What are Non-Cash Accounts?

Non-Cash revenues and expenses impact the Income Statement bottom-line just as their cash counterparts do

Define Non-Cash Account

An organization's Chart of Accounts normally includes a few Non-cash Revenue accounts and Non-cash Expense accounts. Non-cash accounts are so-named because they record only transactions that do not involve the payment or receipt of cash funds. For example …

- "Depreciation Expense" is a non-cash Expense account.

- "Accrued Revenues" is a non-cash Revenue account.

Non-cash accounts conform to the accounting definitions for expenses and revenues because they ultimately decrease or increase owner's equity on the Balance sheet, jin the same way that cash-account expenses and revenues impact owner's equity.

Non-Cash revenues and expenses impact the Income statement "bottom-line" in the same way that cash revenues and expenses raise or lower net profits. Non-Cash accounts, however, have no impact on the firm's reported net cash flow for the period.

Explaining Non-Cash Account in Context

This article further defines and describes the terms Non-Cash accounts, Non-Cash revenue, and Non-Cash expense, in the context of related concepts from accounting, finance, and business analysis. Sections below focus on two themes:

- Defining Non-Cash revenues and expenses, and how Non-Cash sums compare to cash expenses and revenues.

- The role of Non-Cash revenues and expenses in deriving actual cash flow totals on the Statement of Changes in Financial Position (the Financial Cash Flow Statement).

Contents

What Are Non-Cash Revenues?

The Non-Cash Revenue accounts include items such as accrued revenues (or unrealized revenues). A company may earn certain "revenues" in the current accounting period by closing a sale and shipping goods, but these are Non-Cash revenues until the customer pays. Accountants sometimes call such revenues unrealized revenues. In any case, these revenues will remain Non-Cash revenues until either of two events occurs:

- The customer makes a cash payment.

- The seller decides that payment will not be forthcoming, in which case the seller can write-off the unrealized revenues as bad debt.

In accrual accounting, firms report Non-Cash revenues as earned revenues on the Income statement, but they cannot add to the cash inflow total on the cash flow statement.

What Are Non-Cash Expenses?

Transactions in Non-Cash Expense accounts meet the textbook definition of expense: Generally, they decrease owner’s equity by using up assets. They do not represent actual cash flow, however. The most common Non-Cash accounts are for depreciation expenses, but others include amortization and bad debt expenses.

Non-Cash expenses appear on the Income statement to reduce bottom-line earnings, thereby lowering taxes. Consider, for instance, a company buying an expensive asset entirely with cash:

Buyer's Cash Holdings on Balance Sheet Decrease By Full Purchase Amount

When money flows to the vendor, the buyer enters the full purchase amount as a Credit (CR) to one of the buyer's asset accounts, most likely "Cash on hand." In double-entry accounting, a credit transaction decreases the balance in an Asset account. In other words, the payment action reduces the buyer's cash holdings by the full amount of the purchase.

At the end of the reporting period, the full purchase amount appears on the buyer's cash flow statement (statement of changes in financial position, SCFP) under "Uses of cash."

The Buyer's Income Statement Reports Expenses Less Than Purchase Amount

On the buyer's Income statement for the period, however, only part of the purchase amount appears, and this in the guise of a depreciation expense. The full purchase amount (or most of it) arrives piecemeal in this way, distributed across several years or more (as the depreciation schedule prescribes) for the asset).

Non-Cash Depreciation Expense Helps Apply Matching Concept

Spreading an asset purchase expense across several years of asset life helps the buyer apply the matching concept in accrual accounting. This principle requires that firms report revenues in the same period with the expenses that brought them. Suppose, for instance, that an asset helps earn revenues for five years. Firms use depreciation expense to achieve matching, by spreading the asset cost across the same five years. As a result, firms report actual earnings for these years accurately.

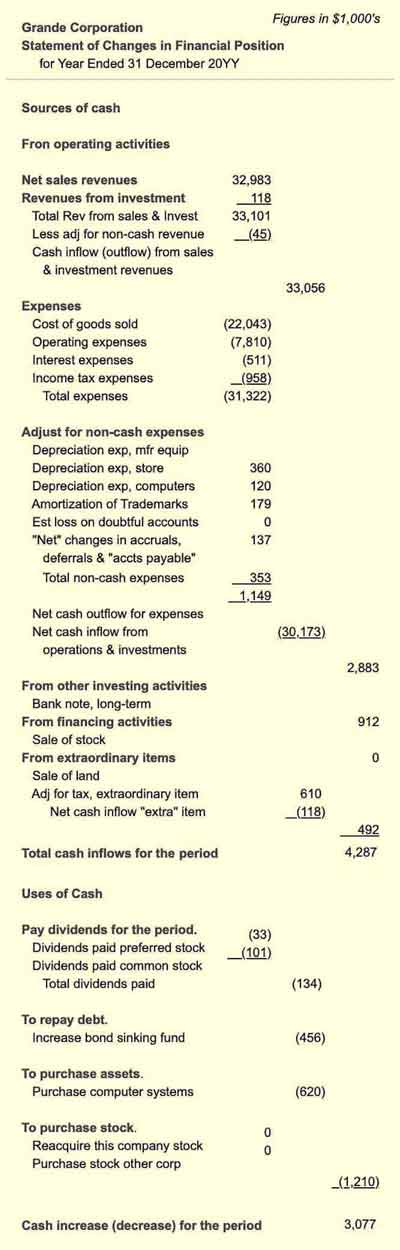

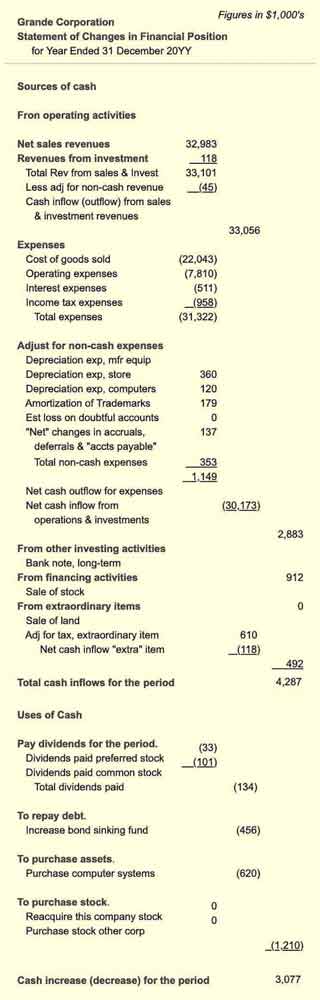

Adjusting Cash Flow Statement for Non-Cash Events

Because Non-Cash revenues are not real cash flow, they do not add to "Total cash Inflows" on the cash flow statement (statement of changes in financial position). Similarly, Non-Cash expenses do not add to "Cash outflows" on the cash flow statement. Nevertheless, Non-Cash revenues and expenses are indeed visible on the cash flow statement. They appear on the cash flow statement to show how actual cash inflows and outflows derive from Income statement revenue and expenses figures.

Cash Flow Calculated From Income Statement Figures

- The cash flow statement approaches the "Total cash inflows" figure by starting with the Income statement "Total sales and investment revenues."

- As the example below shows, however, Non-Cash revenues are immediately subtracted from this total.

- The cash flow statement then takes a starting "Total expenses" figure from the Income statement, and then "adds back" the individual Non-Cash expense items that are part of the Income statement expense total.

- Net cash inflow is then the difference between the new revenues total and the new expense total.

It is useful to structure the cash flow statement this way so that everyone can see the source of cash flow numbers.

Example SCFP (Cash Flow Statement)

Showing Adjustments for Non-Cash Accounts

The example Statement of Changes in Financial Position in Exhibit 1 below shows how Non-Cash accounts impact cash flow totals.