What are Receivables and Accounts Receivable?

Is the firm's collection process effective and efficient? The Accounts Receivable Turnover metric provides an answer.

Businesses that practice accrual accounting normally claim as assets certain debts that customers or borrowers owe the company. Money the firm expects to receive when their debtors pay, appears in the accounting system and on the balance sheet as Receivables.

Define Receivable, Accounts Receivable

The term Receivable refers to a debt that a customer or borrower owes to a firm that meets two requirements.

- Firstly, the customer or borrower legally owes money to the firm.

- Secondly, the firm has good reason to believe it will receive payment.

Accounts Receivable is an accounting system liabilities account holding all of the firm's receivables.

When a customer buys goods or services using seller-provided credit, the customer becomes an account receivable for the seller. As a result, seller and buyer have a creditor-debtor relationship that remains until the buyer makes cash payment.

During the life of the debt, however, the amount due contributes to an asset account in the seller's accounting system, "Accounts receivable." The seller's Accounts receivable balance is the sum of all such debt currently due to the seller, with pay off in the near term.

Receivables Help Define Financial Position

The firm's receivables balance contributes to financial position metrics that involve asset accounts. The following financial statement metrics (business ratios) all reflect receivables balances:

- Working Capital

- Current Ratio

- Quick Ratio / Acid-Test Ratio

- Accounts Receivable Turnover

- Return on Total Assets ROA

- Return on Capital Employed ROCE

Sections below illustrate the role of receivables in these metrics.

Receivables Help Define Financial Performance

Receivables also impact measures of financial performance, such as margins and profits. Creating a "receivable" from trade activities, for instance, results in two accounting system entries.

- Firstly, a debit(increase) to a receivable asset account, such as "Accounts receivable."

- Secondly, a credit (increase) to a revenue account, such as "Sales revenues."

In other words, the seller registers revenue earnings as soon as the Account receivable exists. Increasing "revenue," of course, improves margins and profits.

Explaining Receivables in Context

Sections below further explain receivables and their role in financial accounting, financial metrics, and economic analysis, in context with similar terms including…m

Contents

- What is the definition and meaning of receivables and accounts receivable?

- Basic receivables concepts and definitions.

- Who uses Accounts receivable and other kinds of receivables?

- What role does the receivables concept play in financial reporting and financial analysis? Balance sheet example.

- Five financial metrics measure receivables performance.

- Accounts receivable transactions at work.

- The full accounts receivable story.

Related Topics

- See Account Payable for an introduction to payable transactions.

- See Accrual Accounting for an introduction to basic accrual concepts.

Who Uses Receivables?

Strictly speaking, the receivables concept is possible only under an accrual accounting system. Receivables appear in accrual systems because accrual accounting applies two fundamental principles:

- Firstly, recording revenues when the provider earns them (by delivering goods and services).

- Secondly, recording expenses when the firm owes them.

Public companies, everywhere, must report to shareholders, regulators, and tax authorities, in conformance with the country's Generally Accepted Accounting Principles (GAAP). For businesses, this almost always calls for accrual accounting. For firms that sell goods or services, the most prominent receivable category on the Balance sheet is, not surprisingly, Accounts receivable. However, the other kinds of receivables are also possible for an accrual-based company.

Receivables Under Cash-Basis Accounting.

Very few firms in business use the alternative to accrual accounting, cash-basis accounting. Firms that do use cash-basis accounting record revenues only when they receive a cash payment. And, they record expenses only they pay them. Under the strict form of cash basis accounting, therefore, "Accounts receivable" and other kinds of receivables do not exist. That is, they do not exist in a cash-basis system as formal accounting concepts.

This cash-basis limitation does not mean, however, that cash-basis firms must refuse to "sell on credit." Nor does it imply that cash-basis firms lose track of monies that buyers owe them.

- Privately held companies, government organizations, and non-profit entities that do not need to comply with business-GAAP requirements can communicate and manage using a form of accounting that is a mix of cash-basis and accrual methods, hybrid accounting, or modified cash basis accounting or modified accrual accounting. These three terms are essentially interchangeable.

Hybrid approaches can record revenues when they are received (as in cash accounting), but record expenses when the firm incurs the obligation to pay (as in accrual accounting). Or firms can do the reverse: record revenues when they earn them, but record expenses only when they pay them. - Entities reporting under strict cash basis accounting can still create "receivables" accounts to keep track of monies legally owed them. They use transactions and balances in these accounts for planning, billing, and budgeting purposes. For the cash-basis firm, however, these accounts do not appear in financial reports.

Receivables in Reporting and Analysis

Balance Sheet Examples

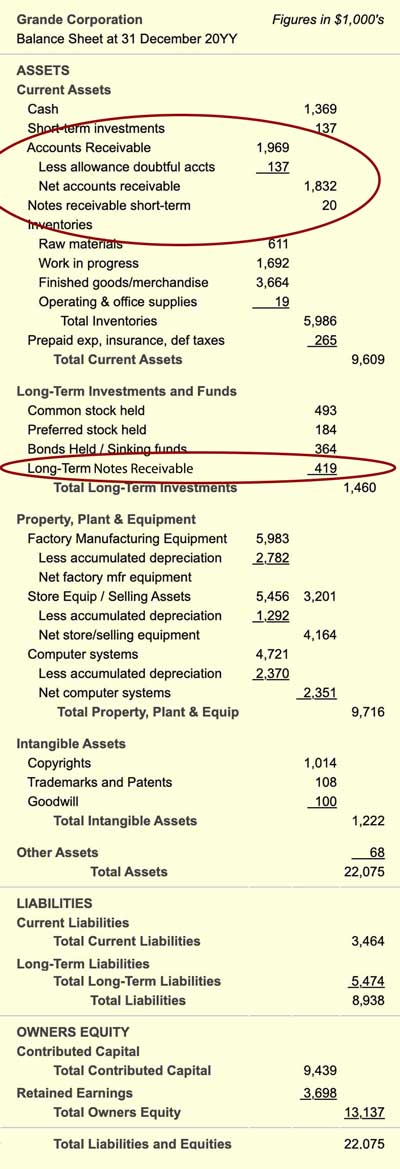

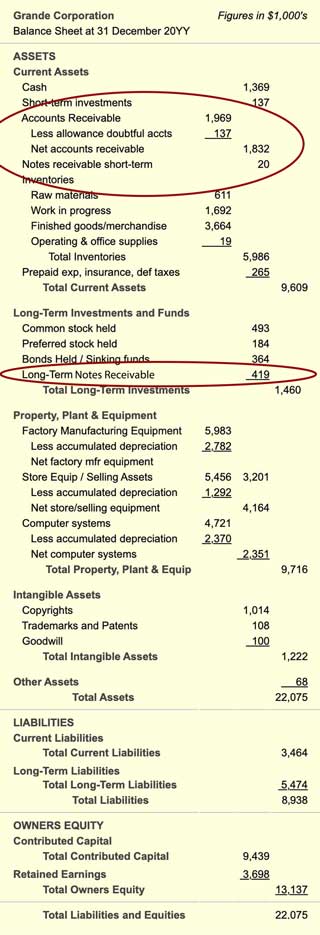

At the end of a reporting period, "receivables" may appear on the Balance sheet as Exhibit 1 shows.

Receivables may appear under both Current Assets and Long Term Assets.

- Short-term receivables accounts (including Accounts receivable and short-term notes receivable) appear as line items on the Balance sheet under Current assets

- Long-term receivables come after all Current assets, listed instead with a name that includes "Long-term." The example above, for instance, is Long-term notes receivable..

Note that Net accounts receivable is more appropriate than Accounts receivable for use in the financial metrics below.

On the Balance sheet, "Allowance for doubtful accounts" is an account that recognizes that payments for some of receivables will never arrive. A seller might decide that the customer will never pay, for instance, because the customer is out of business. As the example shows, "Net accounts receivable" is the "Accounts receivable" balance less "Allowance for doubtful accounts."

Five Receivables Performance Metrics

"Current assets" including "Accounts receivable" and other short-term receivables contribute to measures of the organization's liquidity, such as Working capital, the Current ratio, and the Acid test (Quick ratio). Receivables also contribute to quite a few other metrics, including efficiency metrics such as Accounts receivable turnover, and profitability metrics such as Return on assets (ROA).

The examples below show how to calculate and interpret liquidity, activity, and profitability metrics that include receivables. The models use figures from the Balance sheet in Exhibit 1, above, to calculate these five measures of receivables performance:

- Metric 1: Working capital with receivables.

Working capital measures liquidity, in this case, funds available for use in the near term. - Metric 2: Current ratio with receivables.

Current Ratio measures liquidity, in this case comparing near term funds to near term spending obligations. - Metric 3: Quick ratio / Acid-test ratio with receivables.

Quick ratio measures liquidity, in this case comparing only the most liquid of near term funds to near term spending obligations.

- Metric 4: Accounts receivable turnover.

Accounts receivable turnover efficiency and activity in collecting receivables.

- Metric 5: Return on total assets.

Return on total assets the firm's performance in earning from its asset base.

Receivables Performance Metric 1

Working Capital With Receivables

Working capital is a measure of liquidity, stated as in currency units. A firm's working capital is merely the difference between its Current assets and its Current liabilities.

Working capital =

Current assets – Current liabilities

= $9,609,000 – $3,464,000

= $6,145,000

Note that "Current assets" includes Net accounts receivable of $1,832,000 and Short-term notes receivable of 20,000. Without short-term receivables, the company's working capital would be 4,295, 000.

In any case, management will respond to such figures by asking: Is this enough working capital? They will try to answer this question by estimating short-term liabilities, cash inflows, and short-term receivables for the next year.

Receivables Performance Metric 2

Current Ratio With Receivables

A company's Current ratio is another liquidity metric built from the same Balance sheet figures that go into the working capital calculation. Instead of showing a difference, however, the "Current ratio" is—no surprise—a ratio: "Current assets" divided by "Current liabilities."

Current ratio =

Current assets / Current liabilities

= $9,609,000 / $3,464,000

= 2.77

Without short-term receivables, the company's current ratio would instead be 2.32. In any case, analysts typically refer to a current ratio of 2.0 as a "rule of thumb" minimum for healthy liquidity. On the other hand, a current ratio under 1.0 (or working capital less than zero) is a cause for alarm.

Receivables Performance Metric 3

Quick Ratio / Acid Test With Receivables

The Quick ratio or Acid-test ratio is a more severe liquidity test. This metric is similar to the "Current ratio," except that the "Current Assets" figure in the numerator does not include "Inventories." Removing Inventories from Current assets provides a more severe liquidity test because Inventories are the least liquid Current assets components:

Quick ratio =

(Current assets – Inventories) / (Current liabilities)

= ($9,609,000 – $5,986,000) / $3,464,000

= 1.04

Whereas this company's Current ratio looked strong enough, the Acid-test ratio might be cause for concern. Analysts generally consider an Acid-test ratio of about 1.1 as a minimum healthy level. The same ratio without short-term receivables in Current assets would be even more alarming: 0.511.

Receivables Performance Metric 4

Accounts Receivable Turnover

The Accounts receivable turnover metric measures the firm's operational efficiency, or productivity, in earning from its assets. In this case, the assets in view are Accounts receivable. Assets that take longer to turn over are considered less productive than those that turn over quickly.

Accounts receivable turnover is the ratio of Net sales revenues (from the Income statement) divided by Accounts receivable (from the Balance sheet). For this example, assume that the firm reports "Net sales revenues" of $32,983,000. The turnover metric calculates from this "Net sales revenues" figure, and the "Net accounts receivable" value of $1,832,000 (from Exhibit 1). The turnover metric is, therefore:

Accounts receivable turnover =

Net sales revenues / Net accounts receivable

= $32,983,000 / $1,832,000

= 18.0

This firm achieves 18.0 "Accounts receivables turns" for the year. A turns rate of 12 or more shows that, on average, the firm collects Accounts receivable in one month or less.

- If the receivables turn rate is in accord with its payment terms, the firm's collection performance seems healthy.

- However, the opposite conclusion follows if the receivables turn rate shows average collection times much longer than the stated payment terms.

- This result could be a signal that the firm is accepting business from customers who are poor credit risks.

- Or, a low "turns rate" may also mean that the firm has to negotiate very long payment terms to win sales.

Receivables Performance Metric 5

Return on Total Assets

Profitability metrics measure a firm's ability to earn from its asset base. Receivables—because they are Balance sheet assets—contribute to several profitability metrics, including "Return on total assets" (ROA), "Return on capital employed" (ROCE) and "Return on equity" (ROE). The importance of the receivables contribution to these metrics depends, of course, on the relative size of the receivables component in the organization's asset structure.

A "Return on total assets" (ROA) example appears below. For ROE and ROCE examples, please see the article Profitability.

"Return on total assets" is simply "Net income" divided by "Total assets." For this example, assume that the firm's Income statement shows Net income of $2,126,000 for the year. Assume also that the end-of-period Balance sheet (Exhibit 1) reports Total assets of $22,075,000. ROA, therefore, is:

ROA = (Net income) / (Total assets)

= $2,126,000 / $22,075,000 = 9.6%

Note that the contribution of "Accounts receivable" to this ratio is complicated. The complication results because a change in the "Accounts receivable" figure impacts both the numerator and denominator of the ROA ratio. Decreasing "Accounts receivable," for instance, lowers the Total assets figure, of course. However, the same decrease also implies that sales revenues also decrease.

In any case, company managers and owners will compare the firm's ROA with other firms in the same industry. And, they will look for year-to-year trends in the firm's ROA.

Receivables Transactions at Work

In accrual accounting, receivables can appear in quite a few different kinds of transactions. Because firms carry receivables in Asset category accounts, debit and credit actions have the following impacts:

- Asset account balance increases with a debit entry.

- Asset account balance decreases with a credit entry.

In double-entry accounting, however, an entry in a "receivables" Asset account also calls for a corresponding debit or credit in any of the five account categories—Assets, Liabilities, Equities, Revenues, or Expenses.

Below are just a few basic examples of debits and credits that result from creating a receivable.

First Example: Creating the Receivable

Consider, for example, a manufacturer selling goods to another company. On 20 September, Grande Corporation sells and delivers a product purchase to the buyer, Mercury Corporation. At the same time, Grande Corporation sends Mercury an invoice for $84,400. The invoice states "Net 30," meaning that Mercury must pay Grande Corporation in 30 days or less.

At sale closing, a Grande bookkeeper recognizes the sale with two journal entries such as these:

| Grande Corporation Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 20-Sep-20YY 20-Sep-20YY |

NNN Accounts receivable NNN Sales revenues |

$84,400 | $84,400 |

The sale to Mercury becomes an account receivable for Grande Corporation. As a result, Grande's Accounts receivable account balance increases by (debits) $84,400. Grande also claims sales revenues at this time by simultaneously increasing (crediting) its Sales revenues account by the same $84,400.

The receivable now exists, and sales revenues are now "on the books," even though Mercury has not yet paid.

Before Mercury pays the bill, Grande and Mercury have a creditor-debtor relationship. The seller (Grande) carries another $84,400 in its Accounts receivable" account, while the buyer (Mercury) adds (credits) $84,400 to its own "Accounts payable" account, a liability account.

Second Example: The Customer Finally Pays in Cash

What happens next depends on whether or not Mercury pays Grande Corporation. If Mercury pays in cash within 30 days or less, say on 15 October, Grande Corporation (the seller) preserves $84,400 in sale value by moving that sum out of Accounts receivable and into another asset account, Cash.

| Grande Corporation Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 15-Oct-20YY 15-Oct-20YY |

NNN Cash NNN Accounts receivable |

$84,400 | $84,400 |

double-entry bookkeeping and accrual accounting have kept the sale on the books while Grande waits for Mercury's payment. With payment, Cash increases by $84,400 while Accounts receivable is decreases by the same amount.

Third Example: Customer Goes Bankrupt Instead and Does Not Pay

Assume now, however, that instead of paying its debt, Mercury goes into bankruptcy and becomes unable to pay. Furthermore, Mercury's liquidator lets Grande know that asset liquidation will not generate funds enough to pay the debt. Grande knows now that the Mercury will never pay the $84,400 debt.

In that case, Grande Corporation can write off the debt by increasing two accounts by $84,400: Bad debt expense and an Allowance for doubtful accounts.

| Grande Corporation Journal for Fiscal Year 20YY | |||

| Date | Account | Debit |

Credit |

| 15-Nov-20YY 15-Nov-20YY |

NNN Bad debt expense NNN Allowance for doubtful accounts |

$84,400 | $84,400 |

Here, an $84,400 increase to"Bad debt expense" (an expense account) pairs with an $84,400 addition to "Allowance for doubtful accounts." The "Allowance" account is an asset category account, but it is also a "Contra asset account," meaning that "Allowance for doubtful accounts" increases with a credit transaction (opposite to the credit impact on a standard Asset account).

Getting the Full Accounts Receivable Story

The Balance sheet example above shows one way the "Accounts receivable story" can end. In Exhibit 1, Accounts receivable has a balance of $1,969,000. This figure still includes the $84,400 sale value to Mercury. However, the Allowance for doubtful accounts line also appears, in this case with a balance of $137,000. Mercury's bad debt accounts for $84,000 of this. Note especially that "Net accounts receivable is the Accounts receivable figure less Allowance for doubtful accounts.

Other ways to dispose of the asset value involve crediting (decreasing) the Accounts receivable account before it gets to the Balance sheet. Either approach is legal and supported by GAAP. However, many people in business prefer showing mathematics on the Balance sheet, in the interest of full transparency for regulators, investors, and tax authorities.

Note, finally, that disposing of the Account receivable does not impact the Sales revenues report on the Income statement. Sales revenues earnings, after all, do not diminish because the customer fails to pay.

However, notice the above journal entry debiting (adding to) "Bad debt expense." On the Income statement, the firm subtracts "Bad debt expense" from revenues before reaching "Operating profit" and "Net profit." The firm now reports profits correctly for the "revenues" it receives.