What is Pricing?

Marketers set prices aiming for sales goals. Normally, they price to maximize sales revenues, profits, market share or units sold.

Without pricing activities in one form or another there would be no sales transactions. This rule holds in normal business where sellers themselves set prices, of course, but also in less conventional settings where other parties have a hand in determining the actual selling price—sales on consignment, sales by auction, sales by lottery, or barter situations. This article focuses on pricing theory and practice in business, where sellers themselves create a pricing strategy, choose a pricing model, and set prices.

Define Pricing

The term Pricing refers to a seller's approach to setting the purchase prices of goods and services products

Pricing strategy is a plan that describes how the seller pursues sales and marketing objectives through pricing.

Sellers implement pricing strategy with a pricing model. The model essentially provides instructions or rules for setting prices and creating margins.

Pricing is a Marketing Activity

In business, sellers view pricing as a marketing activity. And, textbooks typically define "marketing" in terms such as the following. Marketing is a set of actions:

- That communicate customer value in products to sell products.

- Meant to increase customer demand.

Also, textbooks often designate Pricing as one of four Marketing "Ps" that support these objectives. The other three are Product, Placement, and Promotion.

Financial Objectives in Pricing

Pricing occurs when the seller sets a list price (or reference price, or base price) for specific products. The reference price is the price customers usually pay (however, see the discussions below on discounts and sale prices).

Sellers usually price with one or more of the following financial objectives in view. They designate list prices to:

- Maximize unit sales and market share in terms of units sold.

- Increase sales revenues and market share in terms of sales revenues.

- Maximize gross profits.

- Leverage sales of related products or services.

Sellers also use pricing to pursue positioning objectives such as these:

- To communicate and reinforce brand value.

- To create a perception of high product quality, desirability, or value.

Explaining Pricing in Context

Sections below further define and explain pricing as a marketing activity in context with pricing terms from marketing and from economics, emphasizing five themes:

- First, defining pricing as a marketing activity, in which sellers set prices for their goods and services with sales objectives in view.

- Second, from the marketer's viewpoint, demand is a function of price. Quantitative demand curves show sellers which prices should optimize sales revenues, units sold, or profits.

- Third, from the economist's viewpoint, price is a function of demand (the reverse of the marketer's view).

- Fourth, marketers commonly use any of twelve popular pricing strategies, or pricing Models.

- Fifth, marketers try to avoid common pricing mistakes.

Contents

- What is "pricing?"

- What is the role of customer demand in product pricing analysis?

- Marketers see demand as a result of price. Economists see price as a result of supply and demand.

- Calculating (measuring) and interpreting the elasticity of demand

- What is the difference between PEoD arc elasticity and PEoD point elasticity?

- Real-world price and demand analysis: A complex task

- Sale and discount pricing: Significant exceptions from the list price

- What is the difference between retail pricing and wholesale pricing?

- What are the most popular pricing strategies?

- What is a pricing model? How is a pricing model used?

- What are the most common pricing mistakes?

Related Topics

- For a complete introduction to Business Strategy, including the role of pricing strategy in the overall strategic framework, see Business Strategy.

What is the Role of Customer Demand in Pricing Analysis

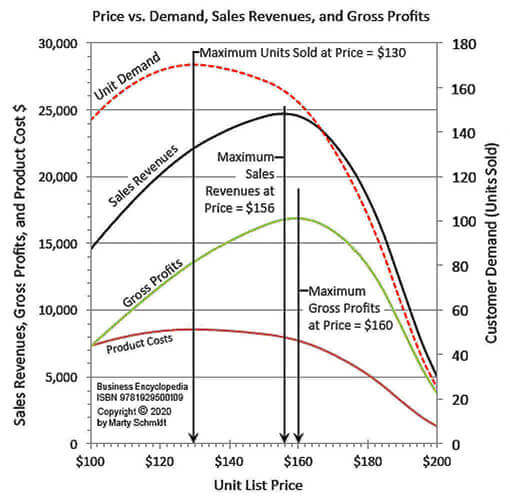

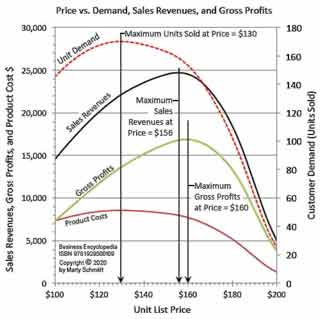

To pursue one or more of these objectives through pricing, sellers first try to understand the relationships between price, on the one hand, versus other factors such as customer demand, sales revenues, product costs, gross profits, and product positioning. Exhibit 1 below shows how some of these relationships might appear for one product.

The analysis begins when the seller estimates unit demand as a function of price, to create a price-demand curve like Exhibit 1. Then, for each price point,

Sales revenues = Unit demand * Unit list price

Product costs (cost of goods sold, or cost of services)

= Fixed costs + (Unit demand * Variable cost Increment per unit)

Gross profits = Sales revenues – Product costs

Pricing analyses like this often find that maximum units sold, maximum sales revenues, and maximum gross profits all result at different price points. Actual pricing then depends on the seller's pricing objectives.

The Price-Demand Curve for Marketing Purposes

Exhibit 1 shows how the seller estimates the demand for one product, as a function of price per unit. The price-demand curve (red dashed line) is crucial and central in price analysis and price decisions.

- Customer demand (as a function of price) is necessary for estimating other factors. Revenues, product costs, and gross profits are functions of both price and market demand. For pricing analysis, in other words, the price-demand curve comes first.

- Of all factors appearing in Exhibit 1, customer demand can be the most difficult to estimate and the most uncertain. Almost all of the uncertainty in forecast revenues, costs, and gross profits comes from changeability in the price-demand curve estimates.

- When sales and profit forecasts for pricing decisions turn out to be entirely wrong, the problem is usually due to an inappropriate demand curve.

In brief, the price-setting marketer or analyst should heed this statement: "Get the demand curve right, and you won't go wrong with your sales and profit forecasts."

Using Price Elasticity of Demand (PEoD, PED, or Ed)

The relationship between demand and price is known formally in economics as price elasticity of demand (abbreviated PED, PEoD, or Ed). PEoD indicates how demand and prices change together. And, economic theory provides a mathematical basis for measuring and modeling PEoD.

For real-world pricing decisions, sellers may look to economic theory to suggest the general shape of the demand curve for a given product class. Note that the red dash line in Exhibit 1 is an example. However, analysts know that demand also responds to a wide range of other factors in the market, economy, and environment. Such factors are not "easy" to build into the economist's model. And, they complicate the PEoD estimating task for marketers.

For more on the factors that play a role in marketing price-demand analysis, see the section below, Real-world Price-Demand analysis.

To Marketers, Demand Results from Price.

Economists See Price as the Result of Supply and Demand.

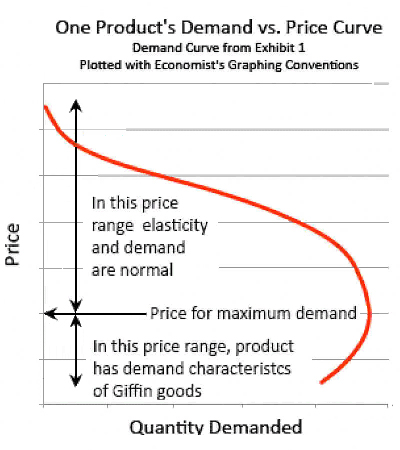

The red dash line in Exhibit 1 is one form of a price-demand curve, as it appears for pricing analysis. The marketer who turns to economic theory to begin a marketing price analysis quickly discovers that economists graph demand curves differently. Economists usually place "Demand" on the horizontal axis and "Price" on the vertical axis. The economists' method is just the reverse of the marketer's approach in Exhibit 1.

It is essential to understand the reason for this difference in conventions:

- Firstly, to the economist studying markets and economies, "price" is a result (or dependent variable). To the economist, "price" is a function of factors such as supply and demand.

- Secondly, to the marketer analyzing price-demand relationships, demand for a product in a specific market will be the result (dependent variable). For the marketer, "demand" is a function of price (the independent variable).

Graphing Conventions in Economics

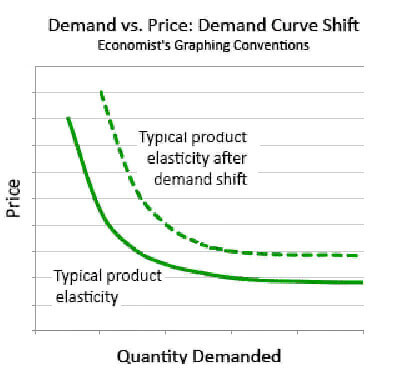

When sellers engage in price setting, they sometimes turn to economic theory and a substantial body of empirical research on price and customer demand as a first step to estimating the correct price-demand curves for their products.

Exhibits 2A, 2B, and 2C show a few primary price-demand curves as economists present them.

Demand Curves for Normal Products and Giffin Products

Exhibit 2A shows that, for "normal" products, demand decreases with increasing price, giving these curves a negative slope. The negative slope explains why these products have a negative PEoD coefficient. The slope shows, in other words, that demand decreases as price increases. The higher the demand curve slope, the more that demand changes with a given price change.

Exhibit 2A also shows a price-demand curve for so-called Giffin products (dash line). For Giffin products, demand increases as price increases. Products that genuinely have Giffen demand curves throughout the full possible price range are rare. However, many essentially "normal" products do show Giffin-like demand characteristics for short segments of their possible price range (See Exhibit 2C below).

Demand Shift for a Typical Product

Exhibit 2B also shows how the demand curve can shift when market demand changes. The green dash line shows how the same demand curve after the market events increase demand. Shifts like this can occur when competitors raise prices or leave the market, or when the seller's promotional campaigns succeed. A demand shift back to the original location (solid green line) or elsewhere may occur near the end of product life, or when competitors lower their prices.

Exhibit 2B also shows how the demand curve can shift when market demand changes. The green dash line shows how the same demand curve after the market events increase demand. Shifts like this can occur when competitors raise prices or leave the market, or when the seller's promotional campaigns succeed. A demand shift back to the original location (solid green line) or elsewhere may occur near the end of product life, or when competitors lower their prices.

Revealing Giffen-like Price-Demand Behavior

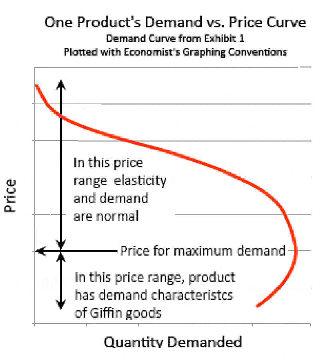

Exhibit 2C below is the same price-demand curve as Exhibit 1 but plotted this time as an economist would chart it. Here, the vertical axis represents price, while the horizontal axis represents demand. For much of this product's possible price range, "demand" changes with "price" in the normal direction: demand increases as price decreases. Some product classes, however, display Giffen-like demand characteristics for short segments of their price-demand curves.

Exhibit 2C. Price-demand characteristics for a typical product that exhibits Giffin-like demand in specific price ranges.

Here, at the lower end of the possible price range, demand increases as price increases. The overall result is a curvilinear price-demand curve, such as Exhibit 2C. Product classes with this kind of demand curve typically include cosmetics and fashion accessories. At meager prices, customers see them as "cheap" or lacking brand appeal. However, as price increases (up to a point), brand image and perceived value also increase, and as a result, demand increases. At very high prices more customers judge the that the price is out of line with value.

Calculating (Measuring) Elasticity of Demand

Sellers can look to economic research data to suggest price elasticity of demand (PEoD) coefficients for product classes. These data also suggest the general price-demand curve shape, or profile, for specific product classes. However, sellers know that demand curves and PEoDs for their products also depend on factors besides price. Demand also reflects the impact of branding, competition, and seasonality, for instance. As a result, sellers try to consider all such factors when creating demand curves and PEoDs for their products.

Knowing the actual PEoD coefficients contributes to accuracy in estimating the complete price-demand curve. And, it also provides sellers with quantitative answers to fundamental pricing questions such as these:

- How will unit sales change if we raise prices 10%?

- How will unit sales change if we put everything on sale at "30% off" list price?

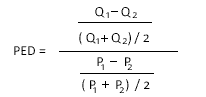

PEoD calculations typically use the following symbols:

Q1 = Unit demand at Price 1 P1 = Price 1 (that is, price before the change)

Q2 = Unit demand at Price 2 P2 = Price 2 (that is, price after the change)

Example: Calculating the Elasticity Coefficient

As an example, consider two price-demand points on the Exhibit 1 price-demand curve.

| Unit Price | $154 | $160 |

|---|---|---|

| Unit Demand | 160 | 153 |

Given a current price of $154, and unit demand for a given time span is 160, what is the PEoD coefficient? Economists have several different approaches for calculating PEoD, but one of the simplest and easiest to apply is this:

PEoD =Proportionate unit demand change / Proportionate unit price change

First PEoD formula

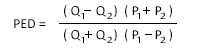

The PED formula above simplifies to the form shown here.

Second PEoD formula

For a price decrease from $160 to $154, we can ask:

What is the effective PEoD coefficient?

That is the same as asking:

How does percent change in price compare the percent change in demand?

The input data for this calculation are these P and Q values:

P1 = $160 P2 = $154 Q1 = 153 units Q2 = 160 units

Using the second PEoD formula, the elasticity coefficient is:

PEoD = (153 - 160) ($160 + $154) / (153 + 160) ($160 - $154)

= ( -7 ) ($314) / (313) ( $6)

= -2,198 / 1,878

= -1.17

Price Elasticity of Demand: Further Meaning and Interpretation.

In this arc on the price-demand curve, changing price by a given percentage should produce a percentage change in unit demand -1.17 times the price change percentage.

- PEoD is negative here, with a negative slope for the price-demand curve arc, in other words, the elasticity of a "normal" product: Demand increases as prices decrease.

- On the other hand, a positive PEoD coefficient would indicate price-demand behavior like that of Giffin goods (demand increases as price increases).

Rules of Thumb for Interpreting Price Elasticity of Demand Coefficients

- PEoD = 0 : A perfectly inelastic product.

Price changes have no impact on demand. - PEoD between -1 and 0: Normal product, but relatively inelastic demand properties.

Demand increases as price decreases, but relatively large price changes bring relatively small demand changes. - PEoD = 1: A "normal" product with unitary elasticity.

A given percentage price change leads to a demand change of about the same percentage. - PEoD between -1 and - infinity: Highly elastic "normal" products.

Relatively large demand changes follow small price changes. - PEoD between 0 and +infinity: A Giffin product.

Price increase leads to demand increases.

PEoD coefficients can be extremely useful for pricing activities in various industries. Airlines, for instance, set prices knowing that first class tickets have a low PEoD coefficient (perhaps around -0.3), while economy class tickets have a much higher PEoD (probably -1.6 to -2.0). Accordingly, airlines apply dynamic pricing strategies more aggressively for economy class tickets (see Dynamic pricing, below).

PEoD Arc Elasticity vs. Point Elasticity

What Are the Differences?

Sections above show how economists define the price elasticity of demand coefficient, PEoD, as the slope of the demand curve. The definition works because most people can readily interpret slope as a change rate. At the same time, however, this definition presents analysts with a mathematical challenge.

Upon hearing the PEoD definition, those familiar with calculus will immediately ask: Which does the PEoD slope represent: (1) A segment of the demand curve, or (2) a point on the demand curve? A fast answer to that question has to make two points:

- Firstly, for practical use, PEoD refers to the slope of a demand curve "arc segment." The PEoD then represents arc elasticity.

- Secondly, economists working on theoretical problems sometimes find the slope at a point on the demand curve. The PEoD then represents point elasticity.

The next sections explain why real-world applications must rely on arc elasticity PEoD instead of point elasticity PEoDs.

Defining Arc Elasticity

Price-demand curves (such as the red dash-line in Exhibit 1) typically have different slopes at different points on the curve. The PEoD coefficient applies to only one segment of the curve, namely the arc from point P1Q1 to point P2Q2. That is one reason for the name arc elasticity for this form of PEoD calculation.

The Asymmetry Problem and Midpoint Elasticity

The second reason this is arc elasticity has to do with a problem in defining "percent changes." If "elasticity" is indeed a property of the arc, then it should be the same for a price increase or a price decrease. However, a $6 reduction from $160 to $154 is a 3.75% price change, while an increase from $154 to $160 is a 3.90% price change. The different percentages illustrate an asymmetry problem.

Arc elasticity deals with this problem by using average price and average unit demand for percentage calculations. Averaging is easier to see in the first PEoD equation above, where sums of two price figures and two demand figures are divided by 2. For that reason, arc elasticity is also known as midpoint elasticity.

Point Elasticity Requires Calculus and a Mathematical Function

Those familiar with calculus know that the slope of a "curve" at any point is the first derivative of the function defining the curve. The analyst can calculate a PEoD as point elasticity instead of arc elasticity, only when the price-demand curve represents a known mathematical function. The point elasticity coefficient at a point on the price-demand curve is the ratio of two derivatives multiplied by price and divided by quantity.

PED = (dQ/dP) (P/Q)

The problem in applying point elasticity for actual price setting is that real-world price-demand curves almost never represent known mathematical functions.

Real-world Price and Demand Forecasting

The Complex Forecasting Challenge

To forecast unit sales, product sales, product costs, and gross profits accurately, the analyst must be able to forecast demand as a function of price accurately. The seller's "price," however, is indeed not the only factor influencing customer demand or price elasticity of demand.

Those estimating demand price elasticity also know when they must take into account other factors such as:

- The presence of competitors and their pricing, as well as the prevailing market price.

- Likely responses from competitors, especially price changes or new products.

- The availability of substitute products and their prices.

- Total market size and the seller's accessible market size.

- The product's place in its product lifecycle.

- Expected market growth (positive or negative).

- Temporary or seasonal trends in demand.

- The strength of branding and brand loyalty for the seller and competitors.

- The seller's ability to create or increase demand through promotion.

- Customer propensity to buy in the current economic environment.

Sale and Discount Pricing

Exceptions From List Price

Seller pricing strategies often call for the judicious use of pricing exceptions to list prices, such as discount pricing and sale pricing. Sales and discounts can be legitimate and useful components of a broader pricing strategy. They work best, however, when they are temporary or special-case deviations from the seller's list prices. When customers believe that the majority of sales occur at discount or sale prices, the legitimacy of seller pricing and seller branding suffers.

Discount Pricing

Sellers sometimes offer discount pricing (prices below list price) under certain conditions or to specific customers. Sales at discount prices bring lower margins than list price sales, but they serve other objectives:

- To reward customer loyalty and encourage customer loyalty.

- As an incentive for larger quantity orders (through discounts for quantity orders).

- To maintain sales volume and market share when competitors reduce prices or introduce new products.

- As an incentive for customers to pay with cash, by offering cash discounts.

- To stimulate otherwise sluggish sales.

- To sell of an inventory of products that are not selling well, or products approaching obsolescence or end of product life.

Discount Pricing and Allowances on the Income Statement

Discount pricing and allowances impact two lines at the top of the company's Income statement. Note that allowances are price reductions the seller grants to buyers, to recognize, for instance, the presence of, damaged, spoiled, or missing goods in product shipments.) For some companies, the Income statement begins with line items such as these:

Gross sales (or Gross sales revenues) ..................... $20,681,700

"Less" discounts and allowances .............................$ 2,240,700

Net sales (or Net sales Revenues)..................$18,441,000

In any case, all profit and margin calculations on the Income statement reference net sales, not gross sales.

Sale Pricing

Sellers can also offer sale pricing, another way to price below list price. Sellers provide sale pricing for the same reasons they offer discount pricing. They usually extend sale pricing to potential customers but for short time periods only. For consumer products, especially, sale pricing typically appears during seasons when customers have a higher propensity for buying (e.g., a "Back to school sale," or "Holiday sale"). Sellers also offer sale pricing to clear out of season inventory of products, or other products that are no longer competitive.

Retail vs. Wholesale Pricing

What Are the Differences?

The terms retail price and wholesale price reflect the reality that many goods reach consumers through a supply chain. The manufacturer may produce and sell products to a distributor, and the distributor then sells the same products to a wholesaler. And, the wholesaler sells the same items to retail businesses. Finally, the retailer sells the same goods to end-users or consumers. Each stage of the supply chain:

- Adds consumer value through such activities as transportation, packaging, product assembly, and making products available when and where customers want them.

- Has a different market, namely, the next stage in the chain.

- Charges the next step a higher price than it paid. In other words,

Manufacturer list price < Distributor list price < Wholesaler list price <Retailer list price.

End-users or Consumers sometimes bypass one or more stages in the chain and buy directly from the wholesaler at wholesale prices (or from the manufacturer at so-called factory prices). When customers buy directly from the wholesaler or manufacturer, this is not an instance of discounting or sale pricing. Customers are instead bypassing part of the supply chain.

Seven Popular Pricing Strategies

Sellers usually approach pricing their goods or services with a pricing strategy. The pricing strategy describes how the seller uses pricing to move toward:

- Specific pricing objectives (such as "maximize units sold").

- Other high-level marketing objectives (such as "achieve leading market share").

- Strategic objectives for the organization or company (such as "become recognized as the low-price leader" or "increase brand strength in luxury goods").

Pricing Strategy 1

Cost-Plus Pricing

With cost-plus pricing, the seller sets a price equal to the seller's product costs plus a certain percentage of product costs. Or, cost-plus pricing instead means pricing equal to seller's costs plus a fixed increment.

Time-and-materials pricing is a variety of cost-plus pricing. Here, the selling price is the sum of seller materials costs, seller labor costs, plus a margin for time and materials.

Absorption pricing is another variety of cost-plus pricing, where the seller's tries to recover product costs. For a given unit volume (target), product cost is an incremental cost per unit plus a fraction of total fixed costs. List price is then product cost per unit plus a given percentage of that cost.

Advantages: Cost-Plus Pricing

- Customers readily understand cost-plus pricing as a rational, fair approach to pricing.

- Cost-plus pricing is simple to apply, and simplicity is necessary when businesses sell hundreds or many thousands of different products. This situation is common with food stores, book stores, hardware stores, and automobile parts stores.

- Gross profits and Gross Margin for each sale are known in advance of the transaction.

- The seller never sells at a loss.

Disadvantages: Cost-Plus Pricing

- Cost-plus pricing takes no account of customer demand, prevailing market prices, or competitor's prices. Cost-plus pricing may or may not be competitive in the current market.

- Cost-plus pricing does not adequately communicate or build brand value or product value in customer perceptions.

Typical Examples: Cost-Plus Pricing

- Food stores typically set a specific cost-plus profit margin to each of their primary product categories. E.g., produce and other perishable foods will have prices that realize one cost-plus margin, while canned goods prices reflect another cost-plus margin.

- Many kinds of contract-labor or services receive prices on a cost-plus (or time and materials) basis.

Pricing Strategy 2

Maximize Unit Sales

Pricing for maximum unit sales (or penetration pricing,or loss-leader pricing) means setting the price point as close as possible to the peak of the demand curve (e.g., a price of $130 in Exhibit 1). For many product demand curves, this means selling at a meager price or even selling at a loss. For some products and services, market-penetrating prices appear only for a short time after product introduction. Penetration to drive competitors out of a market is sometimes called predatory pricing.

The popularization of this pricing strategy as loss-leader pricing may have originated with a salesman named King Gillete. Around 1900, Gillete built a profitable business selling razor blades by giving away the razor handles (which of course required Gillete-Brand blades).

Motives for using penetration pricing may include the following: The seller may try to:

- Take existing market share from competitors, or secure market share before competitors enter the market.

- "Lock-in" customers to a brand, expecting to make real profits later from other products leveraged by the initial sale, such as supplies, upgrades and upsells, support services, advertising sales, repeat business, or renewed subscriptions.

- Achieve strong brand recognition in a short time through high unit sales and a rapidly growing market share.

- Lower seller costs by achieving economies of scale.

Advantages: Penetration Pricing

- Through the price-demand curve, this strategy takes into account the prevailing market prices, competitor's prices, and the presence of substitute products.

- For many kinds of goods and services, penetration pricing offers the fastest possible route to increasing market share and brand recognition.

- Penetration pricing may allow the seller to achieve cost-saving economies of scale quickly, by rapidly ramping up sales volume.

Disadvantages: Penetration pricing

- When penetration pricing means low pricing, it can deliver lower sales revenues and profits than other strategies. If "profits" are too small, and if sales leverage is insufficient, sellers cannot maintain penetration pricing for long periods of time.

- Penetration pricing may build brand recognition, but it cannot enhance a brand image for superior quality. In fact, penetration pricing risks establishing a brand image as "cheap" or "low quality."

Typical Examples: Penetration pricing

- During the first few years of its presence as an internet service provider, America Online (AOL) achieved significant market share by offering free enrollment and free internet software. Other online services continue to follow this lead.

- Manufacturers of office printers typically offer high-quality printers at meager prices, expecting to profit later by selling their brands of printer ink and printer toner.

Pricing Strategy 3

Maximize Revenues or Gross Profits

Pricing for maximum sales revenues or maximum gross profits requires accurate quantitative knowledge of the curves in Exhibit 1: The price-demand curve and the relationships between "price" and "revenue," "product costs," and "gross profits."

Under this strategy, sellers set prices as close as possible to the price point under the peak of the price/revenue" curve or the price/gross profits curve. (In Exhibit 1, these prices are $156 and $160, respectively). When the primary objective is maximizing gross profits, sellers sometimes call the same strategy contribution margin-base pricing.

This strategy is most effective with established companies selling established products in stable markets. For new companies or new products, however, seller's usually choose pricing strategies that aim instead to increase market share, improve branding, or communicate product quality.

Advantages to Pricing for Maximum Revenues Or Gross Profits:

- This pricing strategy provides robust direct support for the highest level financial objectives in private industry:

- Increasing revenues allows companies to survive and grow.

- Increasing profits increases owner value (shareholder value).

- When sellers know the customer price-demand curve accurately, they can set prices competitively because the price-demand curve recognizes:

- The influence of competitor's prices.

- Customer propensity to buy.

- Seasonal or temporary changes in demand.

Disadvantages to Pricing for Maximum Revenues or Gross Profits

- This strategy depends on other marketing actions (besides pricing) to do the following: enhance brand value, communicate product value, and differentiate the product relative to competitive offerings in the same market.

Typical Examples: Pricing for Maximum Revenues Or Gross Profits

- Wholesalers sell consumer products to businesses under these conditions:

- Products are neither at the beginning nor the end of the product lifecycle

- Products are not having frequent design changes or model changes

- The competitive situation is stable and not especially threatening

In such cases, sellers want to realize maximum returns on their product investments.

Pricing Strategy 5

Value-Based Pricing

Under value-based pricing, product price reflects the customer's perception of product value. The seller's production costs or service delivery costs play either a minor role or no role at all in setting the price. Competitor's prices play a role on insofar as they impact the customer's value perceptions in the seller or competitor products. When the "product" is something like an extensive, complex, custom software system, or an extended, complicated customer service contract, the seller may dedicate focused sales and marketing efforts towards the specific customer, to communicate. Salespeople refer to such efforts as value-based selling.

When sellers propose a value-based price to customers, they typically set the first offer high enough to allow the seller to make price concessions during negotiations later.

Advantages: Value-Based Pricing

- With value-based pricing, sellers usually realize substantial margins and profits (relative to other pricing approaches) when they communicate customer value successfully. .

- Customer satisfaction can also be high when the seller measures and documents customer value.

Disadvantages: Value-Based Pricing

- Communicating customer value can be difficult for some products. Getting customers to recognize and acknowledge value they receive is also difficult in some settings. Sellers practicing value-based pricing may have to produce a customer-centered business case analysis to support value claims.

- Once they agree and contract the (value-based) selling price, the seller must deliver at that price. Sellers who underestimate actual delivery costs face thin margins or even losses.

Typical Examples: Value-Based Pricing

- With large and complex contracts for outsourcing IT services, sellers negotiate prices with customers. As a result, the seller and customer must agree on the solution's value to the customer.

- Sellers of custom software applications sometimes price according to the seller's judgment on how customers perceive value. In such cases, prices bear little or no relation to the seller's actual development, production, or delivery costs.

Pricing Strategy 6

Dynamic Pricing / Time-Based Pricing

In some situations, customer demand and willingness to spend vary significantly from time to time, even changing daily. In such cases, sellers change prices often, trying to find the highest possible prices that will still attract customers each day. Travelers know, for instance, that hotel room rates can vary greatly, daily, depending on the number of unsold rooms and demand for each day. When a hotel is "in demand" and nearly booked to capacity (as when there is a significant event in town), room rates are high. For other nights, when demand is low, charges for the same rooms at the same hotel are set much lower.

Advantages to Dynamic Pricing

- In environments where demand and willingness to pay change daily, dynamic pricing brings greater revenues and gross profits than fixing prices at one level. Hotel rooms and airline seats are more likely to at capacity levels under dynamic pricing.

- Dynamic pricing allows price-conscious customers the opportunity to shop for bargain prices.

Disadvantages to Dynamic Pricing

- Customer satisfaction suffers when customers discover they have paid considerably more than other customers for the same product.

- To implement dynamic pricing effectively, the seller must continually access and process large amounts of market and buying behavior data and then forecast demand accurately.

Typical Examples: Dynamic pricing

- Airline tickets often receive dynamic pricing. This pricing approach serves the carrier's goal of filling as many seats as possible at the maximum attainable price.

- Hotel rooms often receive dynamic pricing. Hotel owners do this because it fills as many rooms as possible at the maximum price.

Pricing Strategy 7

Market-Based Pricing

In market-based pricing, the market sets the price, not the seller. Instead, the price is what customers are willing to pay. Market pricing prevails when buyers can get virtually the same product from any of several sellers, and where the seller's participation adds little in perceived value to the product. For sellers to outsell their competitors, or to price successfully above the prevailing market price, they must demonstrate value-add. They must show, in other words, superior customer service, delivery, or ease of ordering, for instance, or product quality in their offerings.

Typical examples: Market-based pricing.

- Shares of common stock bought in the secondary market through stockbrokers

- Commodities such as crude oil or unprocessed foods

Other Pricing Strategies and Methods

Sellers often modify or combine the seven pricing strategies above. As a result, they create different approaches, such as the following:

Price Skimming

Sellers sometimes try Price skimming (or Price creaming) when introducing new products. The term refers to a very high initial price. Here, the seller hopes to maximize profits from early adopters and other buyers who are relatively price-insensitive. Sellers do this, sometimes, in to recover product development costs quickly. Sellers then lower prices to attract more price-sensitive buyers.

Target Pricing

In target pricing, sellers choose a selling price that will deliver a target rate of return or return on investment for the seller, for a given business volume.

Firms sometimes use this approach in capital-intensive industries such as automobile or aircraft manufacturing. Here, producing products requires substantial capital investments, and they need assurance that these investments will bring adequate returns.

Governments also use target pricing to price services from capital-intensive operations. As a result, target pricing applies for public utilities and access to expensive public works, such as toll roads or toll bridge.

Psychological Pricing

Psychological pricing occurs when sellers price products just under a round number. A product priced at $9.99, for instance, may seem lower or in a different price bracket than the same product selling at $10.00. Many restaurant menus use another tactic, listing the price of dinner as, say, 35 instead of $35.00. They do this, hoping that 35 is psychologically easier to "digest" and "lighter" than "$35.00."

Price-Point Pricing

Price-point pricing is one variety of psychological pricing. This approach is the practice of setting prices just under price-point thresholds, such as $20. In the United States, Canada, and Australia, for instance, people commonly carry the $20 bill (banknote). An item that sells for, say, $19.75, seems "easier" to buy than one selling for $20.25. A single $20 bill buys the first item, but not the second.

What is a Pricing Model?

How Are Pricing Models Used?

In the minds of many businesspeople, the terms pricing strategy and pricing model mean virtually the same thing. When setting prices, however, it is helpful to distinguish carefully between the two terms.

- Firstly, pricing strategy describes in general terms how the seller will use pricing to pursue specific business objectives.

- Secondly, the pricing model provides specific rules or instructions for implementing the pricing strategy.

For a seller using a cost-plus pricing strategy, for instance, the pricing model describes in quantitative terms:

- How to calculate "cost."

- How to calculate the "plus" markup.

The cost-plus model may also have to specify precisely how to calculate cost and markup in a variety of different situations. "Markup," especially, may need to be different for different product classes, different markets, or different market segments.

In brief, the cost model describes how to calculate the data for plotting three of "curves" in Exhibit 1, above, namely the curves for revenues, product costs, and gross profits.

What Are Common Pricing Mistakes?

Sellers who choose a pricing strategy do not always achieve their pricing objectives. This kind of failure has many possible causes, but some of the more obvious reasons are the following:

Inappropriate Pricing Strategy.

Many firms Choose an inappropriate pricing strategy for their products and market. For example,

- In markets where customers are very price-sensitive, a seller who insists on sticking to a cost-plus pricing strategy may become a victim of underselling by competitors. As a result, the seller loses market share to other sellers:

- With a better understanding of the real price-demand curve.

- Willing to accept lower margins.

- Premium pricing may deliver disappointing sales results when branding fails. Premium pricing succeeds only where products that are readily branded, or otherwise distinguished from similar products from other sellers.

- Value-based pricing may fail to deliver sales results whenever establishing and communicating high customer value is challenging.

Failing to Anticipate Changes in the Price-Demand Curve.

Many firms do not anticipate and adjust to a changing price-demand curve. Failure to adapt to changing price-demand curves is a frequently-given explanation for business failures in many industries, including real estate, consumer products, and technology, for instance. Other companies survive and grow in these industries precisely because they understand that customer price-demand curves rarely constant for an entire product life.

Quite a few different factors can change the price-demand curve drastically. The curve may change, for instance, when:

- New competitors enter the market.

- New competing products arrive in the market.

- Competitor prices vary.

- Market size changes.

- Products become obsolete.

- Products approach end of life.

- Brand strength erodes.

- Customers can shop elsewhere for better prices.

- Seasonal factors.

Sellers who price according to an out-of-date price-demand curve risk being "blindsided" by competitors. Businesses that excel at dynamic pricing rely on their ability to anticipate and exploit nearly continuous changes in the price-demand curve.

Discounting and Sale Pricing Mistakes.

Firms often fail to manage and control discounting and sale pricing adequately. Sales at discount prices or sale prices should appear as relatively rare exceptions to standard list pricing. When most customers find ways to buy at sale or discount prices, list prices become meaningless. As a result, prices no longer communicate value and contribute little to branding.

The internet now has a thriving traffic in so-called coupon codes or discount codes. Customers search out these codes and try to obtain the price discounts that sellers offer to some customers but not all. As a result, the challenge for sellers is to ensure that discounts are available only for the intended users.