What is a Ledger?

Should anyone ask for the current balance of any accounting system account, the ledger provides the information.

Bookkeepers and accountants rightly view the ledger as the centerpiece of the accounting system. The ledger is the "go-to" place for anyone with questions about the state or recent history of accounting system accounts.

Define Ledger

The Ledger is a paper or electronic book or record for collecting historical transaction data from a journal and organizing entries by account. The ledger provides the transaction history and current balance for each accounting system account, throughout the accounting period

At the end of the period, therefore, the ledger is the authoritative data source for building the organization's financial accounting reports, including the income statement and balance sheet.

- The Income statement is essentially a summary of account activity for the period in the firm's Revenue and Expense Accounts.

- The Balance sheet is essentially a summary of the current balances in the firm's Assets, Liabilities, and Equities accounts, as they stand at the period end.

Sections below further define, explain and illustrate ledger in context with similar terms and concepts, emphasizing three themes:

- First, the ledger's role in the accounting cycle, the nature of posting, and practices in "continuous accounting."

- Second, how firms record and organize transactions of various kinds through the Journal, Sub-Ledger, and General Ledger.

- Third, Ledger structure and contents, including the T-account Structure

Contents

The Ledger Role in the Accounting Cycle

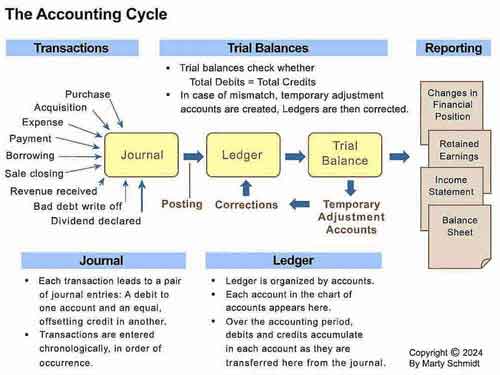

Exhibit 1. The accounting cycle. Transactions enter the journal as the first and second steps in the accounting cycle. The journal is a chronological record, where entries accumulate in the order they occur. Journal entries transfer (post) to a ledger, as the third step. Ledgers organize entries by account.

The ledger is rightly called the centerpiece of the accounting cycle. The accounting system and the firm's financial reports, after all, are "all about" the firm's accounts—their balances and transaction histories. The ledger is the authoritative source on this information, for all accounts in the system. This section further describes the ledger's role in several steps of the accounting cycle.

The Accounting Cycle

Exhibit 1 shows the significant steps in the accounting cycle, using accrual accounting and the double-entry bookkeeping system. The overwhelming majority of companies and organizations, worldwide, use this approach.

- First, business transactions of many kinds occur, which must ultimately impact the firm's accounts. Earning revenues, incurring expenses, and many other transaction activities are the first step in the accounting cycle.

- Second, transactions usually enter the accounting system as journal entries—the second step in the cycle. The journal records transaction entries chronologically, that is, in order as they occur.

- Third, journal entries transfer (post) to the ledger. The ledger organizes transactions by account, revealing each account's transaction history and current balance.

- Fourth, just before the end of the reporting period, accountants use account balances and transaction histories to create a trial balance. The primary purpose of this cycle step is to check ledger accounts for accuracy by trial balance. The trial balance should find that total debits equal total credits across all accounts. They perform other kinds of error-checking at this time, as well, making corrections and adjustments when necessary.

- Fifth, the firm ends the cycle by publishing financial statements (financial reports). The Income statement, Balance sheet, and other statements, essentially, consist of account balances and account histories for the period just ending.

The Age of Continuous Accounting

Historically, journals and ledgers were always bound notebooks in which bookkeepers hand wrote entries shortly after the firm closes a sale, incurs an expense, earns revenues, or any other event that impacts the company's accounts.

Today, of course, journals and ledgers usually exist as software and data records in the firm's accounting system. Bookkeepers in large firms still make transaction entries, of course, but quite a few other individuals may also contribute entries as well. Entries are created manually, through onscreen forms, but many entries are also made automatically (for instance, by a point of sales system).

Electronic accounting systems, moreover, usually provide user guidance and error-checking, to help ensure that transactions impact the appropriate accounts and that debit or credit entries register correctly.

The software also automates other stages of the accounting cycle, including the third stage—posting journal entries to a ledger. Until the middle of the twentieth century, when bookkeeping and accounting meant handwritten notes on paper, the posting of journal entries to ledger accounts was infrequently done during the accounting cycle. However, with electronic systems, journal entries can post to the ledger continuously. And, systems check for errors, continually. Finding errors and making corrections need not wait for the end-of-cycle trial balance period.

The practice of keeping accounting systems always up to date—ready for closing out at any time—is known as continuous accounting.

General Ledger vs. Sub-Ledger

How General and Sub-Ledgers Work Together

General Ledger Accounts

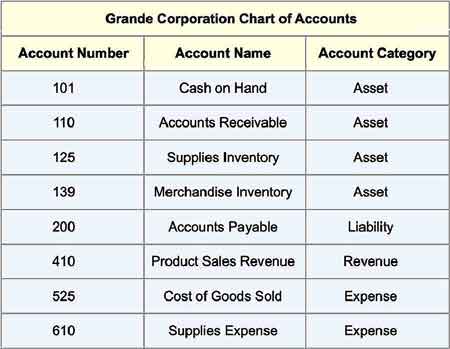

The complete list of accounts that can appear for the organization's journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger is the "top level" ledger.

Each account has a balance, or account value, which can rise and fall as transactions occur. Account summaries in the ledger show at a glance transaction activity for a designated period as well as the current account balance (or, at least, the balance after journal entries were last posted).

Anyone asking questions such as "What is the current cash account balance?" or, "Are sales revenues running ahead of expenses?" should find up-to-date answers in the ledger account summaries.

Ledger T-Accounts

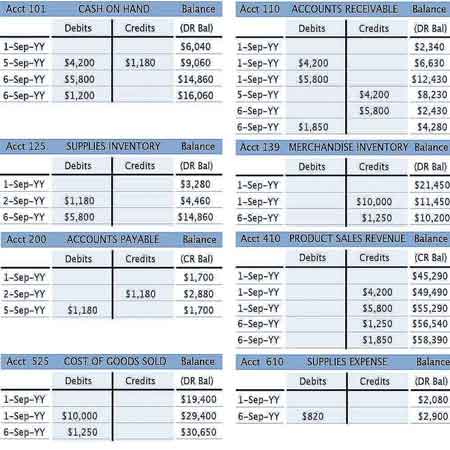

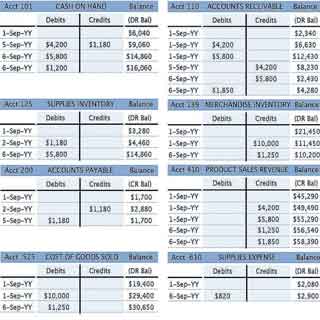

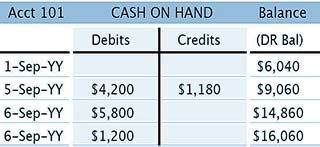

The signature ledger display is the T-Account. Exhibit 2 represents a few entries in one T-Account for this accounting system's Account 101, "Cash on Hand."

Figures under Debits and Credits are the result of posting transactions to the T-account from the journal. Because Cash on Hand is an Asset account, it carries a so-called Debit balance. As a result, debit entries increase the balance and credit entries decrease it.

Sub-Ledgers and Controlling Accounts (Master Accounts)

In large organizations, the Chart of Accounts may include hundreds of different accounts. In such cases, it may be helpful to use not just one ledger (the general ledger), but also use with it a set of sub-ledgers (subsidiary ledgers). Sub-ledgers have the same organization as the general ledger, except that sub-ledgers may include only a few accounts from the Chart of Accounts.

Companies use sub-ledgers to put some accounting data management into the hands of people who engage directly in transaction activity. A "Sales Account" sub-ledger, for instance, might hold only sales-related accounts, such as "Product sales revenues," "Accounts receivable," "Shipping expenses," and "Cash receipts from sales."

The sub-ledger, moreover, may list information that does not go into the general ledger, but which is useful to sales managers. This information could include the identities of individual salespeople, for instance, or customers, or product lines, or specific regions.

When firms use sub-ledgers in this way, they associate sub-ledger entries with specific accounts in the general ledger. One general ledger account, for example, "Product Sales Revenues" can represent the "roll up," or aggregate of several different "Regional product sales revenues" entries from different regional sub-ledgers. In such cases, the general ledger account is the controlling account or master account for the contributing sub-ledger accounts.

Transactions For Different Accounts

Debit and Credit Impacts in 5 Account Types

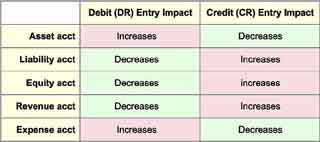

The kind of impact that a debit or credit that a transaction makes on each ledger account depends on which of five Chart of Account categories the includes the account.

Firstly, Three "Balance Sheet" Account Categories:

1. Asset accounts: Resources of value the business owns and uses.

Example: Cash on hand.

Example: Accounts Receivable.

2. Liability accounts: Debts the business owes.

Example: Accounts Payable.

Example: Salaries Payable.

3. Equity accounts: The owner's claim to business assets.

Example: Owner Capital.

Example: Retained Earnings.

Secondly, Two "Income Statement" Account Categories:

4. Revenue accounts: These can be, for example, earnings from selling goods and services, or investment income, or extraordinary income.

Example: Product Sales Revenues.

Example: Interest Earned Revenues.

5. Expense accounts: Expenses incurred in the course of business.

Example: Direct Labor Costs.

Example: Advertising Expenses.

In practice, even a small organization may list a hundred or more such accounts as the basis for its accounting system, and most organizations use many more. Nevertheless, for bookkeeping and accounting purposes, all named accounts fall into one of the five categories above.

Adding and Subtracting With Debits and Credits

In double-entry accounting, every financial transaction brings at least two equal and offsetting account changes. The change in one account is called a debit (DR), and the impact in another is called a credit (CR). Whether a DR or a CR increases or decreases the account balance depends on the kind of account involved, as Exhibit 3 below shows.

Journal Account Entries

Suppose, for example, that a company acquires assets with $100,000. The journal entry for the acquisition will show that an asset account increases $100,000. This entry could be impact, for instance, an account "Factory manufacturing equipment." Because this is an asset account, its balance increase is a debit. However, the balance sheet is now temporarily out of balance until there is an offsetting credit of $100,000 to another account, somewhere in the system. The entry could be, for instance:

- A credit of $100,000 to another asset account, reducing that account value by $100,000. That account could be the asset account "Cash on Hand," representing cash for the asset purchase.

- If instead of using cash, the firm finances the purchase with a bank loan, the offsetting transaction in the journal entry would be a credit to a liability account. The result of that transaction could be a $100,000 increase to the liability account "Bank loans payable,"

The debit and the credit from the acquisition will appear together in the journal entry, but when they post to the ledger, each impact a different ledger account summary (see the journal and ledger entry examples below).

When the journal entry is complete, the fundamental accounting equation holds and the Balance sheet—as always—balances.

Assets = Liabilities + Equities

And, for the account journal entries that follow from a single transaction:

Debits = Credits

The Role of Contra Accounts

The bookkeeper or accountant dealing with journal and ledger entries faces one complication, however, in that not all accounts work additively with each other in financial accounting reports. In some cases, one account offsets the impact of another account in the same category. These are the contra accounts that "work against" other accounts in their categories.

Contra accounts work against others in the same category by reversing the debit and credit rules in Exhibit 3 above. For example, an "Accounts receivable" account and an "Allowance for doubtful accounts" account are both asset accounts. Note especially:

- "Accounts Receivable" carries a debit balance, meaning that a "debit" transaction to this account increases the account balance.

- "Allowance for Doubtful Accounts," however, is a "contra asset account ." The purpose of this account is ultimately to reduce the impact (balance) "Accounts receivable" contributes to the asset base.

- The contra asset account "Allowance for doubtful accounts" carries a credit balance, which means its value increases with a credit transaction.

When these journal entries make their way into financial reports, the Balance sheet result is a "Net Accounts Receivable" that is less than the Accounts receivable value.

In any case, the bookkeeper or accountant working with journal and ledger entries needs to have a solid command of double-entry bookkeeping rules. It also helps to have accounting software that provides clear guidance and careful error checking.

Entries for Accounts in the Chart of Accounts

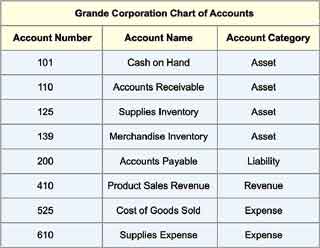

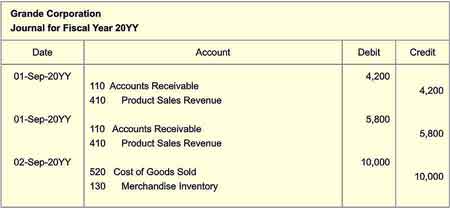

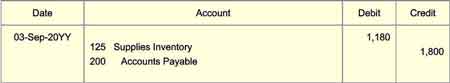

This section illustrates journal entries and their contribution to ledger entries for a small subset of one company's chart of accounts. The examples involve only the very concise chart of accounts in Exhibit 4:

In reality, of course, the full chart of accounts, journal, and ledger will include many others not shown here. However, for one week's activity affecting these accounts, the journal and ledger entries might appear as the following section shows.

Example Journal Entries

On 1 September, two customers place product orders, on credit. Customer1 orders $4,200 in products, and Customer 2 orders $5,800 in products. The company ships the products the next day, 2 September.

Journal Entry for 3 September

On 3 September, the company places a $1,180 order for office supplies:

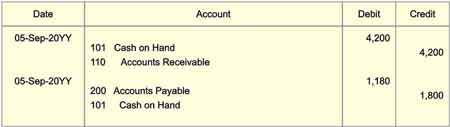

Journal Entries for 5 September

On 5 September, a written check from Customer 1 arrives ($4,200), and the company sends its bank check to the office supplies vendor ($1,180) for supplies ordered on 2 September:

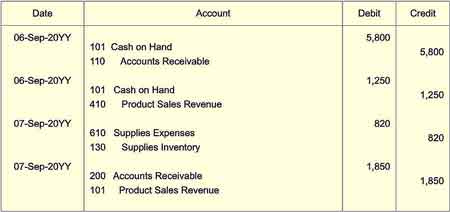

Journal Entries for 6 and 7 September

Four more events occur on 6 September:

- Customer 2 pays for goods in the 1 September order with a credit card ($5,800).

- Customer 3 uses cash to purchase products worth $1,250. The customer takes delivery immediately.

- Accountants find that supplies worth $820 have been used up since the last check of the supplies inventory.

- Customer 4 places a credit order for products ($1,850). This order did not ship by the day's end.

These transactions appear as follows;

A fast scan of the journal entries shows clearly that one part of the accounting equation holds, at least for these entries: Total debits = Total credits. The journal page shows clearly that every journal debit pairs with an equal, offsetting credit. The example also shows, that the journal, like the ledger, follows the practice of listing debit figures to the left of their companion credit figures.

The journal page does not show directly, however, whether or not the company is gaining or losing money. That picture is not entirely in view until the accounting period ends and ledger account balances come together on the income statement. That picture becomes more evident, however, when journal entries such as those above post to the ledger. The ledger summarizes transactions by account, showing each account's debits and credits. Ledger summaries usually show also how different account balances are running (e.g., balances for expense accounts and balances for sales revenue accounts).

Example Ledger Entries

The second step in the accounting cycle is posting journal entries to the entity's general ledger. And, this step sometimes includes "posting" entries to various sub-ledgers as well.

Historically, when journals and ledgers were sewn-page notebooks, and bookkeepers and accountants made entries by hand, with pen and ink, accountants posted journal data into ledgers only periodically. That meant that they knew account balances only through the most recent posting. Software systems, however, usually update ledger accounts frequently or even continuously. Thus, running account balances in the ledger are always current, or nearly so, as Exhibit 4, below, suggests.

Account summaries in the ledger usually appear as T-accounts, as Exhibit 2 above shows. Exhibit 5 shows the T-account version for the eight accounts in Exhibit 3 and the journal entry examples above.