What is Business Case Competency?

Know what it Takes to Deliver a Case That Scores High in Credibility, Accuracy, and Practical Value.

Everyone with an interest in the business case analysis is likely to have serious questions in mind about the case-building process. The project manager, the CFO, the budget director, the consultant, and senior managers all want to know what they are in for and whether the results will be worth the effort. Everyone with a stake in the case wants to know specifically:

- How long will it take to prepare the business case?

- How many work hours and other resources will it require?

- Will the results be accurate? Credible?

- Will the results give us confidence that we're making the best business decision?

You might expect the answers to depend on such things as the complexity of the project or investment under analysis, or the size of the proposal budget. Answers are surprisingly predictable, but they usually depend little on those factors. Answers depend on—and are easier to predict from—the skills and knowledge of the individuals working on the business case project.

Answers to these questions depend, in other words, on the organization's level of Business Case Competency.

Define Business Case Competency

The terms Business Case Competency and Maturity Level refer to the skills, knowledge, and case-building capabilities of individuals in the business organization.

As an organization's competency (maturity level) rises, case-building efficiency and the quality of business case results improve.

This article further defines and explains the business case competency and maturity level concepts, presents a simple checklist for rating an organization's maturity level, and outlines essential requirements for a competency-raising program.

Contents

What's a Business Case?

What Does the Case Aim to Achieve?

Businesspeople everywhere are losing tolerance for management error and demanding real accountability for actions and decisions. And, everywhere, the competition for scarce funds is increasing. It's not surprising, therefore, that everyone talks about the "business case." Nevertheless, surprisingly few people in business truly understand what that means.

This means that the starting point for creating and raising business case competency, in any organization, is to create a basic understanding throughout the organization on the definition of "business case," the nature of case results, and the nature of business case proof.

Define Business Case

The Business Case is an analysis that delivers two kinds of information about the consequences of an action or decision:

- Forecasts. The business case asks "What happens if we take this or that action?" Case results answer in business terms: business costs, business benefits, business risks.

- Proof. Reasoning and evidence make the case for choosing one action over another. The case proves in compelling terms why the chosen action is the better business decision.

Decision-makers and planners rely on solid business case analysis to build the understanding and confidence they need to take action. They need credible forecasts, but they also need trustworthy proof they are choosing the best course of action.

The Purpose Five Reasons to Write a Business Case.

Businesspeople turn to business case analysis to meet several different information needs.

- Decision Support.

Given two or more possible courses of action, the business case provides objective, quantitative measures for deciding which action is the better business decision. The case also shows whether business risks with possible actions are acceptable. - Business Planning.

The business case can deliver accurate forecasts of future spending needs and incoming revenues. - Financial Justification.

The justification business case determines whether the proposed action meets any one of three criteria. The analyst designates at least one of these as the meaning of justification for a given proposal.:- Earns enough to cover its costs. It pays for itself.

- Is more profitable than other options or simply promises acceptable returns.

- Is the least costly solution available or more promises acceptable costs.

- Business Planning.

The business case can deliver accurate forecasts of future spending needs and incoming revenues. - Management and Control.

For project and program managers, the case reveals critical success factors and contingencies they must manage to target levels. For business investments of all kinds, the case provides practical guidance for minimizing costs, maximizing returns, and mitigating risk. - Accountability.

A solid case shows directors, regulators, and government authorities that decisions were made responsibly, with sound judgment, conforming to laws and policies.

The case builder may start with one of these roles in mind, several roles, or all five.

Who Builds the Business Case?

Businesspeople are finding that business case is not just a job for Finance in the back office. Financial experience helps in the case-building process, of course, but the most useful BCA knowledge lies elsewhere. Those best prepared to build the case are those who

- Know the details of day-to-day operations in the business unit.

- Understand the drivers for employee and group performance.

- Have a successful track record managing projects and programs.

As a result, case-building responsibility today rests squarely on those who propose and those who take action. Product managers, engineers, consultants, project managers, IT directors, strategists, business development managers, line managers, and others "in the trenches," know that meeting business case needs means building the case themselves.

Criteria for Business Case Success

Not everyone understands the meaning of business case success alike. To the manager seeking project funding, funding approval might seem like a success. To the salesperson, a BCA that helps close a sale seems like success. Granted, any decision in the case builder's favor feels like success. Nevertheless, case builders better serve their interests—and their organization's interests—by defining business case success in terms of these three criteria.

- Credibility.

The case is credible if stakeholders and decision-makers believe the case rationale and case predictions. - Practical value.

- The case gives decision-makers and planners confidence to act.

- It enables them to manage the action for optimum results.

- It discriminates clearly between proposals to implement and those to reject.

- Accuracy.

The case predicts accurately what happens.

Competency Drives Business Case Value

Green and Red triangles in the image below are meant to suggest the relationship management can expect between (a) the organization's competency maturity level, and (b) the cost and quality of business case results.

Maturity Drives Value Creation

As maturity level increases, business case results create value tangibly, through Increasing:

- Stakeholder Focus: Results speak directly to decision support needs of individual stakeholders.

- Practical Value: Case results bring decision-makers quickly to a confidence level they need to take action. Case results also provide practical guidance that extends through the life of a proposed action: specific guidance for controlling costs, minimizing risks, and maximizing returns.

- Transparency: The path from assumptions to data sources, to analytic methods, to case results, to conclusions and recommended actions, is clear and accessible to all involved with the case.

- Consistency: The organization uses a consistent approach to case-building and case reviewing, meaning that case builders and reviewers know what to look for in each new case.

- Credibility: The veracity of case results is beyond question. Reviewers do not question this conclusion: if the case builder's assumptions stand, the results provided will follow. Reviewers may of course question the case builder's assumptions, but all important assumptions are exposed and open for debate.

- Increasing Accuracy: Accuracy in business case results means that management ability to use case results effectively for decision support, planning, management and control, and accountability purposes, increases.

Maturity Works Against Value Destruction

As maturity level increases, moreover, the case-building process itself is increasingly less responsible for value destruction decreases. As maturity level increases, the organization sees decreasing levels of:

- Uncertainty in Business Case results. The probability is high that results other than the predicted results will occur.

- Costly Mistakes. Leaders make fewer decisions to fund projects that should not receive funding or make investments that turn out badly.

- Opportunity Loss. Leaders will overlook or pass over fewer projects or investments that deserve funding.

- case-building cost and time, effort, and other resources needed for case-building decrease.

Five Business Case Competency Levels

A Self-Scoring Competency Level Check List

Management or an outside consultant can easily assess an organization's competency maturity level simply by checking bullet points in the five "Maturity Level' sections that follow.

Each bullet point describes something that organizations typically do at a given level. For most real organizations, the results may include check marks at more than one level. For most organizations, however, there will be a concentration or cluster of checks in the level that best describes the organization.

Maturity Level 1

Competency: Unaware

What is typical in Organizations at Level 1?

- There is little or no awareness of the value of business case analysis in decision-making and planning.

- Managers and decision-makers are largely unaware of the role business cases can play in reviewing capital proposals, in project management, in evaluating budgetary funding requests, in product life-cycle decisions, or in setting target levels for strategic objectives.

- Proposals and funding requests do not need to provide financial justification, cost-benefit analysis, or return on investment projections.

Maturity Level 2

Competency: Aware But Uninformed

What is typical in Organizations at Level 2?

- There is an awareness that the company needs business case competency, but only that.

- "Customer ROI" may figure prominently in the company's marketing messages, but the firm neither knows or measures its training ROI, or its ROI for marketing, R&D, projects, and programs.

- The company still makes bad, costly decisions that it could avoid with good business case analysis.

- No one knows gross profit or contribution margin by product, product line, or service offering.

Maturity Level 3

Competency: Ad Hoc

What is typical in Organizations at Level 3?

- Some in the firm perform business case analysis for planning and decision support, but the organization has no standard form and does not reuse cases.

- The organization develops elaborate Total Cost of Ownership (TCO) models, but these models only capture cost savings. The models do not capture or quantify other strategic benefits.

- There is much talk of business case analysis and ROI, but most people don't know how to do them.

- The organization models financial results in spreadsheets, but it does not reuse these models nor standardize results.

- Some individuals recognize the need for business case training.

- The organization has partial knowledge of its ROI on training, marketing, R&D, and projects, from a few ad-hoc case studies.

Maturity Level 4

Competency: Standardized

What is typical in Organizations at Level 4?

- The organization establishes internal business case standards.

- The organization has partial knowledge of its ROI on training, marketing, R&D, and projects from case studies, not through continuous monitoring.

- Business cases measure risks and identify critical success factors, using dynamic financial models and Monte Carlo simulation.

- There is a cross-functional, cross-organizational "Core team" with business case expertise.

- Funding requests above a specified level require business case support.

Maturity Level 5

Competency: Optimized

What is typical in Organizations at Level 1?

- Managers review business case results and hold people accountable for results.

- The company contracts with its customers with service level agreements and customer business performance targets.

- Leaders use business case projections and models for management and control throughout the life of the project or investment.

- There is a library of previous business cases and business case resources that everyone can access.

How Do Organizations Raise Competency Levels?

It's Not a Quick Fix. It's a Program, and it Takes Time

What does it take to establish competent business case practice in real-world organizations? Training? A good business case tool? Management directives? For most organizations, the answer is "all of the above and more." Establishing a competent business case practice requires a programmatic effort with several components.

Organizations that reach for a quick-fix point solution fail usually fail to establish long-lasting competency that benefits the organization. Sometimes, for instance, a senior manager (usually in Finance) creates business case templates, puts them on a website, with instructions, and requests that people use them. Management may even direct people to "get with the program" and require that proposals and funding requests use the approved templates. The usual result from this kind of point solution is that incoming business case reports seem to fit the mandatory format but do nothing to improve the quality of decision making or the confidence of decision-makers.

The organization begins moving towards higher business case competency as soon as its people understand fully that:

- Establishing good business case competency calls for program of actions. The program requirements below suggest actions that are essential.

- Reaching higher maturity levels takes time. It is difficult for large organizations to ascend more than one or two levels the maturity scale in less than a year.

- The Business Case Competency Program has multiple facets, involving cross-organizational Initiatives and senior managers, project managers, capital review committees, product managers, strategic planning staff, Finance, Accounting, the Budget Office, and anyone else who submits funding requests.

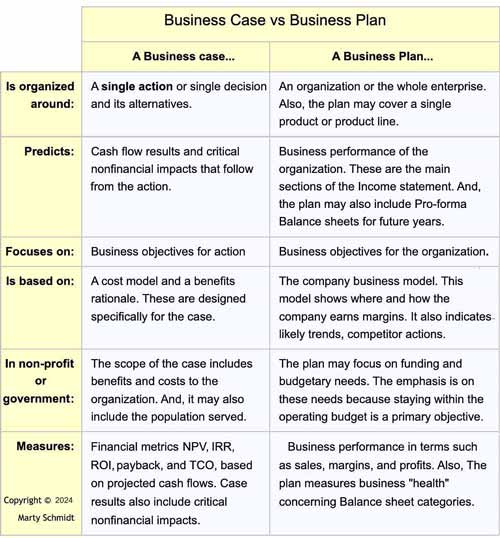

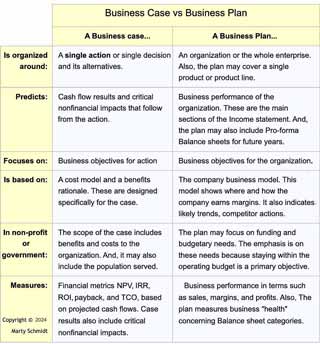

Business Case vs. Business Plan

How Are They Different? How Are They Related?

Some people in business use the terms business case and business plan more or less interchangeably. Some use one term when they mean the other. Responsible decision-making and planning, however, call for a precise understanding of each term's meaning and the differences between them.

As a result, prudent business case builders take care to be sure that everyone involved with the case understands these terms precisely.

In fact, the critical distinction between them is clear, simple, and easy to summarize.

The business case is about an action, while the business plan is about the business.

Questions For the Business Plan

The business plan addresses issues like these:

- What will the business look like in one year? In three years? In other words, what will financial position and earnings look like then?

- How can the business achieve those results?

- What sales, margins, and revenues can we expect next year?

- How long will it take for a start-up company to earn a profit?

The business plan answers such questions by providing:

- Predictions and target objectives for future financial results.

- Important risk factors that would bring different business results. The plan also presents strategies for dealing with threats and reducing risks.

- A business model. The model shows where and how the company expects to spend money, bring in revenues, and earn margins.

- Fundamental assumptions and trends for projecting business results. These may focus on business volume, market demand, and competitor actions. Management tracks these factors carefully and updates them when necessary.

- Guidance for setting and prioritizing business objectives.

- Spending and revenue forecast for budgeting and planning.

Questions for the Business Case

The business case focuses on a single action or decision. The business case addresses issues like these:

- What financial outcomes follow if we choose option X?

- Are there significant nonfinancial outcomes we expect under option X?

- What is the capital budget impact if we buy service vehicles instead of leasing them?

- How do we justify the investment in new phone technology? Is there a positive ROI?

The business case addresses such questions by projecting cost and benefit cash flows that follow from the action. Also, the business case also anticipates nonfinancial impacts on crucial key performance indicators.

Comparing the Business Case to the Business Plan

The table below summarizes and contrasts critical differences between the business case and business plan.