What is a Capital Gain?

When assets sell for more than they cost, sellers realize capital gains. Capital gains are a special income class for tax purposes.

Tax authorities in many countries consider gains from selling assets (capital gains) as taxable income.

- Countries that tax capital gains include the United States, United Kingdom, and Canada.

- Other countries, such as Switzerland and Singapore, do not tax most classes of capital gains.

In general, country tax codes for capital gains differ significantly regarding exemptions for capital gains taxes, the impact of asset ownership time on tax liabilities, and other factors.

Define Capital Gain and Capital Loss

A capital gain is a profit from selling an asset for more than the purchase price. Capital gains typically result from the sale of stocks, bonds, real estate, or even intangible assets such as goodwill.

A capital loss is a loss from selling an asset for less than the purchase price.

In cases where capital gains incur tax liabilities, a capital loss can result in tax savings by offsetting other positive income or capital gains.

Explaining Capital Gains in Context

Sections below further illustrate reporting conventions for capital gains, along with brief summaries of capital gains tax treatments in twenty countries.

Contents

- What is a "Capital Gain?"

- How do companies claim capital gains on the income statement? Where do they report capital gains taxes?

- Which Countries Tax Capital Gains? Tax Code Sources for Twenty Countries.

Related Topics

For an explanation of the favorite "return on investment" metric in real estate investing, see the article "Cash On Cash."

The article "Return on Investment" explains and illustrates ROI and other "Investment View" financial metrics.

For more on different meanings of "Capital" in business, see the article "The Meaning of Capital."

Capital Gains on the Income Statement

Where Do Companies Report Capital Gains Taxes?

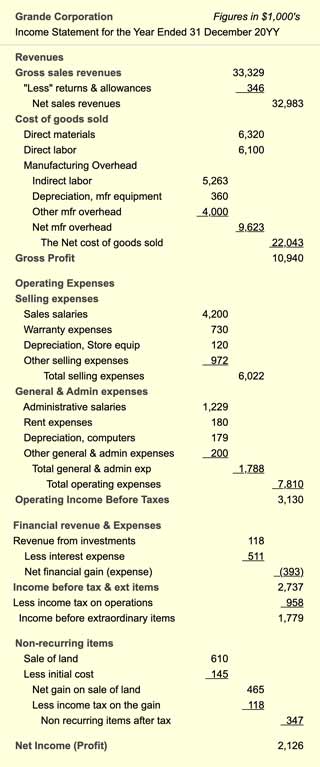

Companies report capital gains and their taxes at the end of every period on the Income statement. To conform with the "matching principle" in accounting, each period's "Income statement" pairs capital gains taxes along with the capital gains or losses that brought them.

In the income statement example in Exhibit 1 below, for instance, capital gains taxes (income taxes on gain) are taxes on a profit from an "Non-recurring item," sale of land, during the reporting period. For more on the several meanings of capital in business, finance, and economics, see Capital.

Which Countries Tax Capital Gains?

Capital Gains Taxes and Tax Code Sources for 20 Countries

The Exhibit 1 table shows that capital gains tax requirements are sometimes complicated and that they differ significantly between countries.

For more specifics on the tax consequences of capital gains or losses, consult your country's tax authorities.

Capital Gains Taxes By Country

| Australia | Capital

gains tax in Australia is payable upon realized capital gains, but

liability is subject to many exemptions and individual

adjustments depending on the length of time the owner holds the asset, the year the owner acquires the asset, and the kind of asset. Gains from the sale of

family homes, especially are subject to exemptions. For complete details

consult the Australian Taxation Office at www.ato.gov.au. |

|---|---|

| Canada | For individuals, Canada generally taxes capital gains at 50% of an individual's income tax rate. Capital gains for corporations, however, are taxed at the company's full tax rate. For complete details consult Revenue Canada at www.cra-arc.gc.ca. |

| Denmark | Denmark imposes capital gains taxes on gains from share dividends, interest income from bank deposits and bonds, and a few other kinds of benefits, although the tax rate varies greatly depending on the amount of gain, and whether the increase is realized by an individual or by a corporation. For complete details consult the Danish Ministry of Finance at www.fm.dk. |

| France | France imposes capital gains taxes on individuals for gains on the sale of financial instruments such as stock shares or bonds, at a 30.1%, rate. There are special conditions, however (for example, holding funds in a PEA account), which reduces the tax rate. France generally does not impose capital gains tax on the sale of a principal residence, depending on the length of ownership. For complete details on capital gains taxes for individuals and corporations, consult French tax authorities at www.impots.gouv.fr. |

| Germany | Germany imposes capital gains taxes on profits from selling financial instruments, such as stock shares or bonds, only if the purchase date was after 2008. Taxation on other capital gains depends on the

length of time held. Germany does not impose a tax on profits from real estate sales if the owner owns the property for ten years or more. For complete details, consult the German Federal Ministry of Finance at German Federal Ministry of Finance at www.bundesfinanzministerium.de. |

| India | Capital gains on the sale of equities are tax-exempt if the owner sells shares through the recognized stock exchange and pays ST Tax on the deal, and if the holding period was one year or more. Gains from shorter-term ownership may be taxable. Tax requirements for sale of other capital investments, such as real estate, or bank deposits, may be taxed depending again on the period of ownership. For complete details, consult the Indian Department of Revenue at www.incometaxindia.gov.in. |

| Ireland | The Republic of Ireland imposes a 25% tax on capital gains, but there are some exclusions and deductions. Exemptions include, for example, selling agricultural land, or a primary residence, or for transfers between spouses. The tax rate on certain kinds of investments, however, ranges from 23% to 40%. For complete details consult Irish Tax and Customers Revenue at www.revenue.ie/en. |

| Israel | Israel imposes a flat 20% tax rate on capital gains. |

| Italy | Italy imposes a capital gain tax of 27.5% on corporations and a capital gains tax of 12.55% on individuals, with specific exemptions and conditions. For complete details consult the Italian Ministry of Finance. |

| Malaysia | Malaysia currently does not impose a capital gains tax for sale of equities, but it does require a 5% tax on profits from real estate sales if the owner holds the property for less than five years. For complete details consult the Inland Revenue Board of Malaysia at www.hasil.gov.my. |

| Netherlands | With certain exceptions, there is no capital gains tax in the Netherlands. For complete details consult the Netherlands Ministry of Finance. |

| New Zealand |

New Zealand generally does not have a capital gains tax, per se, except that the country does tax a few classes of gains such as those from selling shares, as ordinary income. For complete details consult New Zealand Inland Revenue at www.ird.govt.nz. |

| Norway | In Norway, individuals are taxed at a 28% rate for capital gains, although there are exemptions (e.g., from selling a principal home). Norway imposes taxes on companies for profits from selling shares or bonds, or for interest income. For complete details consult the Norwegian Ministry of Finance at www.skatteetaten.no. |

| Singapore | Singapore does not generally impose a capital gains tax. For more details consult the Inland Revenue Authority of Singapore at www.iras.gov.sg. |

| Sweden | Sweden imposes a 30% tax on capital income. For complete details consult the Swedish Tax Agency at www.skatteverket.se. |

| Switzerland | Swiss residents pay no capital gains tax, except in some cases for a capital gains tax on property sales, depending on how long the owner holds property, and also depending on which canton the transaction occurs in. Corporations pay the same tax on capital gains as on ordinary income. For complete details consult the Swiss Federal Department of Finance at www.efd.admin.ch. |

United |

Individuals and corporations in the UK are liable for capital gains taxes, under a complex rate system, which takes into account such factors as the nature of asset or property sold (e.g., stock shares or private residence), the taxpayer's basic tax rate, year of asset acquisition, and many other factors. For complete coverage consult the UK Department of Inland Revenue a twww.hmrc.gov.uk. Search for "capital gain." |

United |

In the United States, individuals and corporations are generally taxed for capital gains at the same rate as for ordinary income, except that individuals may receive a reduced tax rate if the owner holds the property for more than one year. For complete details, consult the US Internal Revenue Service at www.irs.gov, and especially IRS publication 550, Investment Income and Expenses, at www.irs.gov/publications/p550/index.html. |

For more specifics on the tax consequences of capital gains or losses, consult your country's tax authorities.