What is a Cost Object?

Cost Object is a broad term that can include activities, projects, organizations, intangible assets, and a wide range of other resources.

Cost questions needing answers turn up in abundance when a business engages in budgeting and planning. Accurate budgets and feasible plans are next to impossible without plausible cost figures for the firm's cost objects.

Define Cost Object and Costing

Cost object is an accounting term for any item that impacts item can have a cost figure of its own.

Costing is the process of finding and assigning financial value to cost objects.

Trustworthy costing is no less essential for other mainstream activities—setting prices, acquiring assets, hiring employees, reporting business performance, analyzing operations, and optimizing inventory flow—to name a few. It is no exaggeration to state that accurate and comprehensive figures for the organization's cost objects are essential for running a successful business.

Example Cost Object

The term cost object applies to a very wide range of items and activities. Cost object items may include, for instance:

- Services (such as consulting services with a specified cost).

- Goods (such as raw materials for producing products).

- Departments, which themselves contain cost objects such as employees, office furniture, computers, and a monthly electricity bill.

- Products (with product cost including cost objects such as the design process, development costs, production costs, and inventory management costs).

- Projects (for example, a product design project).

- Customers (customers when the cost of selling or service delivery is known).

- Contracts (such as, a product warranty support contract, when the costs of contract creation and service delivery are known).

- Resources (for example, fuel for operating vehicles).

- Activities (such as use of a vehicle to deliver goods).

Financial transactions involving any of these items can result in debit or credit impacts to the organization's accounting system accounts. In such cases, the system treats them as cost objects. Any of these items, moreover, can turn up as a cost object with a known value that impacts budgets, invoices, inventory accounting, purchase orders, project plans, business plans, production plans, and elsewhere.

Contents

- What is a cost object?

- What is the meaning of cost, expenditure, and expense?

- Finding Cost Values.

- Account vs. Cost Object: What's the Difference?

Resources

Visit the Master Analyst Shop and download premier business analysis ebooks, templates, and apps.

What is Meaning of Cost, Expenditure, and Expense?

Many people confuse cost-related terms or use them imprecisely. Many, for instance, see the terms costly and expensive as synonyms. And, some people in business make no distinction between the terms expense, expenditure, and cost.

These terms all have different meanings, however. Those engaged in budgeting or financial accounting need to understand precisely the meaning of each.

What is a Cost?

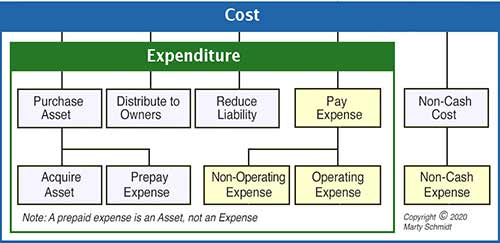

Costs in business also carry many different names and appear under many different terms. The image below shows that cost is the most inclusive of these terms. All of the items in light blue and yellow cells are, arguably, costs.

- In accounting, the term cost primarily means an amount of money given up to acquire something. The name of an activity, "cost accounting," is an example of this usage.

- However, businesspeople also use the term cost widely—and appropriately—when referring to other kinds of losses or negative impacts. Management may say, for example, that a recently-declared pay freeze has "cost the company dearly in lower employee morale." Or, marketers may say that the company is paying a substantial cost, or heavy price, in a damaged brand image due to poor product quality.

Finding Cost Values

There is no one-size-fits-all methodology for finding the cost values for cost objects in business. Cost accountants and analysts may have to resort to several or all of the following for this purpose:

- Historical purchase cost or current market price.

- Estimation, from known costs for similar items, pricing trends, and market forecasts.

- Total cost of ownership TCO analysis (e.g., for complex machinery, vehicles, aircraft, computing systems).

- Hiring costs, known wage and salary costs, known overhead rates, for employees.

- Direct measurement of resource usage by the cost object.

- Cost allocation or apportionment, for cost objects that incur "indirect" costs.

- Professional appraisal for assets such as real estate, artworks, antiques, jewelry.

- Activity-based costing methods based on resource usage by the cost object.

- Historical budget analysis (for organizations or operating units).

Account vs. Cost Object: What's the Difference?

The list of kinds of cost object items could extend indefinitely. A cost object is not the same thing as an account from the organization's chart of accounts.

- An account is a place holder for a category of financial transactions. A chart of accounts might contain, for instance, an expense category account for office supplies. Transactions enter these and other kinds of accounts as debits or credits. At the end of the accounting period, the firm reports a total for each transaction category (for each account).

- A cost object is a specific instance of an item, that can be assigned a cost figure, whose cost can be given, either by estimation, cost allocation, or direct measurement. Office supplies for a specific division, for a specific period of time, are a cost object if the firm can assign a credible cost figure for these items.

Cost Objects in Budgeting

The identification and costing of cost objects is central to budgetary planning, where planners will consider both actual historical costs for sets of cost objects (e.g., office supplies or employee salaries), and likely future cost needs for the same cost objects.

Cost Objects in Financial Reporting

The identification and costing of cost objects supports the preparation of financial accounting reports. The identity of cost objects (e.g., factory labor) and the way they are used (e.g., either in direct product production or as indirect manufacturing support) determine which accounts are impacted and the figures reported.