What is Allowance for Doubtful Accounts?

Businesses use Allowance for Doubtful Accounts to recognize the reality that certain customers will never pay what they owe..

When a business decides that a customer account payable will probably never be paid, accountants acknowledge the reality by designating the amount due as a "a bad debt expense," and making use of the Allowance for Doubtful Accounts account. This act is the normal method for adjusting accounts in the interest of accounting accuracy.

Define Allowance for Doubtful Accounts

Allowance for doubtful accounts is a contra asset account that receives a credit transaction for an amount the firm believes will never be paid. This reduces the receiveables total and thus the firm's current assets total.

The bad debt expense enters the accounting system with two simultaneous transactions.

- Firstly, the firm debits a noncash expense account, Bad debt expense. This expense along with others will be subtracted from sales revenues on the Income statement, thereby lowering Net income (Net profit).

- Secondly, the firm credits a contra asset account, Allowance for doubtful accounts or the same amount. On the Balance sheet, an Allowance for doubtful accounts balance lowers the firm's Net accounts receivable. As a result, the action also reduces the values of Current assets and Total assets.

The examples below further explain how a company writes off bad debt and how these accounts impact each other. The discussion also examines the impact of writing off bad debts on the Income statement, Balance sheet, and statement of changes in financial position.

Explaining Allowance For Doubtful Accounts in Context

Sections below further define and illustrate allowance for doubtful accounts emphasizing three themes:

- First, explaining how accountants use the contra-asset account "Allowance for Doubtful accounts" to maintain accounting accuracy by writing off bad debts.

- Second, examples show how transactions in "Allowance for Doubtful Accounts" turh unpaid debt into an ordinary expense.

- Third, the impact of Allowance for Doubtful Accounts on all four primary financial statements.

Contents

- What is an allowance for doubtful accounts?

- What is the role of "Allowance for doubtful accounts" in writing off bad debt?

- Balance sheet example of bad debt "write off."

- What is the impact of allowance for doubtful accounts on financial statements?

Related Topics

- More on writing off bad debt and inventory loss: See Write-Off.

- Accrual accounting, debits, and credits: See double-entry System.

- Accounts and contra accounts: See Account.

Allowance for Doubtful Accounts and Bad Debt

Writing Off Bad Debt

Before there can be a Bad debt expense or Allowance for doubtful accounts, there must be an Account receivable. This receivable is an amount owed to an entity, usually by one of its customers as a result of a recent sale or the standard extension of credit. A firm that sells and ships goods to a customer, along with an invoice, has an Account receivable until the customer pays.

The invoice will state payment terms such as "Net 30," or "Net 60," which means the customer is obligated to pay the balance due no more than 30 or 60 days after receiving the invoice. Payment is overdue if the customer does not pay by the due date.

When Customer Payment is Overdue

When customer payment becomes overdue on an Account receivable, sellers usually notify the customer of the late status, and then watch the overdue account for another 30 days, 60 days, or some other time span. During this time the seller continues trying to collect payment.

If payment is still not forthcoming during that period, the seller will choose one of two possible actions:

- Firstly, the seller may continue trying to collect the debt.

This attempt may include intensified collection efforts, such as using a Collection service or a lawsuit against the non-paying customer. These options, however, can raise the cost of collection substantially. - Secondly, the seller may recognize the debt as a bad debt expense and write off the debt.

Creditors take this action in the interest of accounting accuracy. A write-off adjusts the seller's Net accounts receivable to reflect the reality. Sellers choose this option when they believe the customer will never pay. They might accept this reality, for instance, when the customer goes out of business or declares bankruptcy.

Transactions in Writing Off Debt

The term, as it appears in this article, is an accounting term. As far as the accounting system is concerned, a write off begins with transactions in two accounts:

- Firstly, Bad debt expense, a noncash expense account.

- Secondly, Allowance for doubtful accounts, a contra asset account.

Exhibit 1 below shows how these appear in the journal.

| Grande Corporation Journal for Fiscal Year 20YY | |||

| Date | Account | Debit | Credit |

| 30-Jun-20YY 30-Jun-20YY | 630 Bad debt expense 120 Allowance for doubtful accounts | $137,000 | $137,000 |

Exhibit 1. Journal entries to start the write-off process.

double-entry bookkeeping requires at least two transactions for the write off action: one a debit and the other an equal, offsetting credit. Here, the account "Bad debt expense" is an expense category account whose balance increases with a debit transaction. The other transaction impacts "Allowance for doubtful accounts,'' is an asset category account, but it is also a "contra asset account." Therefore, a "credit" increases this account's value (the reverse of the impact a credit has on a standard asset account.

Writing off the debt this way, incidentally, does not relieve the debtor of the obligation to pay. The seller undertakes the write off in the interest of accounting accuracy, but the customer is still liable for the debt. The seller retains every right to pursue payment by other legal means, such as engaging a collection service or filing a lawsuit.

Sometimes, customers do ultimately pay the debt, but after the creditor makes the write off transactions. In that case, If the payment comes before the end of the reporting period, the impacts of the initial write transactions can be reversed.

Balance Sheet Reporting Bad Debt Write Off

Balance Sheet Examples

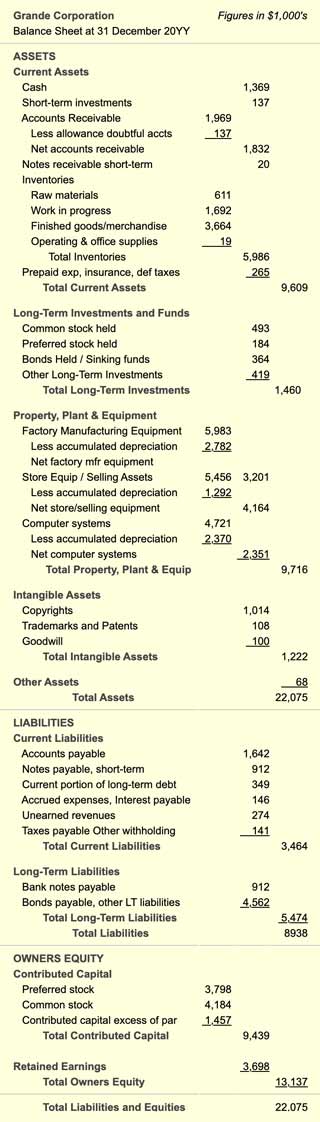

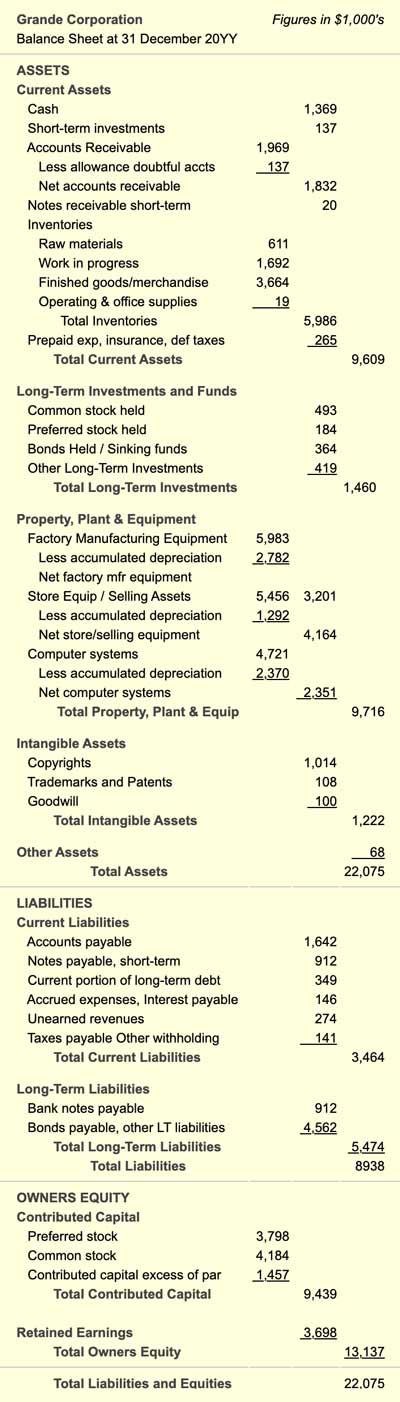

At the end of an accounting period, when financial accounting reports are prepared and published, the sum of receivable accounts appears on the Balance Sheet as Accounts receivable. However, the account Allowance for doubtful accounts also appears along with Accounts receivable to adjust its value downwards, as shown in Exhibit 2 below.

See the encyclopedia entry Balance sheet for more explanation of the above statement. For working examples of interrelated financial statements and coverage of financial statement metrics, see Financial Metrics Pro.

Does Allowance for Doubtful Accounts Impact All Financial Statements?

Writing off the debt in this way directly impacts two accounting system accounts: Bad debt expense, Allowance for doubtful accounts. Changes in these accounts affect others, and, in turn, affect a firm's accounting statements.

Income Statement Impact

Under accrual accounting, the company claims sales earned during the period, including those that are still "payable." Accounts receivable itself is not an Income statement line item, but the receivable balance is part of the Income statement item Total net sales Revenues.

The Income statement may also include a line item for Bad debt expense. This item appears typically under Operating expenses, below the Gross profit line. As a result, Bad debt expense from a write off lowers bottom line Net income.

Balance Sheet Impact.

On the Balance sheet (Exhibit 2), a write off adds to the balance of Allowance for doubtful accounts. And this, in turn, is subtracted from the Balance sheet asset category "Accounts receivable." The result appears as "Net Accounts receivable." The write off thus ensures that Net Accounts receivable is lower than Accounts receivable.

Statement of Changes in Financial Position (Cash Flow Statement)

On the statement of changes in financial position, Bad debt expense appears as a noncash expense item. Bad debt expense from a write off is subtracted from sales revenues, lowering total "Sources of Cash."

Statement of Retained Earnings

Net income (Net profit) from the Income statement makes its way onto the Statement of retained earnings either in the form of dividends paid to shareholders, or as retained earnings, or both. By impacting income, a write off can also lower "dividends" and "retained earnings" on the Statement of retained earnings.