst will try to assign credible financial value credit to these KPI changes, but that attempt may or may not succeed.

Step 5. Examples: Measure Value of Financial Outcome

Three examples from Table 1 (D, E, and F) above identify tangible action outcomes as possible benefits due to actions in the middle column. To ultimately assign business benefit value to outcomes in cases D, E, and F, the analyst completes Step 5.

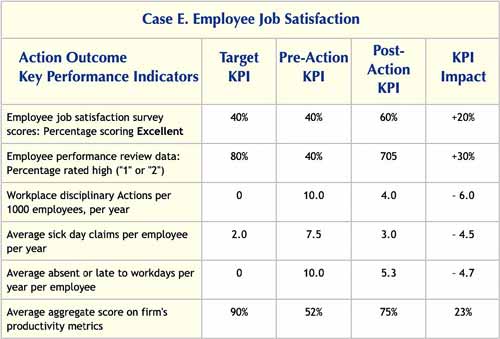

Example Case E. Measuring Impact for Employee Job Satisfaction KPIs.

Making Tangible the Intangible

Business firms and government organizations sometimes use KPI scores to make tangible objectives and benefits that may seem intangible.

Employee job satisfaction (Row E), for instance, is a state of employee minds—not a physical state to measure directly. For this reason, some business say that employee satisfaction is an intangible quality. The same people also apply the intangible label to qualities such as customer satisfaction, group morale, safety, livability, company image, brand strength, military readiness, and risks of various kinds. However, Intangible means untouchable—there is no evidence the objective or benefit exists and no way to measure progress towards it. Considering the accurate meaning of intangible, professional analysts usually decide that objectives and benefits that are truly intangible have no place in a professional cost/benefit study or business case.

A solution that works, often, is to turn so-called intangibles into tangible qualities with key performance indicators (KPIs). Analysts view KPIs as tangible outcomes that are credible indirect evidence of an underlying quality they cannot measure directly. They can assume, for instance, that the KPI employee retention rate is a valid indicator of employee job satisfaction. For practical purposes, the firm in case E above uses the set of tangible KPI's in the right column to define employee job satisfaction.

Organizations that use KPIs in this way typically measure the same KPIs periodically over time, and also after actions aimed at improving the underlying quality—employee job satisfaction customer satisfaction, or branding, for instance.

Measure KPI impact in Step 5

The firm in the Case E example launched an initiative aimed at improving employee job satisfaction. The initiative had these characteristics:

- Business Objective: Rise employee job satisfaction

- Action Addressing the Objective: Change workplace HR practice by moving to flexible working hours, career-enhancing training, and basing pay increases on performance.

Table 6 below shows the Before and After KPI metrics for the Case E firm's action. The difference between Before and After is the size of the impact aimed at improving employee job satisfaction.

Valuing Business Benefits Step 6

Establish the Full Value of Reaching Target Objectives

In Step 6 the analyst focuses entirely on the business objectives that are the reason for action.

Each business objective must come with a tangible target level—if it is to serve for making decisions, planning, or management control. Without the tangible target, after all, no one knows when they reach the objective or if they are moving towards it.

The purpose of step 6 is to identify and secure agreement on the full value of reaching the target.

Preferably, the analyst tries first to establish a value for reaching the objective target in financial terms—even with objectives that have a nonfinancial definition. Then, in Step 7, the analyst will credit some or all of that value to action outcome measures from Steps 4 and 5. Step 7, in other words, completes the process of assigning business value to business benefits.

Practical Tactics for Establishing Value of Reaching Objective Targets

Value of Reaching Financial Objectives

Finding the value of reaching financial objectives is usually simple and straightforward. For example:

- Revenue increases, Investment returns, and other cash inflow objectives. Step 4 above shows that the of for the outcome. Sales revenue increases, for instance, also bring additional incoming costs. The benefit value of revenue increases, investment returns, or other cash inflow gains calculates as the incoming cash value less the additional costs for the increase.

- Net profit objectives have a benefit equal to the profit objective itself. Profits are gains less the costs that bring them. Therefore no further adjustment of the profit figure is necessary.

- Cost savings and avoided costs have a benefit value equal to the savings or avoided cost.

Value of Reaching Nonfinancial Objectives

There may or may not be direct and obvious connections between KPI targets on the one hand, and financial value on the other. In any case, the analyst has available several tactics for attaching financial value to achieving nonfinancial targets.

- First Tactic. Search for financial gains that are easy to link to reaching the nonfinancial KPI target. For example:

- Higher customer satisfaction survey scores (the nonfinancial KPI) can link to the financial value of increasing sales, repeat business, and greater market share.

- A higher number of successful employee training offerings (the nonfinancial KPI) may link to the financial value of higher employee productivity, higher quality work, employee retention, fewer workplace disciplinary actions.

- A lower accident rate on the factory floor (the nonfinancial KPI) many connect with the financial value of fewer lost workdays, lower insurance premiums,

- Second tactic. Find costs that follow from not reaching the target. For example.

- The cost of not reaching a new-product time-to-market objective (one KPI) or new product time to manufacturing target (another KPI) may link to an easy-to-predict financial value for loss of sales revenues, shrinking market share, or lower customer retention.

- The cost of not reaching target levels on customer brand-awareness surveys (the KPI) may link to clearly to financial value loss in market share, sales revenues, and ability to charge premium prices.

- Third tactic. Find the cost of reaching the KPI target level by the next least-costly method.

- Fourth tactic: Simply find the price management is willing to pay to reach the objective target.

As a "last resort" for finding a credible value for reaching the nonfinancial objective, the final suggestion above can be surprisingly successful in producing an acceptable, agreeable value for reaching a target. When management is willing to state a figure they would willingly pay, to buy arrival at the goal, this management has put a precise financial value on reaching the target.

Valuing Business Benefits Step 7

Apportion Value of Objectives to Benefit Outcomes

Step 7 completes the process of assigning business value to the action outcomes.

Before starting step 7, briefly review progress to this point in building the benefit value case:

- In Step 4, the analyst finds the financial value of financial outcomes from actions.

- In Step 5, the analyst assigns financial value to nonfinancial outcomes (KPI impacts) from actions.

- In Step 6, the analyst establishes a financial value for reaching target levels for specific objectives.

Now, the analyst task in Step 7 is to apportion the Step 6 value of reaching objectives, to outcome impacts identified in Steps 4 and 5.

Multiple Actions Address Each Strategic Objective

The seven-step benefit-valuing process aims to answer just one question: What is the business value from a specific action? Less formally, the first six steps ask: What is the benefit worth? Steps 1-6 build a case showing convincingly that reaching objectives has value, and some of that value is due to a specific action.

When the objective in view is an important strategic objective, however, the organization probably has several actions or initiatives underway, all aiming to help meet the same objective. A high-level objective for increasing market share, for instance, may be the reason for product advertising, customer satisfaction initiatives, and brand-building actions.

If market share does increase over a year, the analyst uses steps 1-6 to establish a business value for the market share increase. However, management also needs to know how much of that value is due to advertising actions, how much is due to customer initiatives, and how much is due to successful brand-building actions. The answers are crucial for choosing and planning next year's investments in marketing efforts.

Step 7 is thus necessary when reaching a single objective is the result of multiple actions.

Step 7 Example Apportioning Benefit Value

In the Auto Dealer case from Step 4, the dealer ran a year-long marketing campaign with the objective of increasing sales revenues. Step 4 calculations show how a net benefit value of $4,580,000 derives from $11,400,000 in revenue gains. However, the revenue gains and net benefit value may very well result from two actions during the year:

- The auto-dealer ran a year-long marketing campaign.

- Early in the year, a major competitor dealership in the same geographical market closed. This effectively left the dealer with twice the previous market share.

To gain a sense for the relative sales contribution from increasing market share, the dealer's business manager analyzes the firm's historical win/loss scorecard against the now out-of-business competitor From this, the manager decides that 40% of the year's incremental sales would have gone to the former competitor, if that business were still open. Accordingly, the analyst credits 40% of the benefit value to the windfall market share increase, while crediting 60% to the marketing program.

Notice the roles of these results:

- The benefit values are legitimate data for decision support, planning, sales forecasting, and investment evaluation purposes by owners and analysts. The benefit values play no role in the firm's accounting system, however.

- The firm's accountants record the full $11,400,000 in revenues accounts, along with all other sales revenues for the period. All marketing program and selling expenses will contribute normally to expense entries on the income statement.