What is Financial Justification?

Decision makers always ask whether or not a proposed action is justified in financial terms.

In business, the term financial justification enters the discussion when decision-makers deal with proposals. They often require financial justification before authorizing spending for actions, acquisitions, projects, or investments. The justification concept is also center stage during the budgetary planning cycle, when budgetary funding requests are under review.

"Justified in financial terms" essentially means that decision-makers expect the proposal spending to bring financial gain. Or, it sometimes means simply that the action in view will cover its own costs. However, financial officers and other decision-makers often define justification in more detail, with criteria they believe are appropriate for their own organizations. In most cases, the local version of "Justification" will refer to criteria such as the following:

Define Financial Justification

Financial officers and other decision-makers declare a proposal financially justified if it meets one or more justification criteria. For this, they usually have in mind one or more of these 3 criteria: The proposal…

- Produces returns that exceed investment costs.

- Has the highest profitability (ROI) of available options.

- Delivers gains at an acceptable rate of return (e.g., IRR).

They sometimes add other justification criteria, as well. For justification, they may require that the spending in view …

- Prevents other substantial costs.

- Is the least costly solution available.

- Has an acceptably short payback period.

- Has the greatest net cash flow or NPV of available options.

- Brings break-even business volume faster than other options.

- Lowers financial risk to an acceptable level at acceptable cost.

Depending on their objectives for investment, decision-makers choose one or more of these criteria as the current meaning of financial justification.

Financial Justification vs. Cost Justification

Some organizations use the term cost justification instead of financial justification. These terms in fact have essentially the same meaning, but choosing one or the other reveals something about the organization's view of the proposed action.

- Financial justification suggests an investment viewpoint, meaning the action will bring returns to compare against investment costs.

- Cost justification emphasizes costs rather than returns. The term can mean simply that the proposed action is the most cost-effective solution to a problem or need that absolutely must be addressed.

Explaining Financial Justification in Context

Sections below show how some organizations define a hurdle rate for this purpose, or otherwise use business case analysis and metrics such as net present value NPV, internal rate of return IRR, payback period, break-even point, and return on investment ROI to decide whether or not proposals achieve financial justification.

The following sections further explain and illustrate financial justification in context with related business concepts, emphasizing four themes.

- The financial justification concept in to support for funding decisions, alongside other objectives.

- Financial metrics that often serve as financial justification criteria.

- The Hurdle Rate Test as a financial justification screening criterion.

Contents

The Purpose of Financial Justification

Decisions to approve or deny funding to proposal authors sometimes turn on the answers to just a few kinds of questions. These questions are normally center stage in formal reviews of project proposals, organizational budget requests, capital spending plans, and investment proposals.

Financial Justification Among Equally Important Issues

The financial justification question is important—sometimes crucially important—but proposal reviews normally focus on several other kinds of questions as well. Very briefly, those who review proposals of all kinds usually seek answers to questions such as these:

- Does the proposal align with high-level strategy? Will action or investment outcomes contribute to meeting the organizations' high-level strategic objectives?

- Does the proposal address individual stakeholder needs? Does the proposal address the specific needs of the managers and organizational units that have a "stake" in the action (will see an impact from the action)?

- Is the proposal action justifiable in financial terms?

- Does the proposal action bring unacceptable risks? Does the proposal anticipate likely risks and provide a plan for managing them?

Reviewers and decision-makers normally view proposals that fail on any of these four points as "nonstarters." In many cases, they see financial justification as easiest of these questions to test. For that reason, review processes often approach the financial question with an initial screen tool, the hurdle rate test (see the following section).

Financial Justification: One Criterion or Several?

Reviewers and decision-makers who ask proposal authors to prove financial justification are themselves responsible for specifying in clear operational terms the specific criteria they will use for judging financial justification.

The same reviewers and decision-makers are also responsible for informing proposal authors how best to provide compelling proof that proposals meet or exceed stated financial justification criteria. Different reviewers can recommend different, "proof" methods, ranging from a simple "back of the envelope" ROI calculation, to a rigorous multi-scenario business case analysis.

In any case, proposal authors serve their own interests by finding out—insofar as possible—the specific financial questions that most concern the individuals evaluating their proposals. Such questions may have to relatively less to do with showing a "net gain" from the action and relatively more to do with addressing concerns about the specific action such as these:

- Does the software system we propose represent the best use of funds?

- Can the new building we propose improve our financial position?

- Will the proposed security service "pay for itself" by reducing pilferage?

- What can the project we propose contribute to financial performance of the overall project portfolio?

Armed with a knowledge of individual reviewer interests, the author can then ensure that the proposal provides evidence, financial metrics, and the rationale, that address such questions directly.

Financial Justification as Investment Analysis

Businesspeople sometimes say that an instance of business spending is a business investment. That view is certainly center stage when the funding request faces questions like these:

- Can we justify the spending decision in financial terms?

- Is the action or investment profitable?

- When will the acquisition pay for itself?

Several forms of Investment analysis address these questions. Many apply these methods to traditional investments such as stock shares or bond holdings. However, they also use the same investment metrics to evaluate spending for strategic planning decisions, capital acquisitions, project approvals, business alliances, product launches, infrastructure upgrades, maintenance services, hiring, and more, all of which are, arguably, business investments.

In other words, people in business use a variety of investment metrics to determine whether or not spending is likely to produce returns that justify the cost.

Financial Officers Set the Rules

Financial officers and other decision-makers declare a proposal financially justified if it meets certain financial criteria. Usually, they mean that the proposal meets one or more of these 3 criteria., The proposal…

- Produces returns that exceed investment costs.

- Has the highest profitability (ROI) of available investment options.

- Delivers gains at an acceptable rate of return (e.g., IRR).

Individual CFOs,, Budget Directors, PMO officers, or Capital Review Committees sometimes add other justification criteria, as well, drawing on their own experience in the industry, or on special circumstances. Besides the 3 criteria above, they may declare justification only if a proposal …

- Prevents other substantial costs.

- Is the least costly solution available.

- Has an acceptably short payback period.

- Has the greatest net cash flow or NPV of available options.

- Brings break-even business volume faster than other options.

- Lowers financial risk to an acceptable level at acceptable cost.

Depending on their objectives for investment, decision-makers choose one or more of these nine criteria as the current meaning of financial justification.

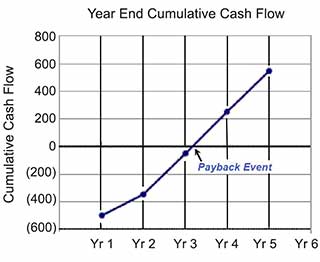

Exhibit 1 shows illustrates the Payback Period Concept. Financial officers may declare that an investment has financial justification if it promises payback in less than a designated time.

Where to Go from Here for Justification Help

Follow these links for explanations, calculations and examples of investment analysis methods in Financial Justification.