What is a Note Payable?

Notes Payable may appear on the Income Statement under both Current Liabilities and Long Term Liabilities.

Virtually every business carries debt of one kind of another on its books, continuously. Most businesses are always slightly in debt to their own employees, for instance, for work up to the present hour that is not fully paid. Most have short term, repeating debts for routine operating expenses, and outstanding bills from suppliers, contractors, tax authorities, and landlords. Management of such debts depends primarily on the firm's ability to manage its working capital supply.

The firm's more significant debts, however, are the larger and longer lasting liabilities that have a substantial share of the firm's capital and financial structures. These debts determine the firm's ability to benefit (or suffer) from financial leverage, the firm's ability to raise capital, and the firm's ability to earn acceptable margins. Most of these debts belong in the general category Notes Payable.

Define Note Payable

A note payable is a liability (debt) of an individual or organization, evidenced by a signed, written promissory note to pay a specific amount (principle due) by a specific date. The promissory note may also specify interest charges, collateral, and penalties for late payment.

The note becomes an active, binding legal obligation at the moment the borrower signs the agreement.

Note payable is an accounting term that can refer to any debt that meets the definition above. However, many of these debts, or instruments, are better known by other names, such as bank loan, mortgage, or debenture.

At signing, the lender records the borrower's written promise in a Notes Receivable account, while the borrower records the obligation in a liabilities account such as Notes Payable, Bank Loans Payable, or something similar.

Where Are Notes Payable on the Balance Sheet?

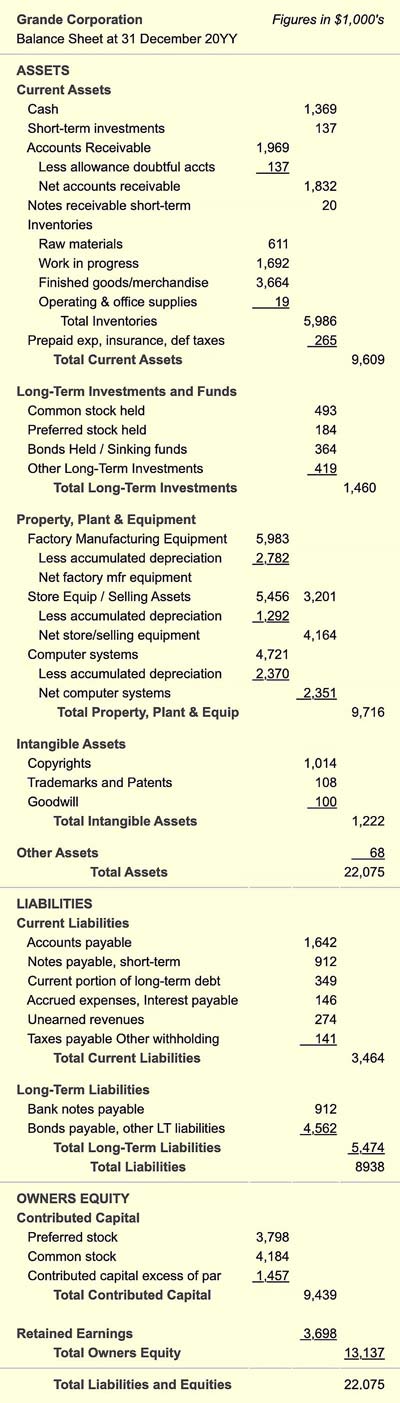

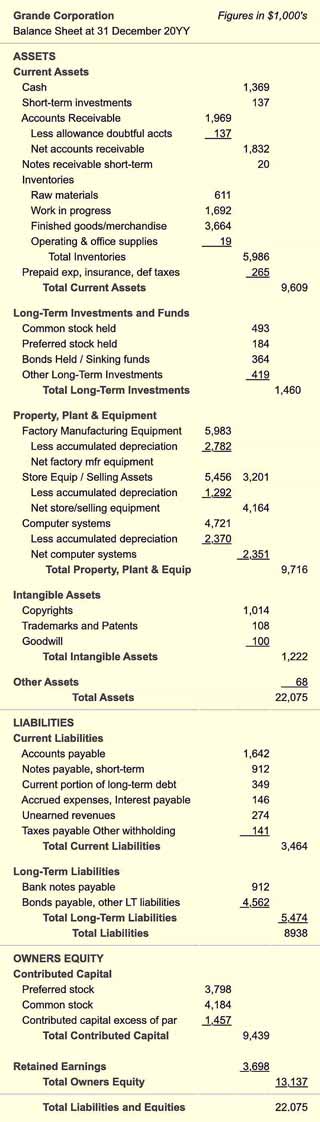

Detailed Balance Sheet Example With Notes Payable

When the borrower signs the promissory note, the lender records the written promise in a Notes Receivable account, which appears under Assets on the lender's balance sheet.

At the same time, the borrower records the obligation in a liabilities account such as Notes Payable, Bank Loans Payable, or something similar. All such "Payable" accounts appear under Liabilities on the borrower's Balance sheet.

- Notes payable in more than one year appear under Long-term

liabilities, except for any portion payable within a year.

As long-term liabilities, Notes payable help define the company's degree of leverage and are a component of both the financial structure and the capital structure. - Short-term notes and any portions of long-term notes payable within a year are carried as Current liabilities. Current liabilities thus contribute only to the company's financial structure but not capital structure.

Exhibit 1 below is a detailed company balance sheet, showing both Long Term Bank Notes Payable, and Current Liabilities with but with more detail. Definitions for the major categories and line items appear below the example.