What is the Annual Report to Shareholders?

Annual Report messages aim to build confidence in the company's future.

Annual Reports: Mandatory for Public Companies

By law, public companies in most countries must publish an Annual Report to Shareholders before each annual meeting to elect directors. Regulatory bodies in some places also mandate requirements for additional reports with more detail. See the final section in this article for more on US Form 10-K, UK Form AR01, and Canadian Form AIF.

Annual Report Purpose

The Annual Report to Shareholders is essentially a "State-of-the-Company-Report," with two general purposes, or two levels of meaning.

Define the Annual Report Purpose

The Annual Report to Shareholders is essentially a "State-of-the-Company-Report," with two general purposes, or two levels of meaning.

- The official purpose of the Annual Report is to provide shareholder owners and investors with information on the company's recent financial performance and its current financial position. This information enables shareholders to make informed decisions when electing directors and when deciding whether to buy, sell, or hold shares of stock.

- The less official but genuine second purpose of the Annual Report targets a broader audience, including current shareholders and potential investors, but also company employees, customers, industry analysts, and competitors. For the broader audience, corporate officers and directors intend to build confidence in the company's future.

As a result, some businesspeople regard the annual report primarily as a marketing vehicle for the company and its management. The reader's challenge—as when reading any marketing message—is to decide which interpretations of historical data are reasonable or likely, and which are more speculative.

Those who read the typical annual report carefully will probably sense that challenge in every significant section of the document. Discussions below emphasize both the factual data and the underlying messages that officers and directors typically intend for each part of the annual report.

Annual Report Structure

Annual Reports to Shareholders in most countries have a structure similar to this description from the US Securities and Exchange Commission:

"The Annual Report to Shareholders is usually a state-of-the-company report, including..."

- An opening letter from the Chief Executive Officer.

- Financial data, to assess the company's financial position, results of operations, and key financial metrics.

- Notes on the financial data describing specific accounting methods and explaining the reasons for specific results.

- Management discussion and interpretation of topics.

- Market segment information: How the company defines its markets.

- New product plans.

- Subsidiary activities.

- Research and development activities on future programs.

What's the Message?

Sections below explain the contents of these items, emphasizing certain messages company officers may intend for different parts of the Annual Report audience.

Shareholder and Investor Audience

Shareholders and investors are the Annual Report's official reason for being. Reports inform shareholders for making decisions when (1) electing directors, and (2) deciding whether to buy, sell or hold the firm's shares.

For this purpose, Annual Reports present the mandatory financial statements and notes, but they also highlight any evidence the officers can find that shows:

- The firm's prospects for growth are excellent,

- The company is competing effectively.

- Management has known problems under control.

Employee, Customer, Industry Analyst, and Competitor Audience

Annual Reports often target this broader audience with presentations aiming to build confidence in the company's future, strengthen branding, and promote company business.

Contents

- What is an Annual Report to shareholders?

- What are the purposes and objectives for the Annual Report to Shareholders?.

- What, should the reader be looking for in the annual report?

- Why does the annual report include an opening letter to shareholders from the Chairman or CEO?

- What is the annual report Operating Review?

- Why does the annual report present "Market Strategy and Market Conditions"?

- What is the purpose of the annual report Management Discussion and Analysis?

- Which Financial Statements and Notes always appear in the annual report?

- What is the auditor's statement and why is it mandatory in the annual report?

- How does the annual report describe corporate governance? How does it identify company directors and officers ?

- What are the US Form 10-K, UK Form AR01, Canadian AIF?

Related Topics

- Selective "Earnings before ..." profit metrics:

See Earnings before interest and taxes. - Three margins: Gross margin, Operating margin, and Net profit margin.

See Margin.

- ROI metrics for company earnings from capital assets and equity.

See Profitability. - An overview of cash flow and financial statement metrics:

See Financial Metrics.

The Annual Report to Share Holders

Annual Report Purpose and Objectives

Most regulatory bodies declare their mission in a similar manner to the US Securities and Exchange Commission (SEC). The SEC states that its mission is…

"To protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation."

In the regulatory context, companies use annual reports to prepare for making decisions when (1) buying, holding, and selling stock shares, and (2) electing directors.

Given contemporary report-writing styles, and the ways that firms write and produce reports for shareholders, many people in business view annual reports essentially as marketing communications. In any case, current reports often look less like financial reports and more like high-quality marketing brochures—with striking images and graphics, creative typography, and glossy pages. Beyond the colorful, glossy pages, management comments present the company positively, emphasizing areas of competitive strength and operational excellence. Here, the audience in view extends beyond the investment community, to include company employees, customers, and competitors. For this group, especially, the report's broader purpose is to strengthen company "branding."

When reporting after a stressful or problematic year, companies use annual report comments as a vehicle for rebuilding investor and public confidence in company management and the company's future. After a challenging year, company officers try to signal that they understand the reasons behind current problems, that management is taking action to correct the issues, and that prospects for the future are good.

How Should You Read the Annual Report?

For What, Precisely, Should You Search?

As a regulatory instrument, the list of mandatory contents for the Annual report is a short list. Usually, one or more company Directors or Officers report and evaluate the company's earnings performance and financial position.

For the first three-quarters of the twentieth century, in most places, the list of mandatory financial statements was simply (a) the company Balance sheet and (b) the Income statement, and (c) notes interpreting these statements. In the last few decades, however, the list of mandatory financial statements grew to include also (d) a cash flow statement for the period (Statement of Changes in Financial Position), (e) a Retained Earnings statement, and (f) an auditor's statement.

Regulatory requirements have in mind the primary audience for annual reports, company shareholders, and potential shareholders. In writing, however, management has in mind a much broader audience, including also company employees, customers, competitors, industry analysts, government regulators, and the news media. All of these groups are have a strong interest in two fundamental questions: " How is the business performing?" and " What are its prospects for the future?"

In addressing these questions, companies usually exceed the regulators minimum content requirements. Companies in all industries, moreover, typically exercise a high level ofindividuality in report structure, contents, and style. Nevertheless, for a profit-making company in the private sector, the only ways to address the two fundamental questions above is to provide evidence and explanations for seven slightly more specific questions:

- Is the company operating profitably in its usual line of business?

- Does the company maintain or improve a robust financial position?

- Are sales revenues, profits, and market size growing?

- Is the company competing successfully? Is it gaining or losing market share?

- Does the firm make a good return on its asset base?

- Is the company using the best strategy for the future?

- Is the firm building value for owners (equity, dividends, and share price)?

When reading an Annual Report for the first time, it is helpful to keep in mind that the report—regardless of structure, contents, or style—aims above all to address these questions.

The following sections describe significant Annual Report content sections.

What is an Annual Report Operating Review?

The annuall report report may include one or more sections reviewing or reporting specific areas where the company wants to present and elaborate on significant achievements. These items may or may not appear in a group in a section with a title such as "Operating Review," and company officers may or may not individually sign these items.

Operating review items serve as "feature articles" highlighting company achievements. These items may cover, for instance, specific

- Operational improvements (e.g., productivity improvements in manufacturing).

- Product plans, product strategies, and product launches—past or future.

- Research and development activities.

Operating review items typically elaborate themes from the initial letter by the Chairman or CEO. The 2013 Annual Report for IBM, for instance, opens with Chairman's letter to shareholders ("Dear IBM Investor") and then presents three "chapters," with the following titles.

- 01. We are making markets by transforming industries and professions with data.

- 02. We are remaking enterprise IT for the era of cloud.

- 03 We are enabling systems of engagement

for enterprises. And we are leading by example.

Operating review items such as these aim to showcase examples of operational excellence, management effectiveness, and—most importantly—the wisdom on display in the company's strategy. IBM's three review items for 2013 appear as "The IBM Strategy."

Why Present Market Strategy and Market Conditions?

For companies in private industry that sell goods and services in competitive markets, the fundamental questions about business performance and prospects for the future require an understanding of the company's marketing strategy. The Annual Report audience will need to know:

- How the company defines its market and market segments.

- How the company describes its market strategy, and how the plan applies to different market segments.

- Which market segments are growing, which are stagnant, and which are shrinking.

- Evidence of new customer wins and strong customer relationships.

Annual Reports sometimes present this information in a section or chapter of its own, with a title such as Market Strategy and Market Conditions. Or, these subjects may appear in other parts of the report. Throughout the 2013 IBM Report, for instance, starting with the Chairman's opening letter and continuing through the other major content sections, the company's market strategy and market conditions are central to the discussion.

What is the Management Discussion?

Most Annual Reports include an extensive and detail-level section called Management Discussion, or Management Discussion and Analysis. Here, management comments in depth on the recent period's financial performance and financial position, but also on other many other topics they deem essential to the report audience, such as:

- Earnings performance by business segment or division

- Performance of subsidiaries

- Strategic successes

- Product and marketing achievements

- Research and development activities

- Company re-organization

- Management appointments

- Mergers, acquisitions, and alliances

- Shareholder matters (notes on share offerings, share ownership, and earnings-per-share performance)

- Employee matters (such as changes in employee headcount, or policies on employee pensions and benefits)

Management Discussion sections can be lengthy with specific details. In the IBM 2013 Report, this section covers 52 pages of small-print text.

Expect Financial Statements and Detail Notes

Annual Reports aim, firstly, to provide investors, owners, and others, with the information they need to evaluate the company's recent financial performance, the strength of its financial position, and its prospects for earnings in the future. The central and primary documents that serve this purpose are—in the minds of most report readers—the financial statements and financial notes, appearing at the heart of the Annual Report under the heading Financial Statements.

The Financial Statements section is arguably the Annual Report's reason for being. Most of the other report sections essentially concern interpretations of the financial statements. Other parts may present vital business metrics, for instance, that derive from financial statement data (such as Return on Assets, Working Capital, Inventory Turns, or Earnings per Share). In the Financial statement section, however, the source data themselves appear—along with extensive annotations. The company may or may not include some other parts of the report, and the company is free to structure these as it desires.

The Four primary financial statements—and the annotations—are mandatory. These statements, moreover, must conform to accounting conventions from the country's Generally Accepted Accounting Principles (GAAP). Also compulsory is an independent auditor's review of the financial statements, with an auditor's opinion, indicating that the reports either do or do not conform to GAAP.

Note that the discussion below on financial statements describes accounting practice for companies that use accrual accounting and a double-entry bookkeeping/accounting system, as almost all public companies do.

Financial Statements sections usually feature the following components:

Financial Results Highlights

Financial results highlights typically appear in a simple table of 10-20 essential performance and financial position measures, including metrics such as net profit, operating profit, gross profit, working capital, cash on hand, return on assets, and earnings per share. A subsection or table with this title may also appear other places in the Annual report, including the Chairman's opening letter and the Management discussion section.

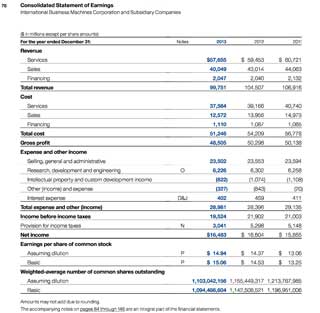

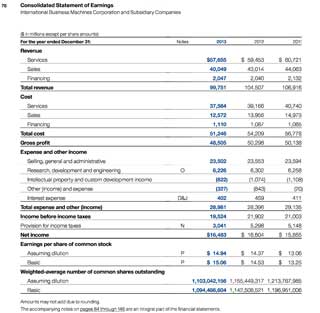

Statement 1.

Income Statement (Statement of Earnings, Profit & Loss Statement)

The Income Statement or Statement of Earnings for the period provides measures of profits and profitability. Net profit, for instance, appears as the income statement "bottom line," in currency figures. Profitability, on the other hand, is net profits as a percentage of revenues.

The company's Chart of Accounts provides five categories of accounts for the accounting system. The Income statement represents the periods activity from accounts in two of these categories, Expense accounts, and Revenue accounts. The statement arranges figures from these accounts to represent the Income Statement Equation:

Earnings (Income) = Revenues – Expenses

Statement 2.

Balance Sheet (Statement of Financial Position)

The company's Balance Sheet uses account balances from the Chart of Accounts other three categories of accounts, Asset accounts, Liability accounts, and Equity accounts. The balance sheet structure uses figures from these accounts to represent the Balance sheet equation (or Accounting equation):

Total Assets = Total Liabilities + Total Equities

The Balance Sheet shows, in other words, what the company has to work with for earning profits (Assets), what the company owes creditors (Liabilities), and what the shareholders own outright (Equities). Metrics from the Balance sheet include the Debt to equity ratio, a measure of leverage representing the company's capital structure. Leverage determines, for instance, how company owners and creditors share business risks and rewards.

Statement 3.

Statement of Changes in Financial Position SCFP,

or Cash flow statement)

The Statement of Changes in Financial Position summarizes cash flow for the reporting period and the SCFP "bottom line" is just that--the net of actual cash inflows and outflows for the period. Other financial statements include noncash transactions, such as depreciation expense, bad-debt write off, and unrealized revenues. For companies that use accrual accounting,

- The timing and management of revenues and expenditures (Income statement items) are critical for reporting earnings, determining taxes, and declaring dividends.

- The timing and management of cash flow (SCFP items ) are critical for meeting obligations and needs: Paying employees, paying interest on loans or bonds, or investing in new product development or an infrastructure upgrade, for instance.

The SCFP structure represents the Cash flow statement equation:

Changes in Cash = Sources of Cash – Uses of Cash

Statement 4.

Retained Earnings Statement

The Statement of Retained Earnings serves as a bridg" between the income statement and balance sheet. This report shows how income statement profits either transferred to the balance sheet as "Retained earnings," or to shareholders as "Dividends." The Statement of Retained Earnings Equation is as follows:

Net Income = Dividends paid on Preferred stock

+ Dividends paid on Common stock

+ Retained earnings

Retained Earnings = Net Income

– Dividends pd on pref stock

– Dividends pd on Common stock

Textbooks often present the highest level objective for public companies in private industry as "Increasing owner value." The retained earnings statement is the "bottom line" statement on changes in owner value for the period.

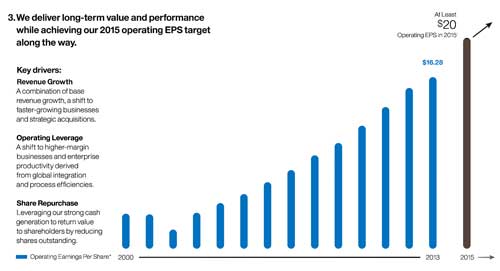

10-20 Year Financial Data History

Companies put the current results in historical context, to address questions about company growth in revenues, earnings, and metrics such as earnings per share. For that reason, annual reports typically include 10-20 year summaries of Income statement and Balance sheet results. Here, for instance, is the summary FROM the IBM 2013 report summarizing earnings per share growth for the period 2000-2013.

In this case, IBM communicates the "steady growth" message, along with implications for the future.

Notes on Financial Statements

Financial statements presented in Annual reports must conform to GAAP, and annual reports must include an auditor's statement affirming that conformance. Nevertheless, accountants have considerable freedom within GAAP to choose among specific accounting methods, in many cases. A "Notes on Financial Statements" section is mandatory, where the company is required to describe accounting choices exercised and their impact on financial statements. necessary information in the "Notes" includes such things as:

- Choice of depreciation or amortization schedules

- Methods for revaluing assets or securities investments

- Methods for handling employee benefits accounting

The "Notes" section, incidentally, often occupies more Annual reports pages than the financial statements themselves. The IBM 2013 Report, for instance, devotes 62 pages of small-type text to "Notes on "Consolidated Financial Statements."

The Annual Report Auditor's Statement

Why is an Auditor's Opinion Mandatory for Public Companies?

Annual reports are necessary for every country with a stock exchange, where companies sell shares of stock to the public. Annual reporting requirements exist, everywhere, because governments regulate the trading of ownership shares. The requirement that companies send an Annual Report to shareholders before an annual meeting is nearly universal, as is one more item: The firm must accompany the Annual report with the written: Opinion of an independent 3rd-Party Auditor:

Auditors issue an "Auditor's Opinion" (or "Auditor's Statement," or "Auditor's Report") after they review the company's financial statements and—insofar as they are able—verify the accuracy of data and the judgments of the company accountants. The auditor's comments do not pass judgment on the company's financial performance or financial position. Even with the most favorable possible Auditor's opinion (an opinion of "Unqualified"), the report assures the public only that the auditor has examined the financial statements and is of the opinion that they present information fairly and in conformance with Generally Accepted Accounting Principles (GAAP).

For example, at the top of this section is the full text of the statement from PricewaterhousCoopers (PWC) to the IBM Annual Report for 2013 filed February 2014). This statement essentially states the "Unqualified" opinion in the opening lines:

"In our opinion, the accompanying Consolidated Financial Statements appearing on pages 78 through 146 present fairly, in all material respects, the financial position of International Business Machines Corporation and its subsidiaries at December 31, 2013 and 2012 and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013 in conformity with accounting principles generally accepted in the United States of America."

Auditor's statements such as the above typically appear on a report page of their own, close to the presentation of company financial statements. Here, PWC did not explicitly classify their judgment by name, but the statement by PWC essentially describes the highest and most favorable outcome for an audit, an unqualified opinion. A favorable audit outcome is necessary for acceptance by regulatory authorities, lenders (banks, bondholders, and investors).

Presenting Corporate Governance

How Does the Annual Report Identify Officers and Directors?

Companies send the Annual Report to Shareholders just before their annual meetings, which they hold to elect directors. Reports therefore include, ostensibly, all critical information that shareholders need to make informed voting decisions. This information includes at least a brief description of corporate governance responsibilities and the identities of current Directors and corporate officers. The list of corporate officers usually consists of the "C" level executives (e.g., CEO, CFO, or CIO) the President, and Senior Vice Presidents.

Leadership information is sometimes minimal, appearing on the final pages of the report, listing nothing more than name, position, and affiliations. Alternatively, more abundant governance and leadership information sometimes appears in the early pages and includes brief biographies, years of service, and educational backgrounds as well.

In any case, however, however, leadership information in the Annual Report is not overtly positioned as "campaign" material for the forthcoming election of Directors. Overt solicitations for support in the Directors election—if present— is sent separately to individual shareholders, either by candidates or by those who are gathering proxy votes for them.

Other Forms Required For Regulators and Tax Authorities

Besides the Annual Reports to Shareholders, public companies in some countries must publish quarterly and annually another report with more detail that is more comprehensive than the Annual Report to Shareholders. The primary audience for these additional reports includes regulatory bodies and tax authorities.

United States

- In

the United States, the Securities and Exchange Commission, describes its mission as follows: "To protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation."

The SEC requires public companies to produce and send the Annual Report to Shareholders before annual meetings, but the SEC also quarterly and yearly reports on SEC Form 10-K, within 90 days of the end of the reporting period. In SEC terminology, the shorter term "Annual Report" refers to the Form 10-K report.

United Kingdom

- United Kingdom reporting requirements are the responsibility of the Financial Reporting Review Panel (FRRP), a subsidiary of the United Kingdom's Financial Reporting Council (FRC). The FRRP describes its mission "...to ensure that the provision of financial information by public and large private companies complies with relevant accounting requirements such as the Companies Act 1985."

The FRRP requires public companies to send an annual report to shareholders, including at a minimum (1) A Balance sheet, (2) Profit and loss summary (Income statement), (3) notes on the financial statement, and (4) a Director's report.

Public companies in the UK must also file a comprehensive report, with more detail, usually as Form AR01, the Annual Return. They must submit the Annual Return each year with the registrar of companies (Companies House) within 28 days of the company's anniversary of incorporation.

Canada

- The Canadian Securities Administration (CS) is responsible for publishing reporting requirements for Canadian public companies. The CSA is an umbrella organization for the country's provincial and territorial securities regulators. CSA states that its mission is "to improve, coordinate and harmonize regulation of the Canadian capital markets."

- Public companies that trade on the country's exchanges must send an annual report to shareholders before yearly meetings, but these companies must also file a more comprehensive report with more detail, usually as Annual Information Form (AIF). Most AIF Issuers must submit their annual information forms within 90 days of year-end.

Other Countries

- Other countries, however, have nothing comparable to the Forms 10-K, AR01, or AIF requirements (e.g., India, and Australia).