What is the Meaning of Expense?

Decision-makers turn to business case analysis for objectivity, transparency, and the confidence they need to choose the best business decision.

In everyday speech, the term expense can refer to almost anything that causes spending. Outside of business, people use the term more or less interchangeably with other terms, such as cost or expenditure. In everyday speech, this usage is familiar and correct.

To accountants, however, expense, expenditure, and cost have different meanings. Expense, for instance, refers to a particular kind of accounting transaction. Most people in business settings know what accountants mean by "expense" and use the term in that sense—especially when the organization engages in budgeting, planning, and financial reporting.

Define Expense

In accounting, an expense is a decrease in owner equity that results when the firm uses up assets in producing revenue or supporting other activities in normal operations.

Spending on employee wages, for instance, is an expense because it uses up cash assets. However, the definition above also covers noncash expenses, such as depreciation or bad debt expenses. Every expense—cash or noncash—calls for an impact on an Expense-category account in the accounting system. Every expense of either kind lowers the income statement "bottom-line" in the same way

Explaining Expense in Context

This article further defines and explains expense in context with terms such as expenditure and cost. Note that "expense" appears in two contexts:

- First, the term refers to a concept in financial accounting. In this context, expenses are especially prominent on the Income statement.

- Secondly, the term refers to a concept in budgeting. Budgets exist primarily to plan, track, and control expense spending.

Sections below emphasize these themes:

- The precise meaning of "Expense" in accounting.

- Contrasting the accountant's version of Expense with the term's broader use in business, alongside terms such as Cost and Expenditure.

- Examples showing the role of Expenses in financial reporting, most notably on the Income Statement.

Contents

Define Your Terms!

Exactly What Do Expenditure, Expense, and Cost Mean?

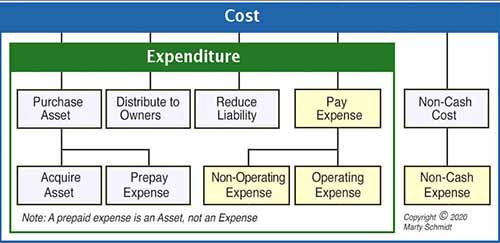

Many people confuse expense-related terms or use them imprecisely. Many, for instance, see the terms costly and expensive as synonyms and some people in business make no distinction between the terms expense, expenditure, cost is the most inclusive of these terms. All items in light blue and yellow cells are, arguably, costs.

- In accounting, the term cost primarily means an amount of money given up acquiring something. The name of an activity, "cost accounting," is an example.

These terms all have different meanings, however. Those engaged in budgeting or financial accounting need to understand precisely the meaning of each.

Defining Cost

Exhibit 1 below shows that le of this usage.

- However, businesspeople also use the term cost widely—and appropriately—when referring to other kinds of losses or negative impacts. Management may say, for example, that a recently declared pay freeze has "cost the company dearly in lower employee morale." Or, marketers may say that the company is paying a substantial cost, or heavy price, for a damaged brand image due to poor product quality.

Exhibit 1 below recognizes both the broader meaning of cost and the accountant's narrower definition.

Defining Expenditure

An "Expenditure" is a spending activity the firm pays, serving at least four different purposes:

- Firstly, to acquire an asset, either by purchasing a capital asset or by acquiring a deferred expense.

- Secondly, to distribute funds to owners (e.g., as shareholder dividends or direct distribution through drawing accounts.).

- Thirdly, to reduce or pay off a liability (debt). Examples include paying off a bank loan or retiring a bond issue.

- Fourthly, spending for an expense. An expense is a reduction in owner's equity due to using up assets.

Defining Expense

Note especially that the definition of "expense" refers to assets.

Expense: A decrease in owner’s equity due to using up assets.

- An expense for office supplies, for instance, uses up cash assets.

- A purchased capital asset (such as a factory machine) decreases book value over time through depreciation expense.

- A prepaid expense, such as prepaid floor space rent, is an asset that turns into an ordinary cash expense as the occupancy period passes.

Kinds of Expenses

Firstly, "expenses" are either operating expenses OPEX or non-operating expenses. Secondly, "expenses" are either cash expenses or noncash expenses. Sections below further explain the role of these distinctions in budgeting and financial reporting.

Where Are Expenses on the Income Statement?

Expenses Appear In Major Income Statement Categories

Expenses impact all of the central financial accounting statements, but especially the Income statement (or Profit and Loss statement, P&L, or Statement of Operations. The Income statement reports financial performance for a specific accounting period. For profit-making companies, of course, the highest-level performance measure is profit.

The Income statement equation shows how profits result from the period's incoming and outgoing funds:

Profit = Revenues – Expenses

Income statements typically include just one or a very few revenue lines, but many expense lines. Note especially that each expense line represents an expense category account (or group of accounts) from the accounting system's Chart of accounts.

What Are the Important Income Statement Expense Headings?

Expense items can appear under any of the five major Income statement headings.

1. Expenses for Cost of goods sold (COGS)

Cost of Goods Sold (COGS or CGS) is the total cost of acquiring raw materials and turning them into finished products. COGS usually does not include expenses that apply to the whole enterprise, or to selling and administrative costs. For firms outside the financial industries, COGS also excludes interest expenses and losses due to extraordinary items.

- COGS for manufacturing firms usually has three parts: direct labor, direct materials, and manufacturing overhead.

- Firms that sell services report the costs of service delivery as Cost of Services instead of COGS.

- Firms selling both services and goods may instead report their direct costs for services and products as Cost of Sales.

Example COGS expenses include the following:

- Direct materials for manufactured goods

- Direct costs of service delivery (for example, direct labor)

- Indirect costs of service delivery

- Purchase merchandise inventory for sale

- "Direct labor" for manufacturing

- Manufacturing overhead expense

- "Indirect labor."

- Production equipment depreciation expense

- Other production or delivery overhead

2. Operating Expenses - Selling

These are expenses for selling. Selling expenses may, therefore, include such things as:

- Store/shop rental, maintenance.

- Sales salaries, commissions.

- Advertising.

- Depreciation for assets used in sales (for example, store furniture).

3. Operating Expenses - General & Administrative (G&A)

These are essential expenses for running the firm's core line of business. G&A expenses may, therefore, include such things as:

- Executive salaries.

- Wages and salaries for employees who are not working in manufacturing or selling.

- Research and development.

- Travel and training expenses

- IT support (when IT supports the entire organization).

- Depreciation for Property, Plant & Equipment assets, and other assets not solely dedicated to manufacturing or sales.

Categories "2" and "3" above sometimes appear as a single heading Selling, General and administrative expenses (SG&A). These expenses appear on some Income statements all under a single heading "Operating expenses."

4. Financial Expenses

These are costs associated with borrowing or earning income from financial investments. Note that this category exists only for firms that are not in financial services. For these firms, therefore, financial expenses are incurred outside the firm's usual line of business.

For firms not in financial industries, these expenses may include the following:

- Loan origination fees.

- Interest on borrowed funds.

5. Extraordinary Expenses

These are the costs for large one-time events or transactions, outside the firm's core line of business. These may include the costs of:

- Workforce reduction, laying off employees

- Selling land, buildings, or real estate

- Sale or disposal of other significant assets

- Selling a business

Expenses Impact Income Statement Profits

Impacts on Gross, Operating, & Bottom-Line Net Profits

It is essential to know which Income statement category a given expense item belongs in for at least two reasons:

- Firstly, the class heading determines which budget includes this item.

- Secondly, the category determines whether the expense item impacts Gross profit, Operating Profit, or only Net Profit.

Cost of Goods Sold Impacts Profits

Gross profit is the difference between total COGS and Net sales revenues. Gross profit, of course, is an amount, expressed in currency units. Businesspeople often find it helpful to deal instead with Gross margin, which is Gross profit as a percentage of Net Sales.

The high-level Income statement shows the Gross profit for the entire reporting firm. The firm's leaders, however, have a keen interest in "drilling down" from the high-level figures. They may need especially to uncover actual Gross profits for individual products, services, and product lines. These figures may show, for instance, that some products are very profitable while others are not. This information is crucial for effective product management and product strategy decisions.

To find product "Gross profits," the firm can estimate sales revenues, direct materials costs, and direct labor costs rather easily and rather directly. However, it is not always so easy to estimate "indirect" or "overhead" expenses. These costs are especially difficult to estimate when overhead or indirect activities support multiple products or product lines.

- Actual product overhead expenses can be very uncertain, where firms rely on traditional costing methods. In those cases, reported "overhead" figures often derive from allocation rules that are somewhat arbitrary. These may or may not reflect actual overhead resource usage for different products.

- When firms must know exactly which products are making money and which are not, they may turn instead to Activity Based costing (ABC). ABC calculates the so-called "indirect" and "overhead" expenses from actual resource usage metrics.

Besides impacting Gross profit, COGS also affects Income statement "Profit" results that appear below Gross profit. Consequently, Operating Profit and Net profit reflect the impact of "Cost of goods sold" (or "Cost of Services," or "Cost of Sales").

Operating Expenses Impact Profits

The Income statement category Operating Expenses typically appears with two main sub-categories:

- Firstly, Selling Expenses

- Secondly, General and Administrative Expenses

Note that some statements replace the heading "Operating Expenses" with "Selling, General, and Administrative Expenses" or SG&A.

In all cases, nevertheless, Operating Expenses are subtracted from Gross Profits to produce Operating Profit. Note especially that the term Operating margin refers to Operating Profit as a percentage of Net sales.

These expenses do not impact Income statement Gross profit because they appear below (after) the Gross profit line. For this reason, these expenses are sometimes called "below the line" costs. Operating expenses, however, do impact Operating Profit and bottom-line Net profit.

Financial and Extraordinary Item Expenses Impact Profits

Extraordinary expenses and Financial expenses usually appear below Operating Profit on the Income statement. Only when the firm operates in the financial industry, do financial expenses appear higher on the Income statement. For financial firms, these expenses may rightfully belong under "Cost of Services" or "Operating Expenses. Outside the financial industries, of course, these expenses impact only one profit result, bottom-line Net profit.

What Are Noncash Expenses?

Noncash Expenses are charges against earnings which exist solely to reduce Net profit (thereby lowering taxes). They do not represent actual cash flow. Note that "noncash expenses" are not an Income statement category. They are instead a kind of expense that can appear in any of the major categories above.

Depreciation Expense is probably the best-known noncash item on the Income statement. Others include amortization and writing off of bad debts. Note also that each noncash expense must also conform to the "expense" definition above:

An "expense" is a decrease in owner’s equity caused by using up assets.

Income statement depreciation is therefore rightfully called "expense," even though it does not result in cash flow. Depreciation charges, however, bring several other noncash actions:

- Firstly, a debit to a Depreciation expense account increases that account balance.

- Secondly, a credit to a contra Asset account, Accumulated depreciation, increases that account balance.

- Thirdly, on the Income statement, the book value of the asset base decreases by an amount equal to the Accumulated depreciation balance.

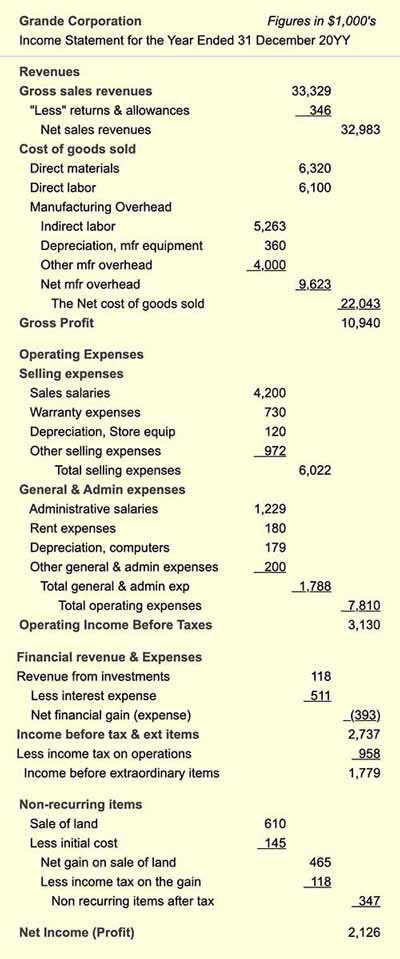

Example Income Statement

Income Profit = Revenues – Expenses

Expenses are center stage in daily operations, budgeting, planning, and preparing the Income statement report. Exhibit 2 is an example Income statement with significant expense categories including (1) Cost of goods sold, (2) Selling expenses, and (3) Administrative (overhead) expense.

What Are Expense Category Accounts?

Other Account Categories in the Chart of Accounts?

Organizations track and report spending by recording transactions in Expense category accounts.

Accounts are the fundamental building blocks of the organization's accounting system, and the complete list of named accounts for the system is the organization's "Chart of accounts." "Chart of accounts." The chart lists account names under five category headings, one of which is "Expense" accounts.

Chart of Accounts: "Balance Sheet" Accounts and "Income Statement" Accounts

The "Chart of accounts" for organizations that use double-entry accounting includes the following five kinds of accounts:

Three Types of Balance Sheet Accounts

- Asset Accounts such as "Cash on Hand," "Accounts Receivable"

- Liability Accounts such as "Accounts Payable," "Salaries Payable"

- Equity Accounts such as "Owner Capital," "Retained Earnings",

Two Types of Income Statement Accounts

- Revenue Accounts such as "Product Sales Revenues," "Service Revenues"

- Expense Accounts such as "Direct Labor Expense," "Advertising Expense"

Expense Account Transactions

When the business pays out funds, the appropriate expense account balance changes. In the language of double-entry bookkeeping, transactions in expense accounts are nearly always debited. And, for these accounts, debits increase the account balance. As the payout increases, the debit balance increases.

Every debit to an expense account occurs along with an equal, offsetting credit transaction in another account. With expense transactions, the offsetting credit usually impacts an account in another category, for example, an asset account, or a liability account.

Consider for instance what happens when a firm buys office supplies (an expense) with cash (an asset):

- For the purchase, the firm records a debit to an expense account (Increasing the expense account's balance).

- At the same time, the firm enters a credit to an asset account, "Cash on hand." The credit transaction decreases the asset account balance.

How Are Expense Items Budgeted?

What Are the Main Budget Categories?

Firms usually plan, authorize, and manage expense spending through budgets. Budgets result from a budget process, which repeats every budget cycle.

- Almost all spending items appear in either an operating budget or a capital budget.

- Some non-budgeted spending may occasionally occur, however. Non-budgeted expenditures are sometimes called "emergency spending." Most firms establish a process and policies specifically for requesting non budgeted funds.

Operating Expenses and Operating Budgets

Operating expenses (OPEX) represent spending for normal business operations. OPEX may include spending for salaries and wages, insurance, floor space rental, electricity, or maintenance contracts, for instance. In brief, almost all routine expenditures a company makes are operating expenses, except for a few non-operating costs (such as costs of financing a loan, or one-time costs for closing a plant), and except for capital expenditures.

The organization's operating budget is the primary tool for planning and managing spending on operating expenses. Operating expenses may be budgeted and accounted for on an annual, quarterly, monthly, weekly or even a daily basis.

Operating expenses bring tax savings in the period they occur. On the income statement, expense spending is subtracted from revenues, thereby lowering income (Net profit). And that results in tax savings.

Tax savings = Expense * Tax rate

Consider, for instance, tax liabilities for a firm that pays tax on operating income and takes in revenues of $1,000.

- If the tax rate is 32%, and if there are no expenses, the tax liability for $1,000 is $320.

- If instead, however, expenses during the same period are $600, the tax liability reduces to $128. That is because the 32% tax applies only to $1,000 less $600, that is, $400, yielding a tax liability of $128.

In conclusion, the firm enjoys tax savings is$192, compared to the same revenues with no expenses:

Tax Savings

= $600 * 32%

= $192

Capital Expenditures and Capital Budgets CAPEX

The term capital expenditure (CAPEX) refers to spending that contributes value to the property and equipment base owned by the business. Capital asset purchases, for instance, are capital expenditures. As a result, these assets become part of the organization's asset base. Consequently, they contribute to asset accounts on the Balance sheet.

Firms usually plan, decide, and manage capital spending with a capital budget. Items in the capital budget do not appear in the operating budget.

CAPEX vs. OPEX Differences

Classifying spending as either CAPEX or OPEX depends on several factors:

- What the firm buys.

- The use of the purchase.

- The country's tax laws.

As a result, tax-paying companies usually define specific criteria, or "rules," that qualify an acquisition as CAPEX. Expenses that do not meet these criteria are, by default, OPEX.

Capitalization Criteria

Capitalization criteria, serve three purposes:

- Firstly, these rules help ensure that the firm complies with local tax laws.

- Secondly, criteria help ensure consistency in the way that acquisitions qualify as CAPEX.

- Thirdly, public criteria assure third-party auditors that the firm's financial statements conform to GAAP.

Typical requirements for capitalization might include, for instance:

- A minimum useful life (for example, one year or more).

- A minimum purchase price (for example, $1,000).

- The acquisition must support the firm's usual line of business.

Capitalization, incidentally, can include more than direct item purchases. Note that projects that build capital assets are called capital projects. Capital projects may incur some expenses that would not otherwise qualify as CAPEX, but which do qualify when they are part of a capital project. As a result, capital projects require CAPEX funding.

IT Systems integration services, for instance, do not by themselves qualify as CAPEX. However, when they are part of a project that results in a capitalized IT system, these service expenses can be CAPEX.

CAPEX vs. OPEX Differences

Note that expenditures for capital assets (CAPEX) contrast with spending that covers operating expenses (OPEX) or investments unrelated to the company's core business.

- Organizations build capital budgets and operating budgets through different processes, often by different managers.

- CAPEX and OPEX budgets use different criteria for prioritizing and deciding spending.

- The period's OPEX appear directly on the Income statement. As a result, profit is what remains after subtracting all expenses from the period's revenues.

- Capital expenditures during the period do not appear directly on the Income statement.

- Instead, CAPEX spending on assets first impacts the Balance sheet. Firms list assets with book values (Balance sheet values). These decrease each year of depreciable life. The annual decrease results from depreciation expense.

- As a result, CAPEX impacts the Income statement, but indirectly. Asset- caused depreciation expenses—like other expenses—reduce profits.