What is a Capital Expenditure?

In large organiztions, capital planning and capital spending are tmanaged by a Capital Review Committee.

A capital expenditure (CAPEX) is an expenditure that contributes value to the property and equipment asset base of a business, in other words, an expenditure to acquire capital assets. CAPEX contrasts with (OPEX), spending that covers operating expenses or purchase of investments outside of the company's primary business.

Most firms plan and control capital spending through a Capital Review Process. This process begins when a Capital Review Committee invites funding requests for capital acquisitions and capital projects from the entire company. The Committee then reviews, evaluates, and prioritizes individual proposals. In this way, the Capital Review Process serves to create the organization's Capital budget, for the next budgeting period, and authorize or deny funding to individual proposals. For manufacturing companies, the largest capital expenditure (CAPEX) items typtically include factory machines and buildings, namely, property, plant, and equipment. Labor costs for those who operate capital items are an operating expense (OPEX). [Photo: Factory winch workers and winch machinery 1920]

The capital budget, moreover, specifies a capital spending ceiling, which typically does not permit funding all funding requests the Committee receives for the period. In such cases, different capital spending proposals must compete with each other for favorable priority ranking by the Review Committee. As a result, lower priority proposals may not receive funding after reaching the CAPEX spending ceiling with higher priority proposals.

Explaining Capital Expenditure in Context

Sections below further define and explain capital spending in context with related terms and concepts, focusing on three themes:

- First, the nature and accounting treatment of Capital spending, as contrasted with expense spending.

- Second, Capital Expenditures in Capital Budgeting, including the conditions that qualify an expenditure as "Capital."

- Third, the treatment of Capital Expenditures in financial reporting.

Contents

- What is a capital expenditure?

- How is capital spending used as a budgeting term?

- What are the differences between capital spending and operating expenses?

- What is the role of capital spending in financial reporting?

- Which kinds of spending qualify as capital spending?

Related Topics

- The article Budget explains the budgeting capital expenditures (CAPEX) in more depth.

- For more on the several meanings of capital in business, finance, and economics, see the article Capital.

- See the article Assets for more on the nature of capital and other assets.

- The article Capital Review Process explains how many firms budget and prioritize capital acquisitions.

How is the Term Capital Spending Used in Budgeting?

Which Criteria Define Asset Service Life?

At the top of the budget hierarchy in most companies and organizations stand two major kinds of budgets, a capital budget and an operating budget. These two kinds of budgets do not overlap: they handle distinctly different spending categories. Capital and operating budgets, moreover, are built through different budgeting processes, by different managers, and they use different criteria for prioritizing and deciding spending.

What are the Differences Between Capital Expenditures (Capital spending) and Operating Expenses?

Whether or not an expenditure qualifies as a capital expenditure CAPEX or as an operating expense OPEX depends on which item the firm buys, what the firm will use it for, and also upon the country's tax laws. Companies and organizations normally designate specific criteria that must be met for an acquisition to qualify as "capital," such as a minimum useful life (e.g., one year or more) and a minimum purchase price (e.g., $1,000).

Definine Your Terms! Expenditure, Expense and Cost.

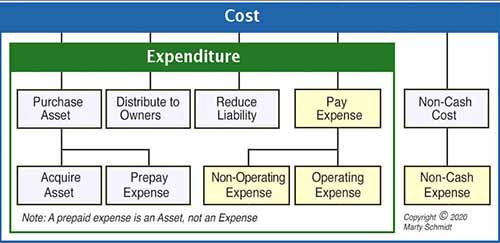

Capital spending is an expenditure, but not an expense. Business people without training in finance or accounting sometimes use the terms expenditure, expense, and cost more or less interchangeably, but these terms have different meanings. When discussing capital spending and budget issues, it is important that everyone involved understands precisely the meaning of each. Exhibit 1 below represents the relationships between these terms.

What is the Role of Capital Spending Financial Reporting?

The tax authorities also have a say in what may be considered a capital expense because capital items go onto the company's Balance sheet as assets, and on the Income statement they create a depreciation expense for each year of the asset's depreciable life. This depreciation expense lowers reported income (profit), thereby creating tax savings for each of these years. Spending on operating expenses, by contrast, impacts profit and tax reports on earnings only in the single reporting period the firm incurs the expense.

Deciding what can and what is and what is not a capital expenditure, therefore, often requires knowledge of local policy and local tax laws. Some expenditures for business start-up costs, for instance, can be capitalized in the United States and some other countries, but not all countries. In some localities, the costs of professional services (such as systems integrations services) can, under some conditions be "bundled" into the full capital costs of acquiring assets (e.g., a large IT system).

What Kinds of Spending Qualify as Capital Spending?

Acquisitions that typically meet company and government criteria as "capital assets" typically include such things as purchased:

- Vehicles

- Factory machinery and production equipment

- Store equipment and furnishings

- Laboratory equipment

- Large IT systems (Hardware and/or Software)

- Buildings

- Office Furniture and Office Equipment.

Operating budgets, by contrast, address spending on predictable, repeatable costs for items or services that they do not register as capital assets and which they do report depreciation expense. That means the company charges the full amount against income during that reporting period and takes all tax consequences for it during that period.