Meanings and Messages in Margins

Sellers have a keen interest in their product margins. Financial officers see margins as the heart of the business model. Investors view margins as the key to leverage benefits.

For businesspeople in commerce, finance, and investing the term "Margin" has at least three different meanings:

Definition 1:

Margin on Sales

As a general term in business and commerce, margin is the difference between selling price and the seller's costs for the goods or services on sale, as a percentage of selling price.

A retail shop owner, for instance, may purchase goods inventory from a supplier at a cost of $8 per item. If the product sells for $10, the shop earns a margin on sales of 20% on it.

The shop owner's margin on sales includes only the seller's direct cost for products or services. The margin on sales does not reflect expenses for selling them (such as the store leasing fees or marketing costs, or salesperson wages), and not business overhead costs (such as computer systems for the business or management salaries). However, operating costs and overhead costs do factor into other margins—the operating margin and net profit margin for the business.

For example calculations and more on using "Margin on Sales" see the section below:

Definition 2:

Margins for Analyzing and Reporting Earnings

In financial accounting, margin refers to three specific Income statement ratios for reporting earnings calculations. Each of these margins normally appears as a percentage of sales revenues.

- • Gross Margin.

- • Operating Margin.

- • Net Profit Margin.

Owners, managers, and analysts use three of these margins as measures of a company's earning performance.

Each Income Statement margin is a ratio made from components of the basic Income Statement Equation:

Income = (Sum of Revenues) – (Sum of Expenses)

The Margin ratio is:

Margin = Income / (Sum of Revenues)

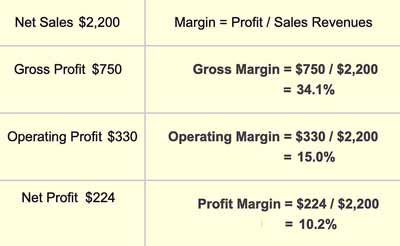

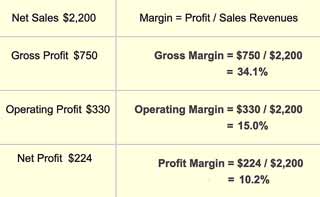

A firm reporting a net income of $224 and revenues totaling $2,200, for instance, is reporting a Net profit margin of $224/$2,200 or 0.102. This will normally be discussed and presented as a percentage, such as 10.2%. Here, "Net Profit Margin" has the same meaning as "Profitability." For more examples Gross margin, Operating Margin, and Net Profit Margin, see the section below:

Definition 3:

Margins in Investing

As an investment term, margin refers to buying shares of stock or other securities with a combination of the investor's funds and borrowed funds. That practice is called buying on margin.

If the stock price changes between its purchase and sale, the result for the investor buying on margin is leverage.

Leverage means that that the investor's percentage gain or loss magnifies relative to compared to the percentage gain or loss had the investor purchased shares without borrowing.

For more examples Gross margin, Operating Margin, and Net Profit Margin, see the section below:

Explaining Margins in Context

Sections below further define and illustrate the margin concept in all three senses. Examples appear in context with related terms emphasizing three themes:

- First, margins from the seller's viewpoint, including margins in retail sales and business-to-business sales.

- Second, margins in financial reporting, especially gross margin, operating margin, and net profit margin.

- Thirdly, the margin concept for investors, where margin means investing with borrowed funds.

Contents

Margins in Business Commerce

Margins are the heart and soul of business performance measurement. Owners and managers at retail shops, product manufacturers, wholesalers, and service providers all take a keen interest in tracking their margins throughout the accounting period.

The Seller's Viewpoint

Sellers (vendors) generally refer to the margin as the difference between their cost for an item and the selling price, expressed as a percentage of the selling price.

- The difference between seller's cost and the selling price, itself, is known as markup express markup as a percentage of their cost.

- The term margin used in this way means the same thing as margin on sales.

Calculating Margin on Sales

Consider, for instance, a product with the following characteristics:

Unit cost to Seller: $100

Markup: 25%

Selling price = Cost + (Cost x Markup %)

Selling price = $100 + (0.25) x ($100)

= $125

Margin = (Selling price – Cost) / Selling price

Margin = ($125 – $100) / $125

= $25 / $125

= 20%

Setting Prices and Choosing a Markup Percentage

Selling price may be the direct choice of the seller, or a chosen markup percentage may determine the selling price.

- In retail businesses, sellers typically use a pricing model that designates a given markup percentage. In such cases, the selling price is determined entirely by the seller's cost and the prescribed markup percentage. By this approach, the seller can achieve a target margin level.

- Where there is a competitive market, however, sellers may have to designate a price based on prevailing market prices and merely accept the resulting markup and margin.

When margin refers to this kind of margin on sales, the term has in view only the seller's costs for items sold. The margin on sales does not include the seller's overhead costs for such things as store leasing fees. Nor does it cover general overhead costs for such things as management salaries. Here, the term is very close in meaning to what accountants call gross margin (see following sections).

Margins in Reporting Earnings and Profits

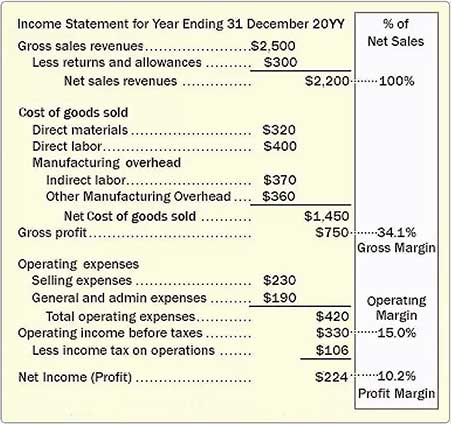

The term margin, in accounting and financial reporting, refers to any of three "profit" lines on the Income statement. A margin, precisely, is a profit figure expressed as a percentage of the company's net sales revenues.

Income Statement Profits

The Income statement generally shows how income figures result by subtracting the entity’s costs and expenses from its total sales revenues.

Income = All Revenues - All expenses

Note, by the way, that reported income, revenues, and expenses do not necessarily represent real cash inflows or outflows. They are not necessarily cash flow, because regulatory groups, standards boards, and tax authorities, allow or require companies to use conventions such as depreciation expense, allocated costs, and accrual accounting on the Income statement.

Actual cash flow gains and losses for the period are reported more directly on another reporting instrument, the Statement of Changes in Financial Position (or Cash Flow Statement).

Three Profits and Three Margins

Bottom line net income on sales (net profits on sales) is a measure of the company's financial performance for the period, but the Income statement contains other performance metrics as well.

The difference between net sales revenues and cost of goods sold is called gross profits, for instance, while the net income from operations—before taxes and before gains and losses from financial and extraordinary items—is called operating income (or operating profits). "Operating profit," in other words, represents the firm's earnings from operations in its usual line of business.

All three of the profit lines from the Income statement can also appear as a percentage of net sales, that is, as margins. Exhibits 1 and 2 below shows the possibilities.

- Firstly, gross margin is gross profit divided by net sales as shown in the table below.

- Secondly, operating margin is operating profit divided by net sales.

- Thirdly, the net profit margin is net profit divided by net sales.

Note, however, that in some cases the Income statement does not distinguish between gross sales and net sales revenues. In those cases, margin figures must, of course, represent percentages of "gross" sales.

In brief, margins serve as essential profitability metrics, of keen interest to company management, employees, competitors, and shareholders.

More Income Statement Resources

Margin in Borrowing Funds for Investing

Investing on Margin Creates Leverage

Investors who buy shares of stock or other securities partly with their funds, and partly with funds borrowed from the broker, are buying on margin.

How Does Margin Create Investor Leverage?

Buying on margin creates leverage. Leverage provides the investor with an opportunity to magnify investor gains from a given size if the stock price rises. At the same time, buying on margin increases investment risk, because the investor's losses also increase if the stock price if the stock price falls.

Example: Stocks Rise, Investors Gain

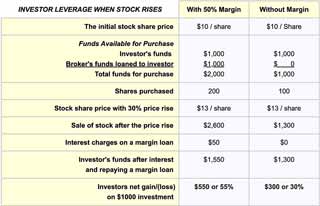

The table below shows how the investors gain by investing $1,000 of their funds when the stock price rises. The gain is shown both with "buying on margin" (middle column) and without margin (right column).

Example: Stocks Falls, Investors Lose

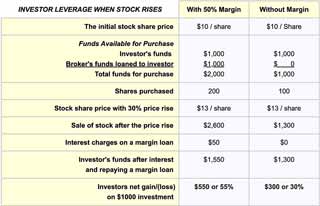

This table shows this effect for two situations: (1) with margin buying allowed (middle column) and (2) without (right column).

Margin Calls With Share Price Drop

When the stock price falls, moreover, the broker may send a margin call to the investor, requiring that the investor contribute funds to restore the original equity (ownership) balance in the position. As an example, consider the "loss" scenario above:

- The broker initially contributed 50% towards the total purchase price of $2,000. As a result, the investor owes the broker 50% of the stock value ($1,000).

- After the 30% reduction in stock price, to $7 per share, the market value of the 200 shares fell to $1,400. However, the investor still owes the broker $1000.

- The broker originally took a 50% equity position in the investment purchase. After the price drop, the broker's equity position rose to about 71%. ($1,000 is 715 of $1,400). At this point, the broker issued a margin call.

- To bring the broker's stake in the investment back down to the original

50% level, the investor must pay the broker's margin call.

Paying the margin call means that the investor must repay part of the initial margin loan. In this case, the investor must pay the broker about $300 to restore the broker's equity stake to 50%. After paying for the margin call, the investor owes $700 to the broker, because the 200 shares are now worth $1,400.