What is Capital?

Capital refers to privately-owned funds or other resources of value, which business owners expect to earn income.

The word Capital has meaning in the field of economics, oof course, but it also has several familiar meanings in business finance, accounting, and budgeting. In business generally, "Capital" turns up in scores of two-word terms such as Capital Expenditure, Capital Structure, and Capital Gains.

Define Capital

The term Capital refers to privately-owned resources for producing goods or services.

Explaining Capital Terms

The familiar meanings of capital derive, no doubt, from the name given in the 18th century to one form of economic system—capitalism. The defining characteristics of a capitalist economy are free market trading and the use of privately owned capital to create business enterprises and earn value for the owners of capital.

Under capitalism, in other words, owners invest their capital resources specifically to build value for themselves. Keeping that statement in mind is key to understanding how "capital" gives meaning to phrases such as the following:

Following sections explain these terms in the context of business finance, accounting, and budgeting.

Contents

Capital in Business

Capitalization and Capital Structure in Finance

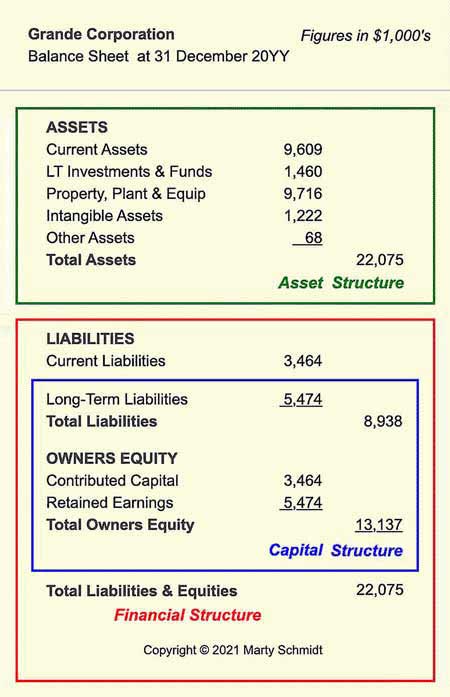

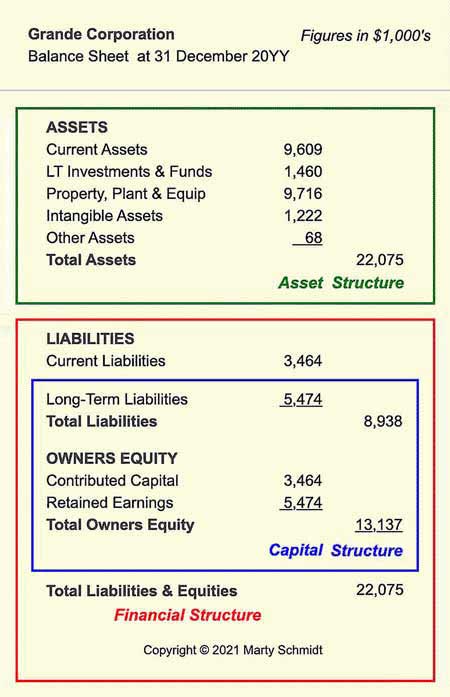

In business, the term capital refers to the investment in a company to conduct business. The firm's capital components appear on the Balance sheet, consisting of long-term debts, preferred and common stock, and retained earnings.

Capitalization refers to the firm's use of owner-supplied capital and lender-supplied capital to acquire income-producing assets. The balance sheet capital structure describes the firms's capitalization in quantitative terms.

In business, the term capital refers to the investment in a company to conduct business. The firm's capital components appear on the Balance sheet, consisting of long-term debts, preferred and common stock, and retained earnings.

Notice that groups of Balance Sheet items define three structures for the firm. The Exhibit 1 Balance Sheet shows the components of the firm's (1) Capital Structure (Capitalization), (2) Financial Structure, and (3) Asset Structure.

Capital Structure refers to the components of the company's total capital, specifically the balance between funding from equities and funding from debt. Analysts assume that firms use funds from both sources to acquire income-producing assets. Owners and creditors share both the risks and the rewards of funding the business in proportion their contribution to the company's underlying value (capital). The terms Capital Structure and Capitalization are interchangeable.

For more on capital structure and the sharing of risks and rewards (leverage), see the article:

What Are Capital Assets? Capital Gains?

The term Capital Asset refers to assets that have these characteristics:

- The firm acquires the asset at a high cost. Companies and organizations sometimes set threshold values for cost, which the purchase must exceed, for the acquisition to qualify as a capital asset.

- The firm intends to keep the asset for the long-term, more than a year at least.

- The asset will not easily turn into cash in the near-term (In other words, it is not a Current Asset).

Assets appearing on the Balance sheet as "Property, Plant, and Equipment," for instance are capital assets. For capital assets in many categories, asset purchase cost converts to expense, over time, through the Depreciation process. Each year of the asset's depreciable life, asset book value decreases as depreciation expense applies.

When a capital asset sells for more than its purchase price, the seller realizes a Capital Gain.

For an introduction to the tax implications considerations that come with Capital Gains, see the article:

What is a Capital Project?

In the expression Capital Project, the term word "Capital" is a stand-in for "large" or "costly." A capital project, in other words, is a project that requires a substantial investment of capital. The capital project purpose may be to create a long-lasting, tangible capital asset, such as a building, a large-scale computing system, or a power transmission line.

A capital project may obtain part or all of its funding from a capital budget. In most cases, firms approve funding from the capital budget through a competitive Capital Review Process (see the section below, "Capital Budgets vs. Operating Budgets"). Note that capital projects may require taking on debt (e.g., through issuing bonds), or they may require new issues of stock, to obtain funding.

What is a Capital Lease?

How Do Capital Leases Differ From Operating Leases?

Leases for using assets generally fall into two categories: Firstly, Capital leases and secondly, Operating leases. The important differences between lease categories have to do with (1) Balance sheet ownership of the asset, and (2) Ownership of the asset when after the life of the lease.

- With an Operating Lease, the original owner (the lessor) retains ownership while the lessee uses the asset. With an operating lease, the user is essentially hiring or renting the asset for a definite period.

- Under a Capital Lease, ownership transfers to the asset user, the lessee. With a capital lease, the lessee is essentially financing purchase of the asset.

For more on the differences between capital and operating leases, see the article:

Capital Budgets vs. Operating Budgets

How Do They Differ?

A Capital Expenditure (CAPEX) is an expenditure that contributes value to the property and equipment asset base of a business, in other words, an expenditure to acquire capital assets.

CAPEX contrasts with (OPEX), spending that covers operating expenses or purchase of investments outside of the company's primary business. Most firms plan and control capital spending through a Capital Review Process. This process begins when a Capital Review Committee invites funding requests for capital acquisitions and capital projects from the entire company. The Committee then reviews, evaluates, and prioritizes individual proposals. In this way, the Capital Review Process serves to create the organization's Capital budget, for the next budgeting period, and authorize or deny funding to individual proposals.

In financial accounting, the designation Capital is used to distinguish Capital Budgeting from the budgeting of Operating Expenses.

- The Capital Budgeting Process results in the firm's plans for capital expenditures (CAPEX) in the next budgetary period.

Most CAPEX spending results in the acquisition of capital assets. Acquisitions that meet the firm's criteria for capital items are almost always long lasting, expensive items, which contribute to the value of Balance sheet assets. - The Operating Budget process results in the plan for spending on operating expenses (OPEX).

Most of the firm's OPEX spending is used for non-capital purchases, such as the purchase of office supplies, paying employee wages, and paying the firm's utility bills.

CAPEX and OPEX do not overlap. The two kinds of budgets handle completely different spending items. Whether an expense item is CAPEX or OPEX depends on the nature of the purchase and how owners use it. Also, the country's tax laws may help determine which items are capital items and which are not capital items.

Organizations create their capital and operating budgets through different processes, involving different managers. Those preparing funding requests should keep in mind these points:

- Firstly, capital and operating budgets usually apply different criteria for prioritizing requests and deciding spending.

- Secondly, many proposals include both CAPEX and OPEX spending. As a result, those asking for funding in such cases must show specifically what they need in CAPEX funds and what they need in OPEX funds.

- Thirdly, as a result, the wise manager, therefore, writes the funding request and its business case with an eye on both sets of decision criteria.

For in-depth coverage of CAPEX and OPEX budgeting, see the article: