What is MACRS Depreciation?

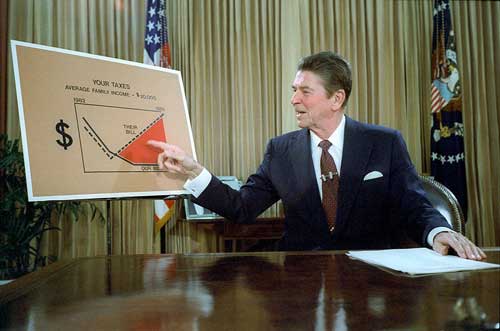

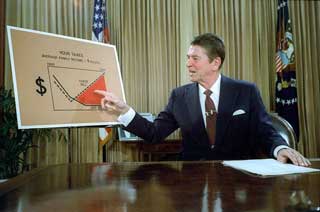

The United States Congress hoped in the 1980s to improve the economy by incenting firms to invest in assets.

Modified Accelerated Cost Recovery System (MACRS) is a form of accelerated depreciation enacted by the US Congress in 1986. Today, 36 years later, MACRS remains the centerpiece of United States IRS Tax code for depreciating property.

Define ACRS and MACRS

US President Reagan proposed, and Congress enacted tax reform twice in the 1980s. Tax Acts in 1981 and 1986 were meant to encourage businesses to invest in assets by allowing accelerated depreciation—and thus larger tax savings in the early years of asset life.

Guidelines and schedules in the 1981 Act are known as the Accelerated Cost Recovery System (ACRS). The Tax Reform Act of 1986 modifies ACRS and renames the system as Modified Accelerated Cost Recovery System (MACRS).

US taxpayers use ACRS for assets placed in service between 1980 and 1987, and MACRS for assets in service from 1987 and later. Businesses use MACRS depreciation for many asset classes, including computing systems, office furniture, automobiles, construction assets, and others.

Explaining MACRS in Context

This article further explains and illustrates Modified Accelerated Cost Recovery System in the context of simioar terms, emphasizing three themes:

- First, how the United States Congress meant to encourage investment in depreciable assets by creating accelerated depreciation schedules

- Second, definition and use of MACRS depreciation schedules.

- Third, MACRS depreciation compared to other standard depreciation schedules.

Contents

- What is MACRS depreciation?

- What does the MACRS depreciation schedule accomplish?

- How does MACRS compare to SL, DDB, and SOYD schedules?

- Varieties of MACRS schedules: Which schedule for an asset class?

Related Topics

- More on role of depreciation in accounting and schedules other than MACRS: See Depreciation

- The US Tax Reform Act of 1986: See Tax Reform Act of 1986.

Resource

- Download IRS Publication 946 "How to Depreciate Property" for the most recent tax year (2020) Opens in a new tab.

What Does MACRS Schedule Accomplish?

The MACRS depreciation schedule is a special form of another well-known accelerated depreciation schedule, the double declining balance DDB method.

Define Accelerated Depreciation

Accelerated depreciation schedules allow owners to claim relatively more depreciation expense early in the depreciable life, and relatively less later in the depreciable life in comparison to straight-line depreciation.

Depreciation Expense Impacts Financial Reporting

For the length of an asset's depreciable life, owners report depreciation expense annually as a noncash expense. This expense has two consequences for the firm's accounts:

- First, depreciation expense lowers owner tax liability by reducing reported earnings.

Under accelerated depreciation, moreover, tax savings are greater early in depreciable life, but less in later in depreciable life. - Secondly, depreciation expense lowers asset book value by turning part of the original asset purchase expenditure into an expense.

This adjustment, in turn, enables owners to implement the accounting matching concept, under which they report expenses in the period they incur the expense. They incur depreciation expense, that is, as they use up (wear out or deplete) assets.

When creating the ACRS Act in 1981, the intent of the US Congress was to incent businesses to invest in assets and improving the health of the national economy by improving productivity, creating jobs, and increasing trade.

MACRS vs. DDB Based Schedules

The DDB-based MACRS schedules differ from normal DDB schedules in two ways:

- Firstly, MACRS and normal DDB methods start applying depreciation at different times.

- DDB schedules begin applying depreciation expense at the start of the asset's first year on the Balance Sheet.

- MACRS rules, by contrast, prescribe starting depreciation at the midpoint of the asset's first year on the Balance sheet.

A five-year MACRS schedule thus contributes depreciation expense in 6 tax years, running from the midpoint of year 1 to the midpoint of year 6. The impact of starting depreciation in the middle of Year 1 is apparent in Exhibit 2, below, seen as the Year 2 "peak" in the MACRS schedule profile.

- Secondly, MACRS permits changing from the DDB method to straight-line depreciation, after optimizing depreciation benefits.

This impact is also apparent in Exhibit 2, below, where the MACRS "curve" sits alongside the normal DDB curve.

MACRS follows normal DDB rules in one aspect: The MACRS schedule disreguards residual values (salvage values), as does the normal DDB schedule. Under MACRS and normal DDB, therefore, depreciation schedule percentages are applied against the full asset cost.

In other words, under MACRS and DDB:

Depreciable Cost = Full Asset Cost

US Government Source for MACRS Rules

Modified Accelerated Cost Recovery System depreciation schedules and rules for applying them to different classes of assets appear in US Government Internal Revenue Service (IRS) Publication 946, "How to Depreciate Property." Information technology (IT) systems, for instance, are covered in the five-year depreciable life category, which also includes other kinds of office equipment and automobiles. Under MACRS, assets in these classes thus have 60-month depreciable lives.

Download US IRS Publication 946 "How to Depreciate Property". Opens in a new tab.

Comparing MACRS to Other Depreciation Schedules

straight-line, Double Declining Balance, and Sum of Years Digits

Exhibit 1 below compares MACRS, DDB, SOYD, and SL schedule percentages for each year for an asset having a 5-year life depreciable life. Figures in the table show percentages of depreciable cost depreciated per year. Acceleration is easiest to appreciate in the Exhibit 2 line chart comparison of these figures.

| Schedule | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 |

|---|---|---|---|---|---|---|

| Straight-Line | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | — |

| MACRS | 20.00 | 32.00 | 19.20 | 11.52 | 11.52 | 5.76 |

| Double Decl. Bal. | 40.00 | 24.00 | 14.40 | 8.64 | 5.18 | — |

| Sum of Years Digits | 33.33 | 26.67 | 20.00 | 13.33 | 6.67 | — |

Exhibit 1. Comparing 5-year versions of four depreciation schedules. Table values are the percentage of the original depreciable cost to charge for depreciation expense.

Exhibit 2 uses the data from Exhibit 1 to produce a line-chart comparing the profiles, or shapes, of four commonly used depreciation schedules, when the prescribed depreciable life is five years. Exhibit 2 schedules include:

- Straight-line SL

- Modified accelerated cost recovery system MACRS

- Double Declining Balance DDB

- Sum of the years digits SOYD

Note that MACRS here refers to a five-year depreciable life that is spread across six fiscal years, beginning at the midpoint of year 1.

Varieties of MACRS Schedules

Which Schedule for an Asset Class?

The discussion above shows MACRS as a relatively simple adjustment to the familiar DDB schedule, where "Regular MACRS" calls for (1) starting depreciation at the midpoint of Year 1, and (2) depreciation changes from DDB to straight-line after optimizing the depreciation benefits.

In reality, however, MACRS and US IRS Tax rules provide multiple possible schedules for different assets, depending on several factors including asset class, the purpose of acquisition, the timing of the acquisition, and source of funding for the acquisition.

Moreover, within a single asset class (e.g., Office Equipment), MACRS sometimes permits asset owners to choose any of these four possibilities:

- Regular MACRS (as in sections above.

- Double Declining Balance Method. This method is also called 200% DDB because calculation includes the doubling of figures.

- 150% Double Declining Balance Method. This form of DDB provides moderately "less acceleration" than the normal 200% DDB method, above.

- Straight-Line depreciation.

The specific MACRS depreciable life for an asset may also depend on the owner's choice between two sets of tables called:

- General Schedules (GDS), which most users choose in most cases.

- Alternative Depreciation Schedule (ADS) which may be used in some cases.

A few of the GDS and ADS schedules Include, for example:

Office Furniture: GDS 7 Years, ADS 10 Years

Computers: GDS 5 Years, ADS 6 Years

Construction Assets: GDS 5 Years, ADS 6 Years

Railroad Cars & Locomotives: GDS 7 Years, ADS 15 Years

In brief, the MACRS tax rules are complex. For complete guidance on which MACRS schedule applies to a specific asset, the best approach is to consult the 110+ page government source, US IRS publication 946 "How to Depreciate Property.

Download US IRS Publication 946 "How to Depreciate Property". Opens in a new tab.